Question: Can you help me with this please Applied vs. Actual Manufacturing Overhead Davis Manufacturing Corporation applies manufacturing overhead on the basis of 150% of direct

Can you help me with this please

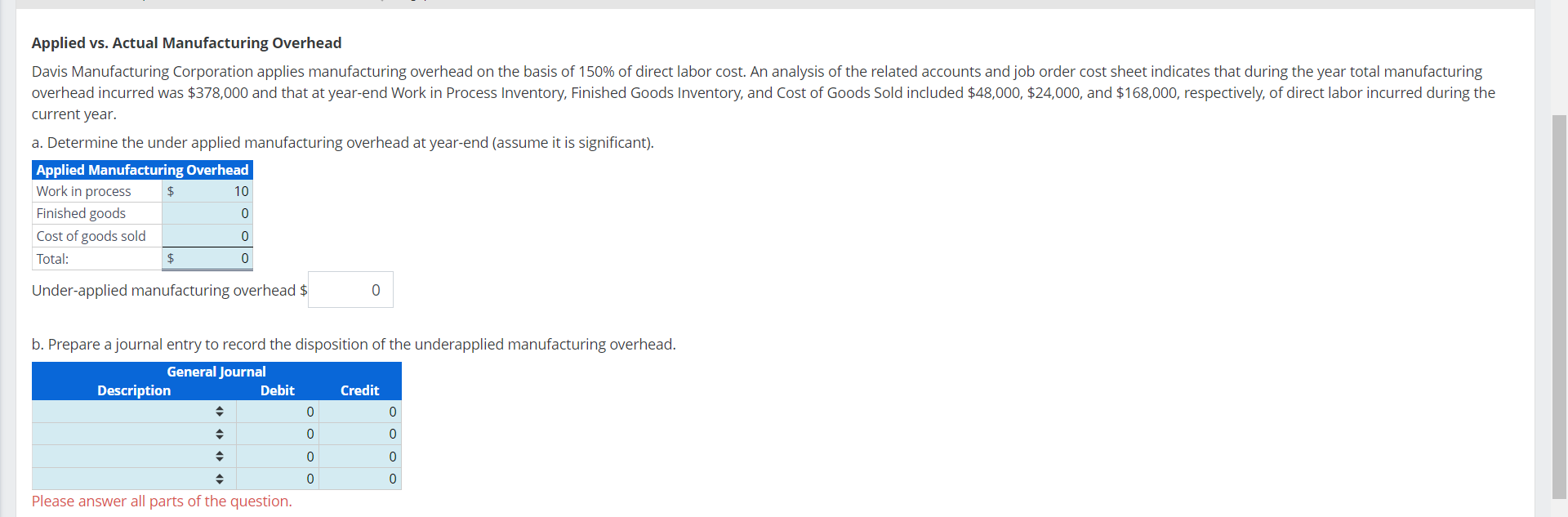

Applied vs. Actual Manufacturing Overhead Davis Manufacturing Corporation applies manufacturing overhead on the basis of 150% of direct labor cost. An analysis of the related accounts and job order cost sheet indicates that during the year total manufacturing overhead incurred was $378,000 and that at year-end Work in Process Inventory, Finished Goods Inventory, and Cost of Goods Sold included $48,000, $24,000, and $168,000, respectively, of direct labor incurred during the current year. a. Determine the under applied manufacturing overhead at year-end (assume it is significant). Applied Manufacturing Overhead Work in process $ 10 Finished goods 0 Cost of goods sold 0 Total: $ 0 Under-applied manufacturing overhead $ 0 b. Prepare a journal entry to record the disposition of the underapplied manufacturing overhead. General Journal Description 1 Credit e|e|a|s cle|e|e @& 0 v O Please answer all parts of the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts