Question: can you help me do this please... I'm confused in the exchange rate Foreign Currency Financial Statements 499 14-ation worksheet, parent accounting amsati the outstanding

can you help me do this please... I'm confused in the exchange rate

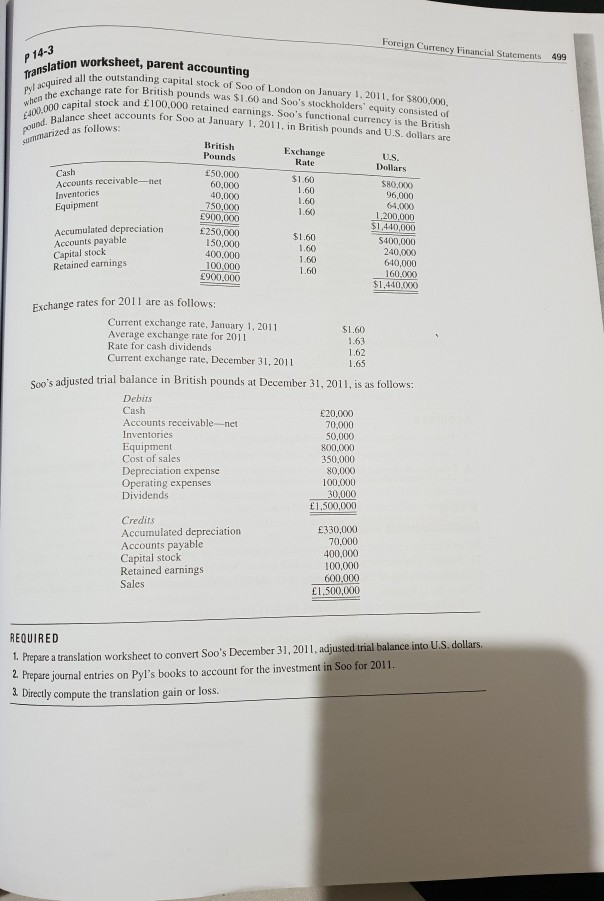

Foreign Currency Financial Statements 499 14-ation worksheet, parent accounting amsati the outstanding capital stock of Soo of London on January 1, 2011, for $800,000. ge rate for British pounds was $1.60 and Soo's stockholders' equity consisted of and 100,000 retained earnings. Soo's functional currency is the British ce sheet accounts for Soo at January 1, 2011. in British pounds and U.S. dollars are Pyl ahe exchan hen as follows: British Pounds Exchange U.S. Dollars Cash Accounts receivable-net Inventories Equipment 150,000 60,000 40,000 750,000 900,000 $1.60 $80,000 96,000 64,000 1,200,000 $1.440,000 .60 Accumulated depreciation Accounts payable Capital stock Retained earnings 250,000 150,000 400.000 100,000 900.000 1.60 640,000 160,000 $1,440,000 1.60 Exchange rates for 2011 are as follows: Current exchange rate, January 1,2011 Average exchange rate for 2011 Rate for cash dividends Current exchange rate, December 31,2011 1.63 1.62 Soo's adj justed trial balance in British pounds at December 31, 2011, is as follows: Debits Accounts receivable-net Inventories Equipment Cost of sales Depreciation expense Operating expenses 20,000 0,000 50,000 800,000 350.000 80,000 100.000 f1,500,000 Credits Accumulated depreciation Accounts payable E330,000 400,000 100,000 600,000 Retained earnings Sales 1. Prepare a translation worksheet to convert Soo's December 31,2011, adjusted trial balance into U.S dollars 2 Prepare journal entries on PylI's books to account for the investment in Soo for 2011 REQUIRED Directly compute the translation gain or loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts