Question: Can you help me solve this please? Use the marginal tax rates in the table below to compute the tax owed in the following situation.

Can you help me solve this please?

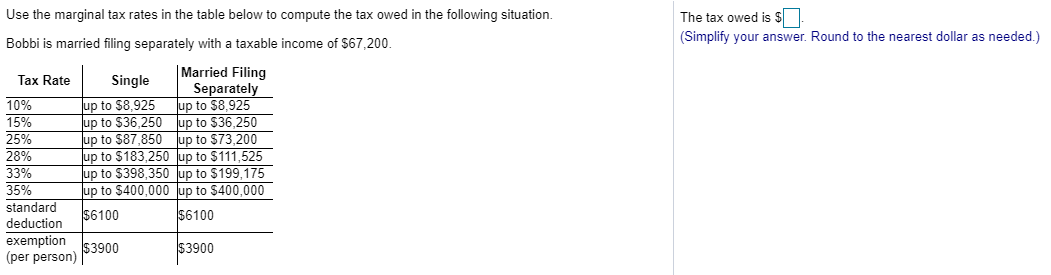

Use the marginal tax rates in the table below to compute the tax owed in the following situation. Bobbi is married filing separately with a taxable income of $67,200 The tax owed is $ (Simplify your answer. Round to the nearest dollar as needed.) 15% Tax Rate | Single Married Filing Separately 10% up to $8,925 up to $8,925 up to $36,250 up to $36,250 Tup to $87,850 Jup to $73,200 28% Jup to $183,250 up to $111,525 33% up to $398,350 up to $199,175 35% up to $400,000 up to $400,000 standard $6100 $6100 deduction exemption 2900 $3900 2900 (per person)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts