Question: Can you help me answer this question? The subject is Accounting (Financial Management) kindly explain also 1. Empire plans to invest $20M to refresh 10

Can you help me answer this question? The subject is Accounting (Financial Management) kindly explain also

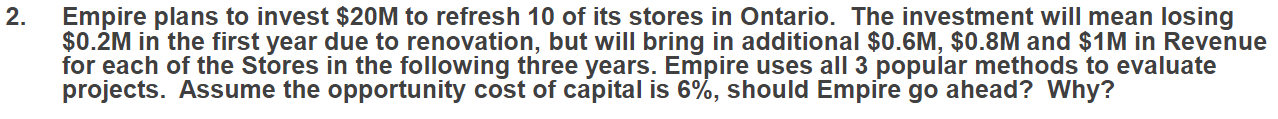

1. Empire plans to invest $20M to refresh 10 of its stores in Ontario. The investment will mean losing $0.2M in the first year due to renovation, but will bring in additional $0.6M, $0.8M and $1M in Revenue for each of the Stores in the following three years. Empire uses all 3 popular methods to evaluate projects. Assume the opportunity cost of capital is 6%, should Empire go ahead? Why?

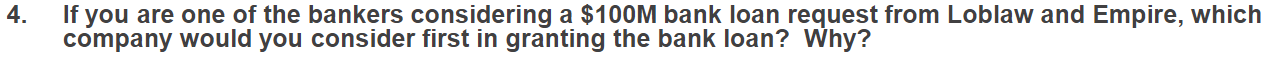

2. If you are one of the bankers considering a $100M bank loan request from Loblaw and Empire, which company would you consider first in granting the bank loan? Why?

Empire plans to invest $20M to refresh 10 of its stores in Ontario. The investment will mean losing $0.2M in the first year due to renovation, but will bring in additional $0.6M,$0.8M and $1M in Revenue for each of the Stores in the following three years. Empire uses all 3 popular methods to evaluate projects. Assume the opportunity cost of capital is 6\%, should Empire go ahead? Why? 4. If you are one of the bankers considering a $100M bank loan request from Loblaw and Empire, which company would you consider first in granting the bank loan? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts