Question: Can you help me to fill this Excel document, and please provide Excel formulas? 5. Management of Seagate Technologies is considering the investment of $350

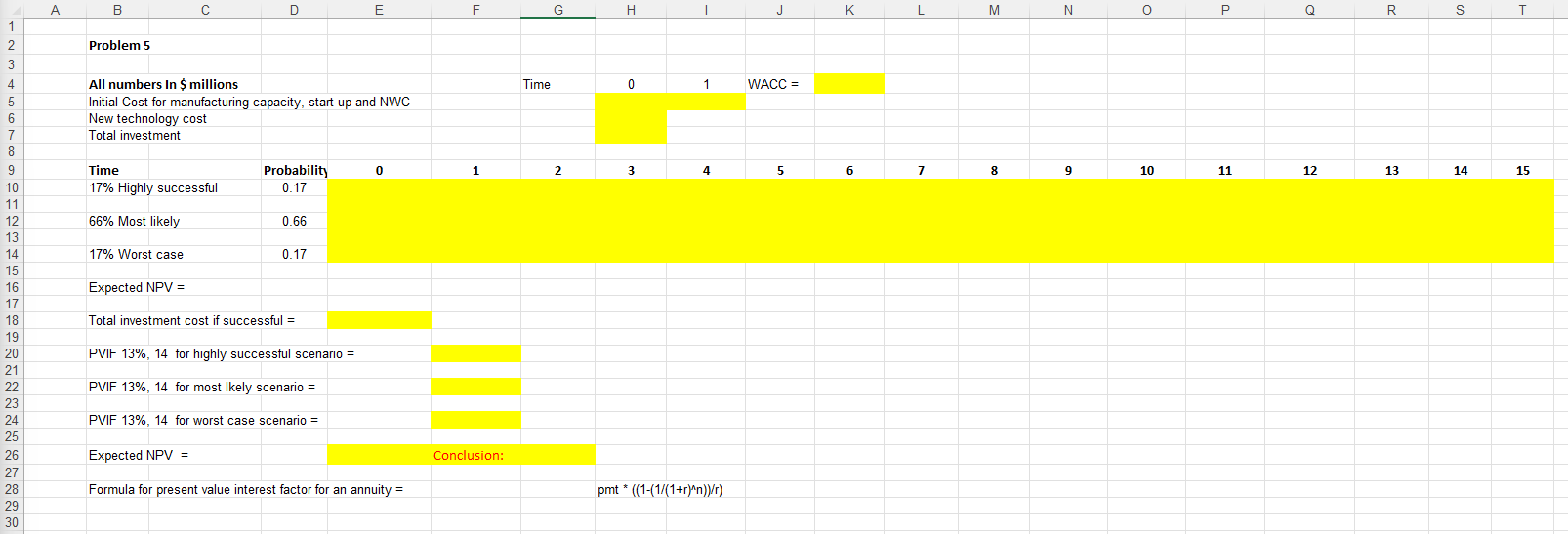

Can you help me to fill this Excel document, and please provide Excel formulas?

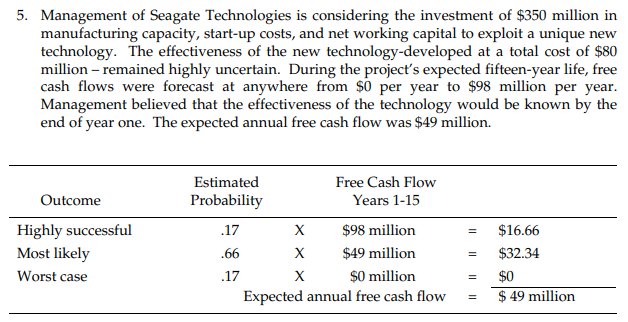

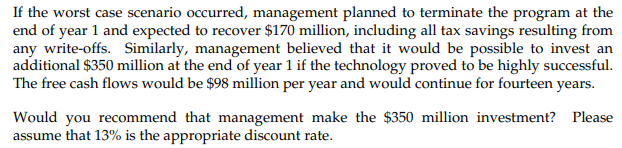

5. Management of Seagate Technologies is considering the investment of $350 million in manufacturing capacity, start-up costs, and net working capital to exploit a unique new technology. The effectiveness of the new technology-developed at a total cost of $80 million - remained highly uncertain. During the project's expected fifteen-year life, free cash flows were forecast at anywhere from $0 per year to $98 million per year. Management believed that the effectiveness of the technology would be known by the end of year one. The expected annual free cash flow was $49 million. If the worst case scenario occurred, management planned to terminate the program at the end of year 1 and expected to recover $170 million, including all tax savings resulting from any write-offs. Similarly, management believed that it would be possible to invest an additional $350 million at the end of year 1 if the technology proved to be highly successful. The free cash flows would be $98 million per year and would continue for fourteen years. Would you recommend that management make the $350 million investment? Please assume that 13% is the appropriate discount rate. 5. Management of Seagate Technologies is considering the investment of $350 million in manufacturing capacity, start-up costs, and net working capital to exploit a unique new technology. The effectiveness of the new technology-developed at a total cost of $80 million - remained highly uncertain. During the project's expected fifteen-year life, free cash flows were forecast at anywhere from $0 per year to $98 million per year. Management believed that the effectiveness of the technology would be known by the end of year one. The expected annual free cash flow was $49 million. If the worst case scenario occurred, management planned to terminate the program at the end of year 1 and expected to recover $170 million, including all tax savings resulting from any write-offs. Similarly, management believed that it would be possible to invest an additional $350 million at the end of year 1 if the technology proved to be highly successful. The free cash flows would be $98 million per year and would continue for fourteen years. Would you recommend that management make the $350 million investment? Please assume that 13% is the appropriate discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts