Question: Can you explain in more depth how he got the answer in red. 5 b (6 points) You are pricing the following option on the

Can you explain in more depth how he got the answer in red.

Can you explain in more depth how he got the answer in red.

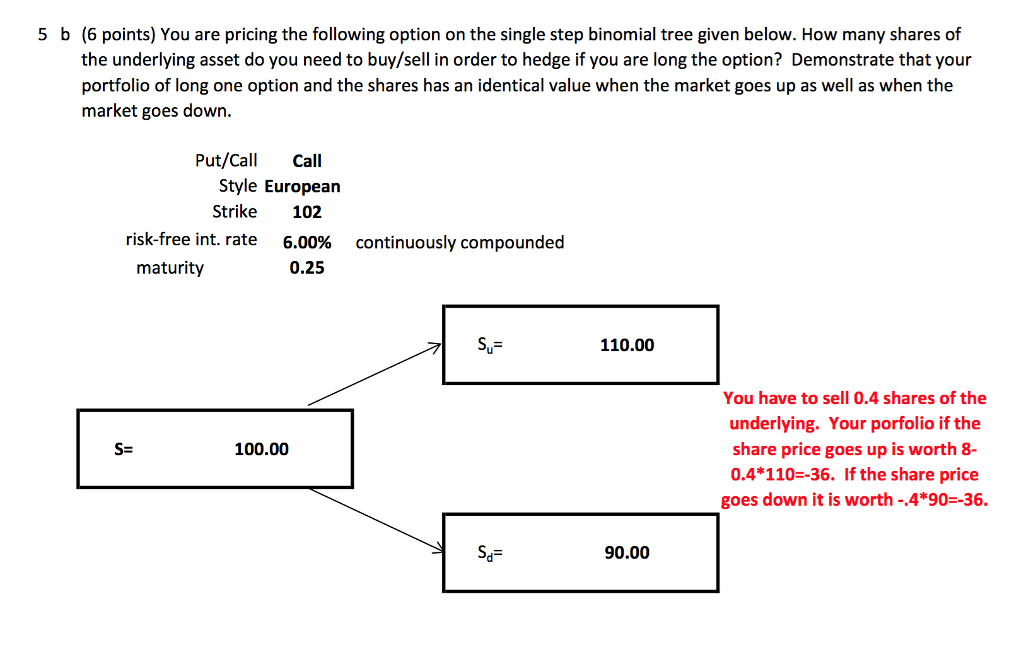

5 b (6 points) You are pricing the following option on the single step binomial tree given below. How many shares of the underlying asset do you need to buy/sell in order to hedge if you are long the option? Demonstrate that your portfolio of long one option and the shares has an identical value when the market goes up as well as when the market goes down. Put/Call Call Style European Strike 102 risk-free int. rate continuously compounded 6.00% 0.25 maturity 110.00 You have to sell 0.4 shares of the underlying. Your porfolio if the share price goes up is worth 8- 0.4 110--36. If the share price goes down it is worth-4*90--36. S- 100.00 90.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts