Question: Can you help me with question 3? Question 3. Beta and Cost of Capital DLT Inc. is a private company and has two lines of

Can you help me with question 3?

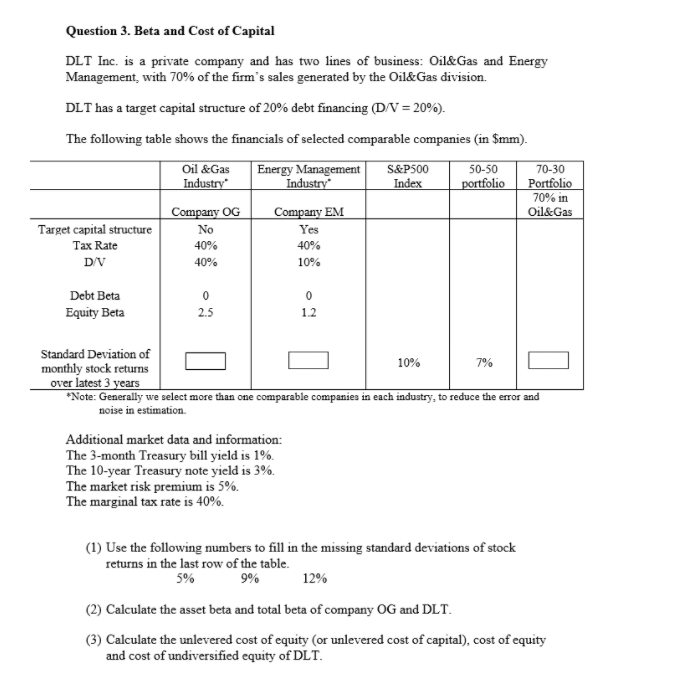

Question 3. Beta and Cost of Capital DLT Inc. is a private company and has two lines of business: Oil&Gas and Energy Management, with 70% of the firm's sales generated by the Oil&Gas division. DLT has a target capital structure of 20% debt financing (D/V = 20%). The following table shows the financials of selected comparable companies (in $mm). Oil&Gas Energy Management S&P500 50-50 70-30 Industry Industry" Index portfolio Portfolio 70% in Company OG Company EM Oil&Gas Target capital structure No Yes Tax Rate 40% D/V 40% 10% 40% Debt Beta Equity Beta 0 2.5 0 1.2 Standard Deviation of 10% 7% monthly stock returns over latest 3 years *Note: Generally we select more than one comparable companies in each industry, to reduce the error and noise in estimation Additional market data and information: The 3-month Treasury bill yield is 1% The 10-year Treasury note yield is 3%. The market risk premium is 5%. The marginal tax rate is 40%. (1) Use the following numbers to fill in the missing standard deviations of stock returns in the last row of the table. 5% 9% 12% (2) Calculate the asset beta and total beta of company OG and DLT. (3) Calculate the unlevered cost of equity (or unlevered cost of capital), cost of equity and cost of undiversified equity of DLT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts