Question: can you help me solve for FIFO and LIFO for periodic inventory system and FIFO AND LIFO for perpetual inventory system? Periodic and Perpetual Systems-Calculating

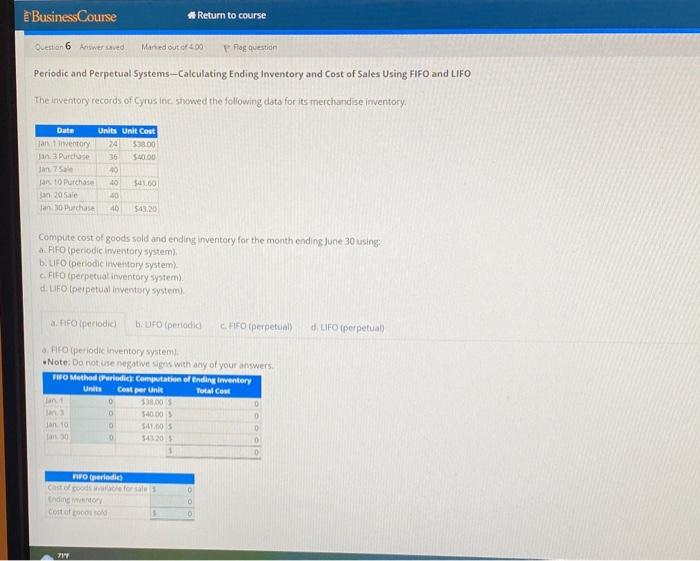

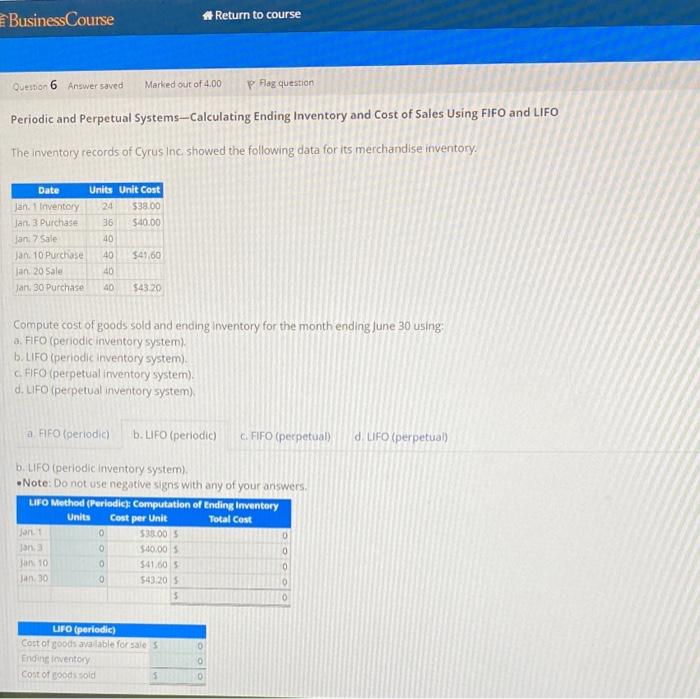

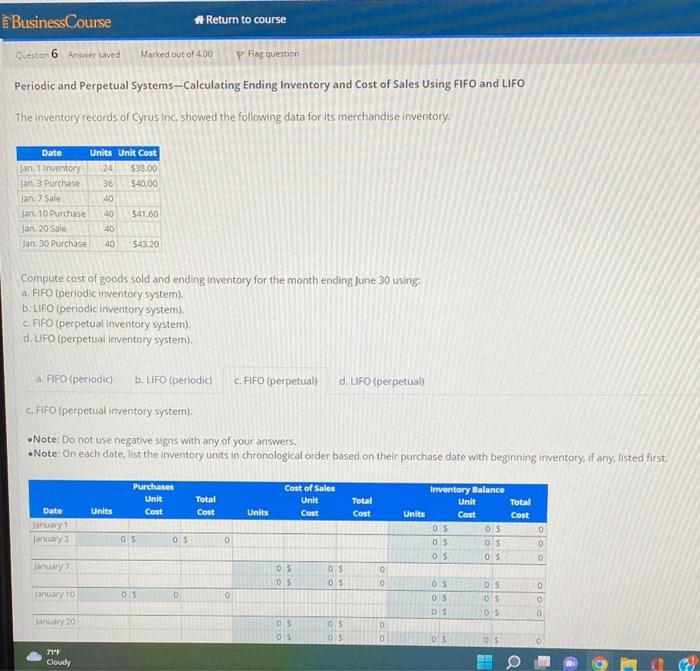

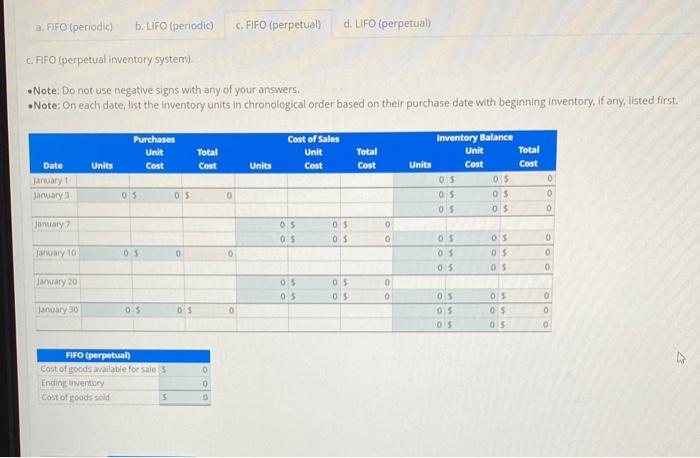

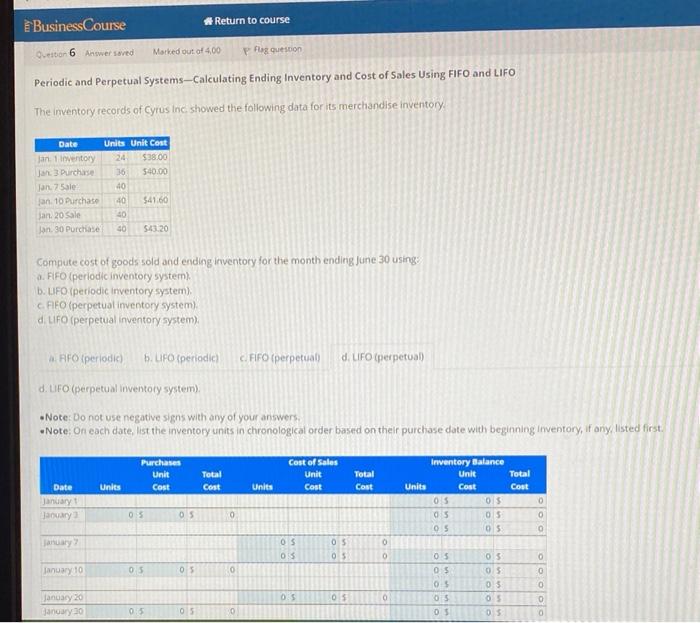

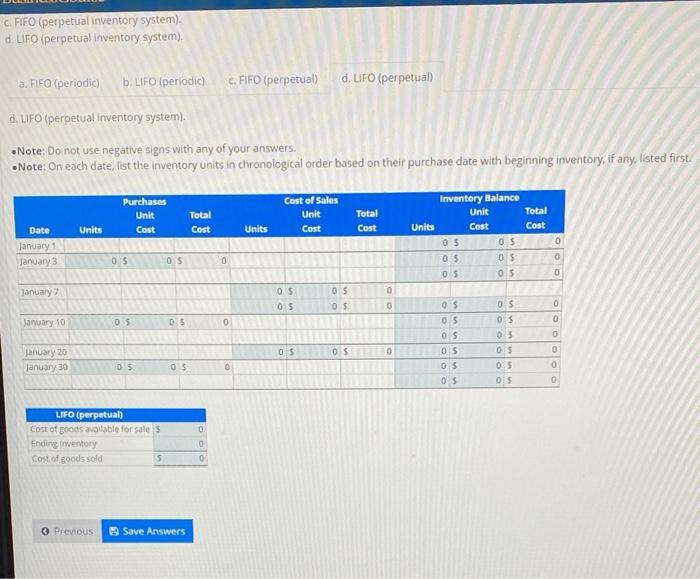

Periodic and Perpetual Systems-Calculating Ending Inventory and Cost of Sales Using FIFO and LIFO The inventory records of Cyrus incic showed the following data for its merchandise imventory. Compute cost of goods sold and ending inventory for the month ending lune 30 using: a. HFO (periodic inventory system) b. UFO (periodic inwemory system) c. FiFo (perpethal inventory system). d. LHFO toetpetual inventory system. a. Hiko (periodic liventory system) -Note: Da not case negative signs with any of your answers. Periodic and Perpetual Systems-Calculating Ending Inventory and Cost of Sales Using FIFO and LIFO The inventory records of Cyrus Inc showed the following data for its merchandise inventory. Compute cost of goods sold and ending inventory for the month ending fune 30 using: a. FIFO (periodic inventory system). b. LlFO (periodic inventory system). c. FFFO (perpetual inventory system). d. LIFO (perpetual inventory system). b. LIFO (periodic inventory system). -Note: Do not use negative signs with any of your answers. Periodic and Perpetual Systems-Caleulating Ending Inventory and Cost of Sales Using FIFO and LIFO The inventory records of Cyrus inci showed the following data for its merchandise inventory. Compute cost of goods sold and ending inventory for the month ending June 30 using: a. FIFO (periodic inventory system). b. LIFO (periodic inventory system). c. FiFO (perpetual inventory system). d. UFO (perpetual inventory system). c. FIFO (perpetual inventory system). -Note: Do not use negative signs with any of your answers. - Note: On each date, list the inventory units in chronological order based on their purchase date with beginning inventory, if any, listed first. c. FIFO (perpetual inventory system). - Note: Do not use negative signs with any of your answers. - Note: On each date, list the inventory units in chronological order based on their purchase date with beginning inventory, if any, listed first. Periodic and Perpetual Systems-Calculating Ending Inventory and Cost of Sales Using FIFO and LIFO The inventory records of Cyrus inc showed the following data for its merchandise inventory. Compute cost of goods sold and ending inventory for the month ending fune 30 using: a. FFFO (periodic inventory system). b. UFO (periodic inventory system). c. FFO (perpetual inventory system). d. LFFO (perpetual inventory System). d. Lifo (perpetual inventory system). -Note: Do not use negative signs with any of your answers. - Note: On each date, list the inventory units in chronological order based on their purchase date with beginning inventory, if any, listed first. c. FIFO (perpetual inventory system). d. LIFO (perpetual inventory system). d. LIFO (perpetual inventory system). - Note: Do not use negative signs with any of your answers. - Note: On each date, list the inventory units in chronological order based on their purchase date with beginning inventory, if any, ilisted first

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts