Question: Help me to findout exact solution a,b &c 2. a. i. Describe the concept of a group as a single economic unit. ii. Identify circumstances

Help me to findout exact solution a,b &c

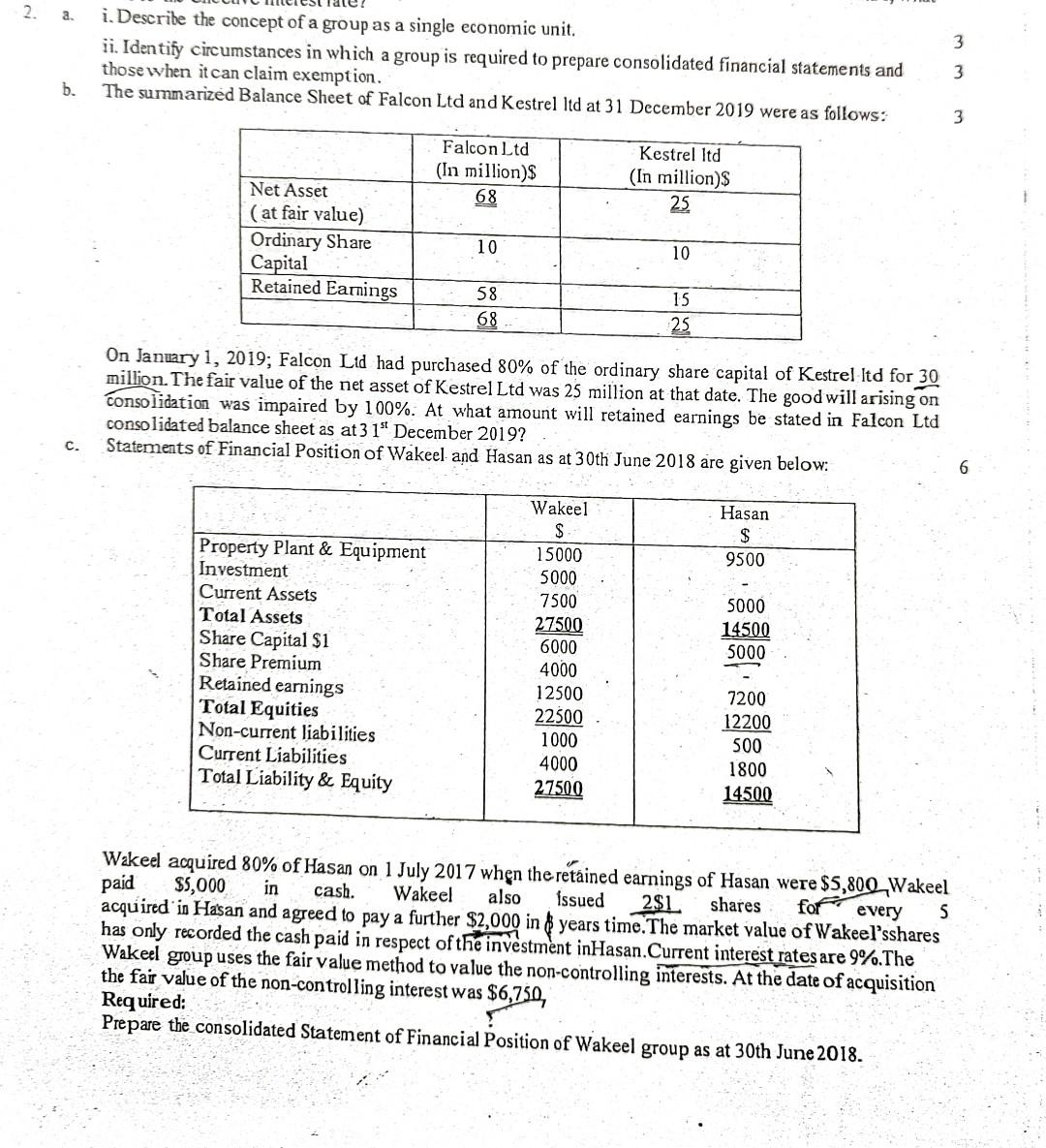

2. a. i. Describe the concept of a group as a single economic unit. ii. Identify circumstances in which a group is required to prepare consolidated financial statements and 3 thosewhen it can claim exemption. b. The summarized Balance Sheet of Falcon Ltd and Kestrel ltd at 31 December 2019 were as follows: 3 On January 1, 2019; Falcon Lid had purchased 80% of the ordinary share capital of Kestrel Itd for 30 million. The fair value of the net asset of Kestrel Ltd was 25 million at that date. The good will arising on consolidation was impaired by 100%. At what amount will retained earnings be stated in Falcon Ltd consolidated balance sheet as at 31st December 2019 ? c. Statements of Financial Position of Wakeel and Hasan as at 30 th June 2018 are given below: 6 Wakeel acquired 80\% of Hasan on 1 July 2017 when the retined earnings of Hasan were $5,800 Wakeel paid $5,000 in cash. Wakeel also issued 2$1 shares for every 5 acquired in Hasan and agreed to pay a further $2,000 in \$ years time. The market value of Wakeel'sshares has only recorded the cash paid in respect of the investment inHasan.Current interest rates are 9%. The Wakeel group uses the fair value method to value the non-controlling interests. At the date of acquisition the fair value of the non-control ling interest was $6,750, Required: Prepare the consolidated Statement of Financial Position of Wakeel group as at 30th June 2018. 2. a. i. Describe the concept of a group as a single economic unit. ii. Identify circumstances in which a group is required to prepare consolidated financial statements and 3 thosewhen it can claim exemption. b. The summarized Balance Sheet of Falcon Ltd and Kestrel ltd at 31 December 2019 were as follows: 3 On January 1, 2019; Falcon Lid had purchased 80% of the ordinary share capital of Kestrel Itd for 30 million. The fair value of the net asset of Kestrel Ltd was 25 million at that date. The good will arising on consolidation was impaired by 100%. At what amount will retained earnings be stated in Falcon Ltd consolidated balance sheet as at 31st December 2019 ? c. Statements of Financial Position of Wakeel and Hasan as at 30 th June 2018 are given below: 6 Wakeel acquired 80\% of Hasan on 1 July 2017 when the retined earnings of Hasan were $5,800 Wakeel paid $5,000 in cash. Wakeel also issued 2$1 shares for every 5 acquired in Hasan and agreed to pay a further $2,000 in \$ years time. The market value of Wakeel'sshares has only recorded the cash paid in respect of the investment inHasan.Current interest rates are 9%. The Wakeel group uses the fair value method to value the non-controlling interests. At the date of acquisition the fair value of the non-control ling interest was $6,750, Required: Prepare the consolidated Statement of Financial Position of Wakeel group as at 30th June 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts