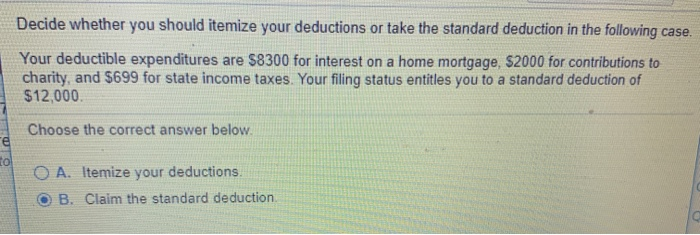

Question: Decide whether you should itemize your deductions or take the standard deduction in the following case. Your deductible expenditures are $8300 for interest on a

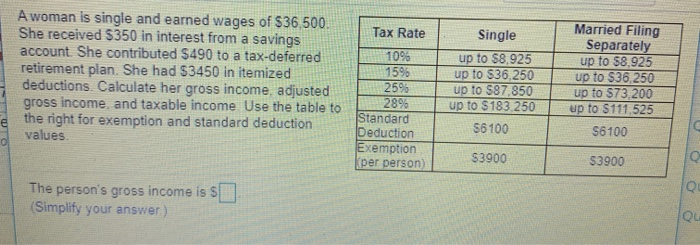

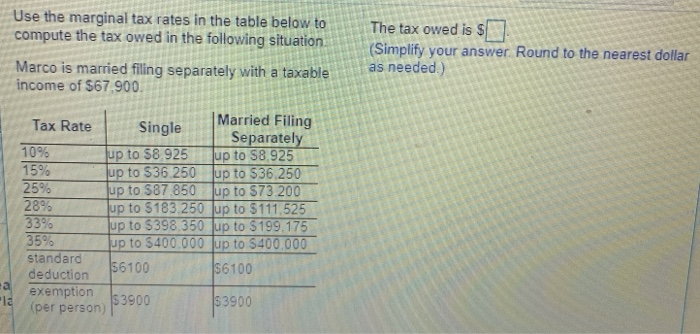

Decide whether you should itemize your deductions or take the standard deduction in the following case. Your deductible expenditures are $8300 for interest on a home mortgage, $2000 for contributions to charity, and $699 for state income taxes. Your filing status entitles you to a standard deduction of $12,000. Choose the correct answer below O A. Itemize your deductions. O B. Claim the standard deduction Tax Rate A woman is single and earned wages of $36,500. She received 5350 in interest from a savings account. She contributed $490 to a tax-deferred retirement plan. She had $3450 in itemized deductions. Calculate her gross income, adjusted gross income, and taxable income Use the table to the right for exemption and standard deduction values Single up to $8.925 up to $36,250 up to $87.850 up to $183 250 56100 Married Filing Separately up to $8.925 up to $36.250 up to $73,200 up to $111.525 56100 2593 2896 Standard Deduction Exemption Kper person 53900 $3900 The person's gross income is SE (Simplify your answer.) Use the marginal tax rates in the table below to compute the tax owed in the following situation The tax owed is $ 7 (Simplify your answer Round to the nearest dollar as needed.) Marco is married filing separately with a taxable income of 567.900. Tax Rate 10% 15% 25% 289 33% 35% standard deduction Single Married Filing Separately up to 58.925 up to 58.925 up to $36.250 up to $36.250 up to $87 850 up to $73 200 up to $183.250 up to $111.525 Jup to $398.350 up to $199.175 up to $400.000 up to $400.000 156100 156100 exemption 53900 $3900 (per person)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts