Question: Can you make these into couple sharp bullet points - use acronyms and no headersAccess has shown a strong Revenue with projected revenue increasing from

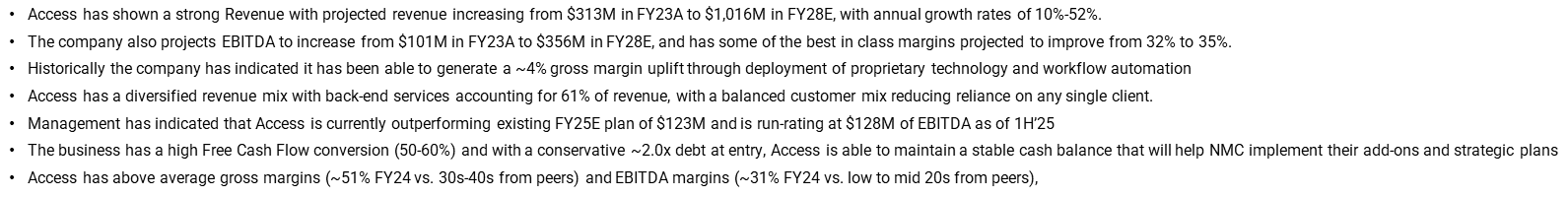

Can you make these into couple sharp bullet points - use acronyms and no headersAccess has shown a strong Revenue with projected revenue increasing from $313M in FY23A to $1,016M in FY28E, with annual growth rates of 10%-52%.The company also projects EBITDA to increase from $101M in FY23A to $356M in FY28E, and has some of the best in class margins projected to improve from 32% to 35%.Historically the company has indicated it has been able to generate a ~4% gross margin uplift through deployment of proprietary technology and workflow automationAccess has a diversified revenue mix with back-end services accounting for 61% of revenue, with a balanced customer mix reducing reliance on any single client.Management has indicated that Access is currently outperforming existing FY25E plan of $123M and is run-rating at $128M of EBITDA as of 1H'25The business has a high Free Cash Flow conversion (50-60%) and with a conservative ~2.0x debt at entry, Access is able to maintain a stable cash balance that will help NMC implement their add-ons and strategic plansAccess has above average gross margins (~51% FY24 vs. 30s-40s from peers) and EBITDA margins (~31% FY24 vs. low to mid 20s from peers),

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts