Question: can you help me do BE2-6 to BE2-9. I attached the other questions if you need those to answer these. BE2-6 M. Therriault, a fellow

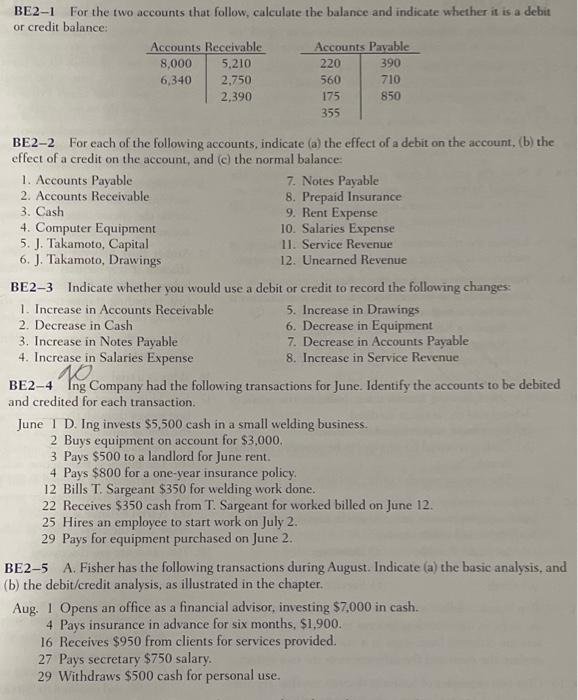

BE2-6 M. Therriault, a fellow student, is unclear about the steps in the recording process. Iden- tify and briefly explain the steps in the same order as they are performed. BE2-7 Using the data in BE2-4 for Ing Company, journalize the transactions. BE2-8 Using the data in BE25 for A. Fisher, journalize the transactions. BE2-9 Post the journal entries from BE2-8 to T accounts. BE2-1 For the two accounts that follow, calculate the balance and indicate whether it is a debit or credit balance: Accounts Receivable Accounts Payable 8,000 5,210 220 390 6,340 2.750 560 710 2,390 175 850 355 BE2-4 Tea BE2-2 For each of the following accounts, indicate (a) the effect of a debit on the account. (b) the effect of a credit on the account, and the normal balance: 1. Accounts Payable 7. Notes Payable 2. Accounts Receivable 8. Prepaid Insurance 3. Cash 9. Rent Expense 4. Computer Equipment 10. Salaries Expense 5. J. Takamoto, Capital II. Service Revenue 6. J. Takamoto, Drawings 12. Unearned Revenue BE2-3 Indicate whether you would use a debit or credit to record the following changes. 1. Increase in Accounts Receivable 5. Increase in Drawings 2. Decrease in Cash 6. Decrease in Equipment 3. Increase in Notes Payable 7. Decrease in Accounts Payable 4. Increase in Salaries Expense 8. Increase in Service Revenue Company had the following transactions for June. Identify the accounts to be debited and credited for each transaction. June 1 D. Ing invests $5,500 cash in a small welding business. 2 Buys equipment on account for $3,000. 3 Pays $500 to a landlord for June rent. 4 Pays $800 for a one-year insurance policy 12 Bills T. Sargeant $350 for welding work done. 22 Receives $350 cash from T. Sargeant for worked billed on June 12. 25 Hires an employee to start work on July 2. 29 Pays for equipment purchased on June 2. BE2-5 A. Fisher has the following transactions during August. Indicate (a) the basic analysis, and (b) the debit/credit analysis, as illustrated in the chapter. Aug. 1 Opens an office as a financial advisor, investing $7,000 in cash. 4 Pays insurance in advance for six months, $1,900. 16 Receives $950 from clients for services provided. 27 Pays secretary $750 salary. 29 Withdraws $500 cash for personal use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts