Question: Can you please answer (b) (c) and (e) 4. Suppose that you enter to a financial market consisting of a stock and cash. Assume that

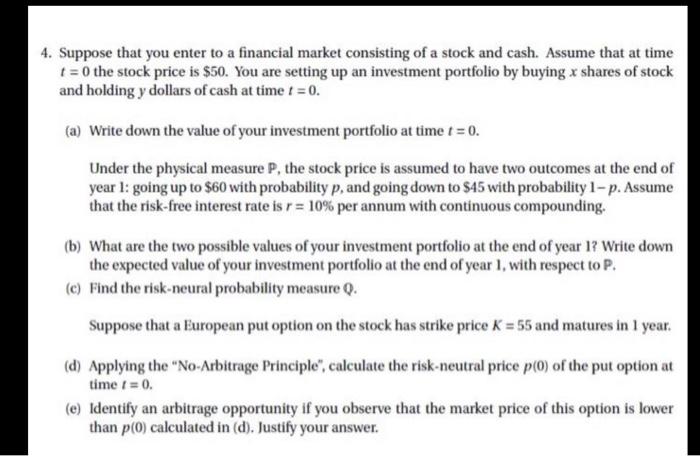

4. Suppose that you enter to a financial market consisting of a stock and cash. Assume that at time 1 = 0 the stock price is $50. You are setting up an investment portfolio by buying x shares of stock and holding y dollars of cash at time t = 0. (a) Write down the value of your investment portfolio at time t = 0. Under the physical measure P, the stock price is assumed to have two outcomes at the end of year l: going up to $60 with probability p, and going down to $45 with probability 1 - p. Assume that the risk-free interest rate is r = 10% per annum with continuous compounding. (b) What are the two possible values of your investment portfolio at the end of year 1? Write down the expected value of your investment portfolio at the end of year 1, with respect to P. (e) Find the risk-neural probability measure Q. Suppose that a European put option on the stock has strike price K = 55 and matures in I year. (d) Applying the "No-Arbitrage Principle", calculate the risk-neutral price p(0) of the put option at time I = 0. (e) Identify an arbitrage opportunity if you observe that the market price of this option is lower than p(0) calculated in (d). Justify your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts