Question: Can you please answer all pleaseee its all one question just 4 parts to it Crowder Inc is an American company considering a project in

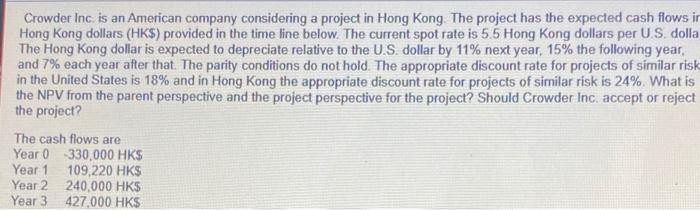

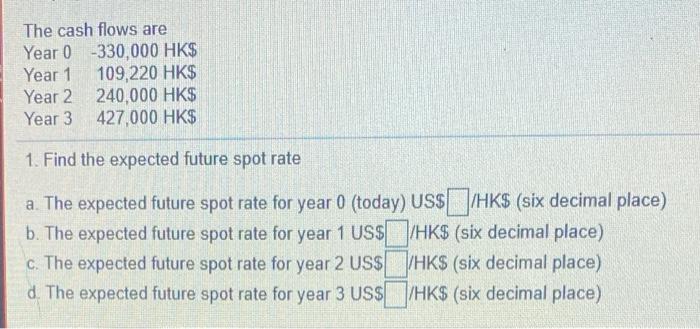

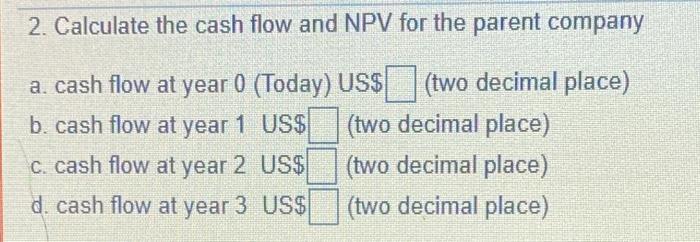

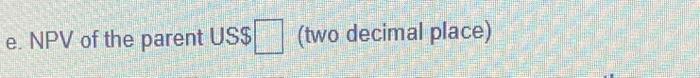

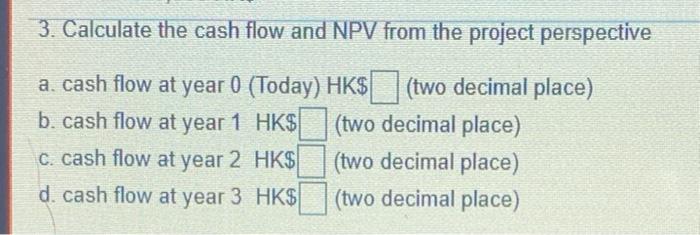

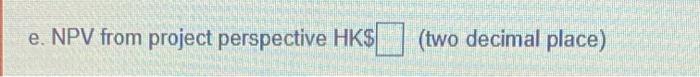

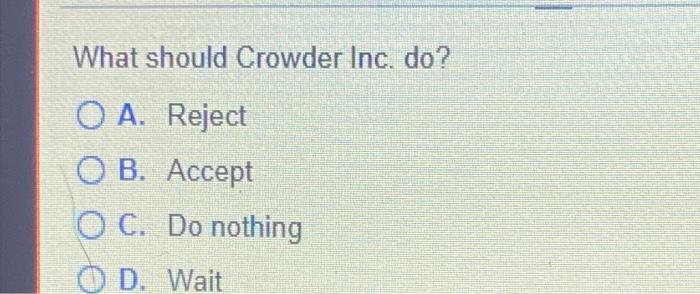

Crowder Inc is an American company considering a project in Hong Kong. The project has the expected cash flows in Hong Kong dollars (HK$) provided in the time line below. The current spot rate is 5.5 Hong Kong dollars per US dolla The Hong Kong dollar is expected to depreciate relative to the U.S. dollar by 11% next year, 15% the following year, and 7% each year after that. The parity conditions do not hold. The appropriate discount rate for projects of similar risk in the United States is 18% and in Hong Kong the appropriate discount rate for projects of similar risk is 24% What is the NPV from the parent perspective and the project perspective for the project? Should Crowder Inc. accept or reject the project? The cash flows are Year 0 330,000 HK$ Year 1 109,220 HK$ Year 2 240,000 HK$ Year 3 427,000 HKS The cash flows are Year 0-330,000 HK$ Year 1 109,220 HK$ Year 2 240,000 HK$ Year 3 427,000 HK$ 1. Find the expected future spot rate a. The expected future spot rate for year 0 (today) US$ HK$ (six decimal place) b. The expected future spot rate for year 1 US$/HK$ (six decimal place) c. The expected future spot rate for year 2 US$ HK$ (six decimal place) d. The expected future spot rate for year 3 US$ /HK$ (six decimal place) 2. Calculate the cash flow and NPV for the parent company a. cash flow at year 0 (Today) US$ (two decimal place) b. cash flow at year 1 US$ (two decimal place) c. cash flow at year 2 US$ (two decimal place) d. cash flow at year 3 US$ (two decimal place) e. NPV of the parent US$ (two decimal place) 3. Calculate the cash flow and NPV from the project perspective a. cash flow at year 0 (Today) HK$ (two decimal place) ) b. cash flow at year 1 HK$ (two decimal place) C. cash flow at year 2 HK$ (two decimal place) d. cash flow at year 3 HK$ (two decimal place) e. NPV from project perspective HK$ (two decimal place) What should Crowder Inc. do? O A. Reject O B. Accept O C. Do nothing O D. Wait

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts