Question: can you please answer all these, it'll be much appreicative and i'll give a thumbs up heres a clearer image but sideways 3. [1/3 Points

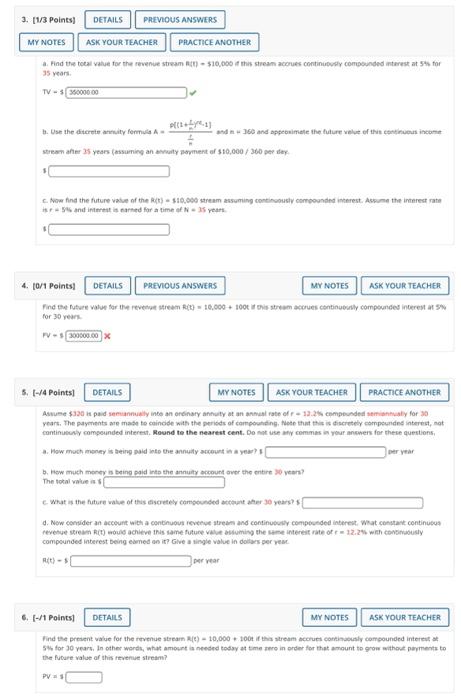

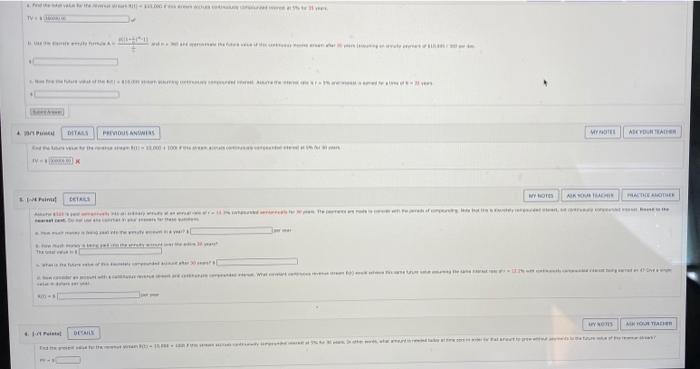

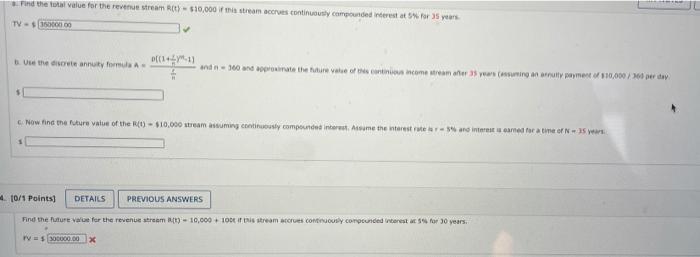

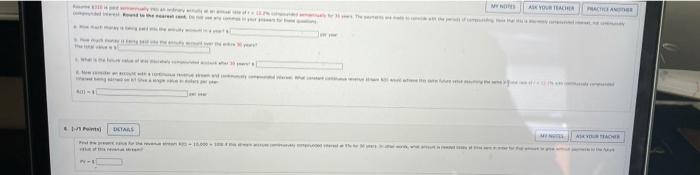

3. [1/3 Points DETAILS PREVIOUS ANSWERS MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER Find the total value for the revenue stream - $10,000 his stream accrues continuously compounded interest at for 35 years TV - 38000000 Une the discrete arsity for alle, ) and 160 and approximate the level of scos com stream after 5 years (asuming an ut soment of 10,000/ 360 per day Now find the future value of the Rt) $10,000 stream assuming continously compounded interest. Assume the interest rate and it is and for a time of years 4. (0/1 Points! DETAILS PREVIOUS ANSWERS MY NOTES ASK YOUR TEACHER Find the future vote for the revenue stream (k) = 10,000+ 100 fois straum accrues continuously compounded interest at for 30 years PV - 3300000.00 5. I-/4 Points) DETAILS MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER Anume $320 is paid semuannually into an ordinary annuity at an annual rate of 13.2 compounded samihaly for 30 years. The payments are made to coincide with the periods of compounding, Note that this is discretely compounded interest, not continly compounded interest, Round to the nearest cent. Do not use any command your answers for these questions, How much money is being paid into the annuity account in a year per year b. How much money is being paid into the annuity account over the entire years? The total values What is the future value of this discretely compounded account her 30 years? d. Now consider an account with a continuous revenue streams and continuously compounded interest Wat constant continuous revenue stream (T) would achieve this same future value in the same interest rate of 12.25 with continuously compounded interest being cared on it? Give a single value in dollars per year t)- per year 6. - 1 Points DETAILS MY NOTES ASK YOUR TEACHER Find the present value for the revenue strat) - 10,000+ 100 the stream scores continuously compounded interest 5 for 30 years. In other words, what amount is needed today at time in order for that amount to grow without payments to the future value of this revenue stream? PV TV YA 4 PRIVOUSAINS THAN ALCAR 100 W wors AKU THEATER Pin LONA MOTHER DECA Find the total value for the revenue stream (t)- 510,000 stream only compounded vores for years TV - 10000.00 Use the discrete annuity for och and 100 and pointe de aureate a contro comeren er 18 years anting on writy payment 110,000/00 per day c. Now in the future value of the ) $10,000 stream assuming continuously comporta interest. Mome the interest were interest earned fue a time of yes 10/1 Points) DETAILS PREVIOUS ANSWERS Find the Future value for the revenue stream ) - 10,000 + 100 tis stream accrues continuously compounded interest as for 30 years. = 200000.00 M AK YOU ACHA CHA DITAS 16.000 1 3. [1/3 Points DETAILS PREVIOUS ANSWERS MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER Find the total value for the revenue stream - $10,000 his stream accrues continuously compounded interest at for 35 years TV - 38000000 Une the discrete arsity for alle, ) and 160 and approximate the level of scos com stream after 5 years (asuming an ut soment of 10,000/ 360 per day Now find the future value of the Rt) $10,000 stream assuming continously compounded interest. Assume the interest rate and it is and for a time of years 4. (0/1 Points! DETAILS PREVIOUS ANSWERS MY NOTES ASK YOUR TEACHER Find the future vote for the revenue stream (k) = 10,000+ 100 fois straum accrues continuously compounded interest at for 30 years PV - 3300000.00 5. I-/4 Points) DETAILS MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER Anume $320 is paid semuannually into an ordinary annuity at an annual rate of 13.2 compounded samihaly for 30 years. The payments are made to coincide with the periods of compounding, Note that this is discretely compounded interest, not continly compounded interest, Round to the nearest cent. Do not use any command your answers for these questions, How much money is being paid into the annuity account in a year per year b. How much money is being paid into the annuity account over the entire years? The total values What is the future value of this discretely compounded account her 30 years? d. Now consider an account with a continuous revenue streams and continuously compounded interest Wat constant continuous revenue stream (T) would achieve this same future value in the same interest rate of 12.25 with continuously compounded interest being cared on it? Give a single value in dollars per year t)- per year 6. - 1 Points DETAILS MY NOTES ASK YOUR TEACHER Find the present value for the revenue strat) - 10,000+ 100 the stream scores continuously compounded interest 5 for 30 years. In other words, what amount is needed today at time in order for that amount to grow without payments to the future value of this revenue stream? PV TV YA 4 PRIVOUSAINS THAN ALCAR 100 W wors AKU THEATER Pin LONA MOTHER DECA Find the total value for the revenue stream (t)- 510,000 stream only compounded vores for years TV - 10000.00 Use the discrete annuity for och and 100 and pointe de aureate a contro comeren er 18 years anting on writy payment 110,000/00 per day c. Now in the future value of the ) $10,000 stream assuming continuously comporta interest. Mome the interest were interest earned fue a time of yes 10/1 Points) DETAILS PREVIOUS ANSWERS Find the Future value for the revenue stream ) - 10,000 + 100 tis stream accrues continuously compounded interest as for 30 years. = 200000.00 M AK YOU ACHA CHA DITAS 16.000 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts