Question: can you help me answer this question. can you help me answer these questions In order to prepare a realistic budget. Mr. Liew Yuan Bing,

can you help me answer this question.

can you help me answer these questions

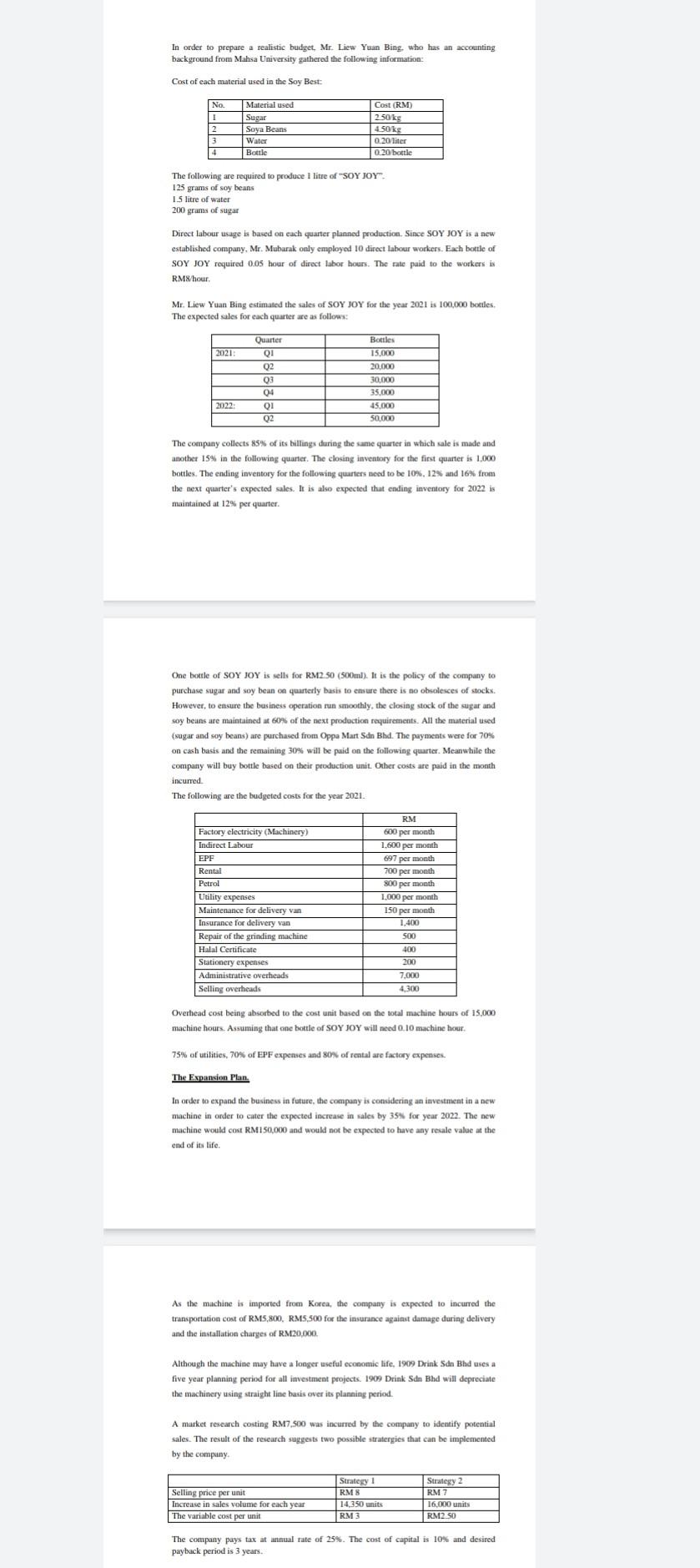

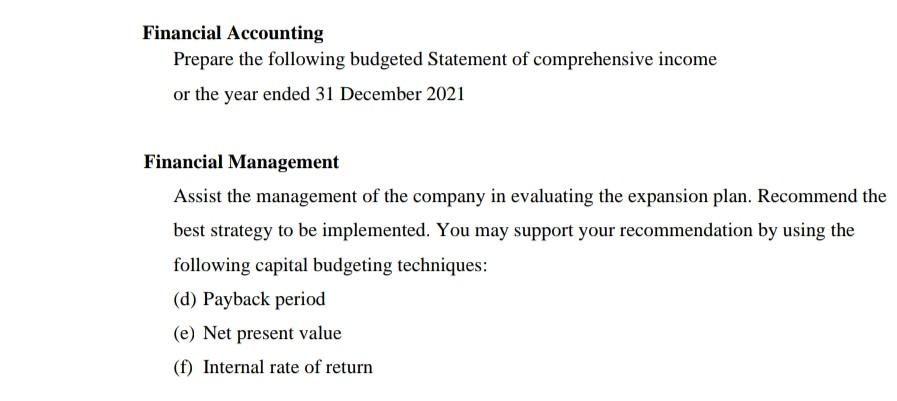

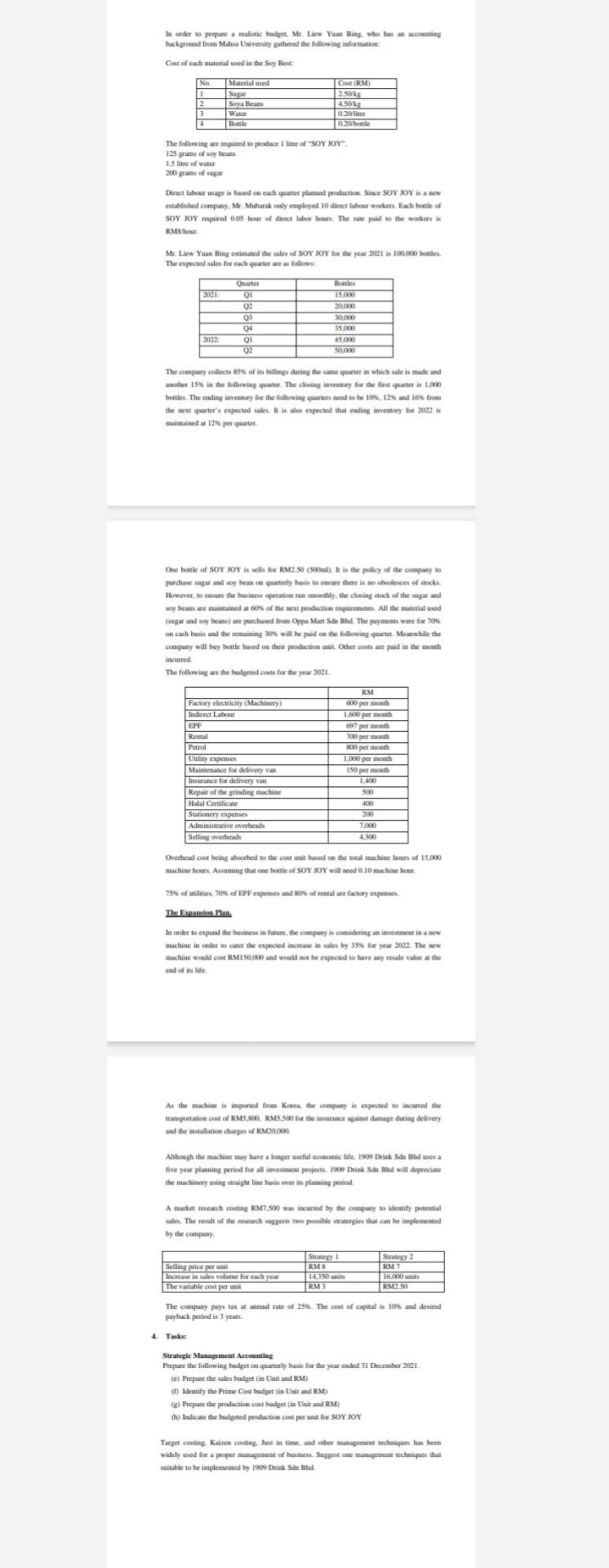

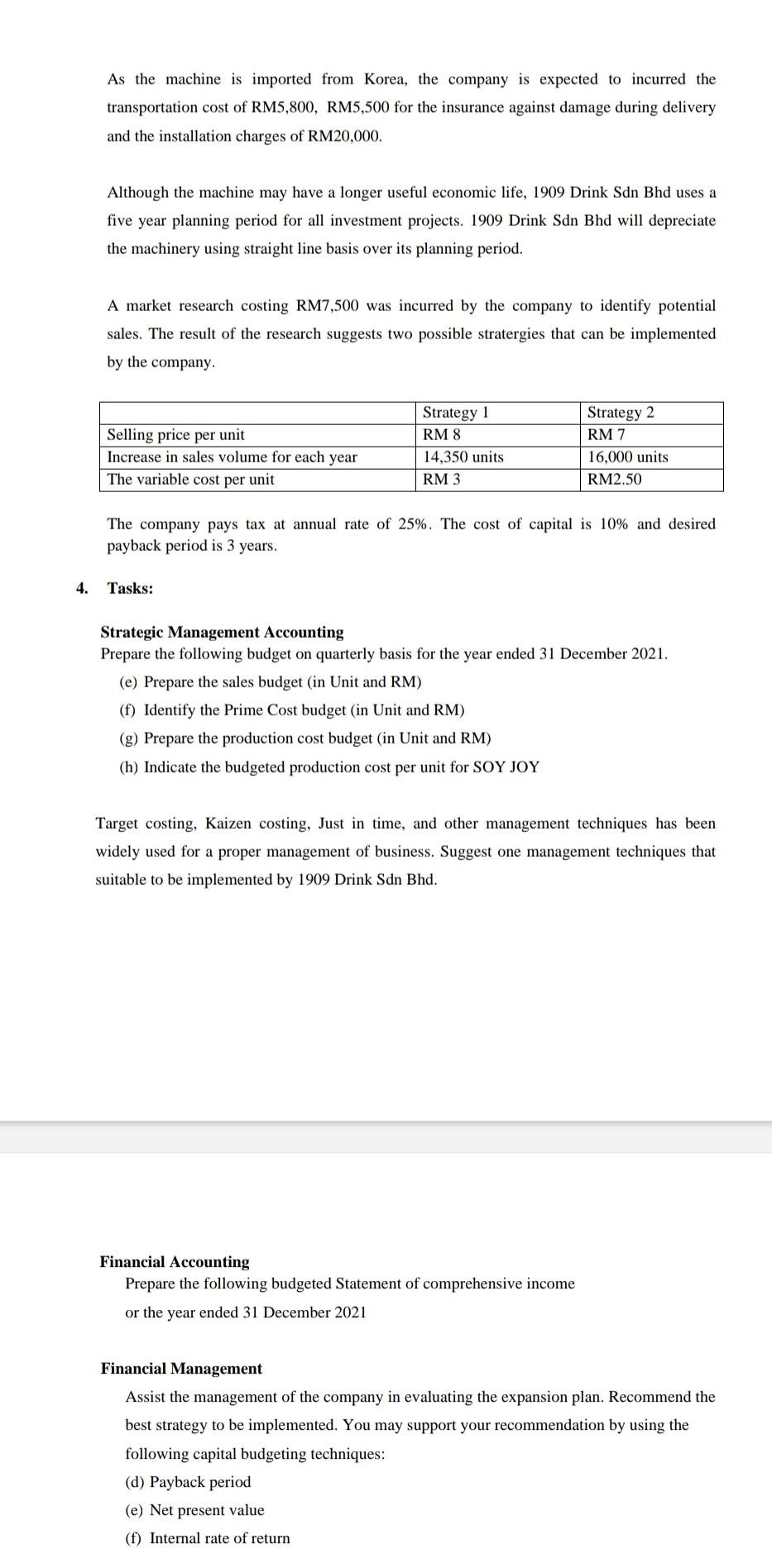

In order to prepare a realistic budget. Mr. Liew Yuan Bing, who has an accounting background from Mahsa University gathered the following information: Cost of each material used in the Soy Best: No 1 2 3 4 Material used Sugar Soya Beans Water Bottle Cost (RM) 2.50 kg 4.50 kg 0.20 liter 0.20 bottle The following are required to produce 1 litre of "SOY JOY". 125 grams of soy beans 1.5 litre of water 200 grams of sugar Direct labour usage is based on each quarter planned production. Since SOY JOY is a new established company, Mr. Mubarak only employed 10 direct labour workers. Each bottle of SOY JOY required 0.05 hour of direct labor hours. The rate paid to the workers is RM8hour Mr. Liew Yuan Bing estimated the sales of SOY JOY for the year 2021 is 100,000 bottles, The expected sales for each quarter are as follows: 2021 Quarter QI 02 03 Bottles 15.000 20,000 30.000 35.000 45.000 50.000 2022 01 02 The company collects 85% of its billings during the same quarter in which sale is made and another 15% in the following quarter. The closing inventory for the first quarter is 1,000 bottles. The ending inventory for the following quarters need to be 10%, 12% and 16% from the next quarter's expected sales. It is also expected that ending inventory for 2022 is maintained at 12% per quarter. One bottle of SOY JOY is sells for RM2.50 (500ml). It is the policy of the company to purchase sugar and soybean on quarterly basis to ensure there is no obsolesces of stocks However, to ensure the business operation run smoothly, the closing stock of the sugar and soy beans are maintained at 60% of the next production requirements. All the material used (sugar and soy beans) are purchased from Oppa Mart Sdn Bhd. The payments were for 70% on cash basis and the remaining 30% will be paid on the following quarter. Meanwhile the company will buy bottle based on their production unit. Other costs are paid in the month incurred The following are the budgeted costs for the year 2021. Factory electricity (Machinery) Indirect Labour EPF Rental Petrol Utility expenses v Maintenance for delivery van Insurance for delivery van - Repair of the grinding machine Halal Certificate Stationery expenses Administrative overheads Selling overheads RM 600 per month 1.600 per month 697 per month 700 per month 800 per month 1.000 per month 150 per month 1.400 500 400 200 7.000 4.300 Overhead cost being absorbed to the cost unit based on the total machine hours of 15,000 machine hours. Assuming that one bottle of SOY JOY will need 0.10 machine hour 75% of utilities, 70% of EPF expenses and 80% of rental are factory expenses. The Expansion Plan. In order to expand the business in future, the company is considering an investment in a new machine in order to cater the expected increase in sales by 35% for year 2022. The new machine would cost RM150,000 and would not be expected to have any resale value at the end of its life. As the machine is imported from Korea, the company is expected to incurred the transportation cost of RM5,800, RM5,500 for the insurance against damage during delivery and the installation charges of RM20,000 Although the machine may have a longer useful economic life, 1909 Drink Sdn Bhd uses a five year planning period for all investment projects. 1909 Drink Sdn Bhd will depreciate the machinery using straight line basis over its planning period. A market research costing RM7,500 was incurred by the company to identify potential sales. The result of the research suggests two possible strategies that can be implemented by the company Selling price per unit Increase in sales volume for each year The variable cost per unit Strategy 1 RMS 14.350 units RM3 Strategy 2 RM 16.000 units RM250 The company pays tax at annual rate of 25%. The cost of capital is 10% and desired payback period is 3 years Financial Accounting Prepare the following budgeted Statement of comprehensive income or the year ended 31 December 2021 Financial Management Assist the management of the company in evaluating the expansion plan. Recommend the best strategy to be implemented. You may support your recommendation by using the following capital budgeting techniques: (d) Payback period (e) Net present value (f) Internal rate of return In order to prepare realistic budget, Mr. Liew Yuan Bing, who has an accounting background from Mahsa University gathered the following information: Cost of each material used in the Soy Best: No 1 2 3 4 Material used Sugar Soya Beans Water Bottle Cost CRM 2.sky 450k 0 20 liter 0.20 battle The following are required to produce 1 litre of "SOY JOY 125 grams of soybeans 1.5 litre of water 200 grams of sugar Direct labour usage is based on cach quarter planned production. Since SOY JOY is a new established company, Mr. Mubarak only employed 10 direct labour workers. Each bottle of SOY JOY required 0,05 hour of direct labor down. The rule paid to the workers is Tute RMWhour M. Lew Yuan Biag estimated the sales of SOY JOY for the year 2001 is 100,000 bottles The expected sales for each quarter are as follows: 2021 Quarter 01 02 03 04 01 02 Bottles 1500 20.000 30.000 35.000 45.000 SO100 3022 The company collects 85% of its billing during the same quartet in which sale is made and another 15% in the following quarter. The closing inventory for the first quarter is 1.000 bottles. The ending inventory for the following quarters need to be 10%, 125 and 16% from the next quarter's expected sales. It is also expected that ending inventory for 2022 is maintained at 12% per quarter % One bottle of SOY JOY is ells for RM2.50 (50ml). It is the policy of the company to ) purchase sugar and soybean e quarterly has to ensure there is no obleces of socks However, to ensure the business operation run smoothly, the clining duck of the war and , woy beans are maintained 60% of the next production requirements. All the material used sugar and soybeans) are purchased from Oppa Mart Sdn Bhd. The payments were for 70% on canh hasix and the remaining will be paid on the following quarter. Meanwhile the company will buy bottle bused on their production unit. Other costs are paid in the month incurred The following are the budgeted costs for the year 2021 Factory electricity (Machinery) Indirect Labour EPF Rental Petrol Uality expenses Maintenance for delivery van Insurance for delivery van Repair of the grinding machine Halal Certificate Stationery expenses Administrative overheads Selling overheads RM 600 per month 1.500 per month 697 per month 200 per month 800 per month 1.000 per month 150 per month 1.400 so 400 7.000 4300 Overhead cout being aborted to the cost unit based on the total machine hours of 15.000 machine hours. Assuming that one battle of SOY JOY will need 0.10 machine hour 75% of utilities 70% of EPF expenses and 80% of rental are factory expenses % The Expansion Plan. In order to expand the business in future, the company is considering an investment in a new machine in order to cater the expected increase in sales by 35 for year 2022. The new machine would cost RM150,000 and would not be expected to have any resale value at the end of in life As the machine is imported from the company is expected to incurred the Korea, transportation cost of RM5.00 RM5.500 for the insurance against damage during delivery and the installation charge of RM30.000 Although the machine may have a longer useful comic life, 1909 Drink Sdn Bhd sesa five year planning period for all investment projecte 1909 Drink Sdn Bhd will depreciate the machinery wing straight line banks creer is planning period is A market research costing RM7,500 was incurred by the company to identity potential sales. The result of the research suggests two possible strategies that can be implemented by the company Selling price permit Increase in sales volume for each year The variable cost per unit Stratery 1 RMN 14.50 wits IRME Strategy 2 RM7 16.000 un RM250 The company pay tax at annual rate of 25%. The cost of capital is 10% and desired payback period is 3 year 4. Tasks: Strategic Management Accounting Prepare the following budget on quarterlyhasis for the year ended 31 December 2001 le) Prepare the sales budget (in Unit and RM) ) Identify the Prime Cost budget in Unit and RM) (g) Prepare the production cost budget in Unit and RM) d) Indicate the budgeted production cost per unit for SOY JOY Target conting. Kaizen casting. Just in time, and other management techniques has been widely used for a proper management of businew, Suggest one management techniques that suitable to be implemented by 1909 Drink Sdn Bhd As the machine is imported from Korea, the company is expected to incurred the transportation cost of RM5,800, RM5,500 for the insurance against damage during delivery and the installation charges of RM20,000. Although the machine may have a longer useful economic life, 1909 Drink Sdn Bhd uses a five year planning period for all investment projects. 1909 Drink Sdn Bhd will depreciate the machinery using straight line basis over its planning period. A market research costing RM7,500 was incurred by the company to identify potential sales. The result of the research suggests two possible stratergies that can be implemented by the company Selling price per unit Increase in sales volume for each year The variable cost per unit Strategy 1 RM8 14,350 units RM 3 Strategy 2 RM 7 16,000 units RM2.50 The company pays tax at annual rate of 25%. The cost of capital is 10% and desired payback period is 3 years. 4. Tasks: Strategic Management Accounting Prepare the following budget on quarterly basis for the year ended 31 December 2021. (e) Prepare the sales budget (in Unit and RM) (f) Identify the Prime Cost budget (in Unit and RM) (g) Prepare the production cost budget (in Unit and RM) (h) Indicate the budgeted production cost per unit for SOY JOY Target costing, Kaizen costing, Just in time, and other management techniques has been widely used for a proper management of business. Suggest one management techniques that suitable to be implemented by 1909 Drink Sdn Bhd. Financial Accounting Prepare the following budgeted Statement of comprehensive income or the year ended 31 December 2021 Financial Management Assist the management of the company in evaluating the expansion plan. Recommend the best strategy to be implemented. You may support your recommendation by using the following capital budgeting techniques: (d) Payback period (e) Net present value (f) Internal rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts