Question: Can you please answer questions 2, 3, 4 & 5? No need to do question 1. Thanks! You have just been hired as a management

Can you please answer questions 2, 3, 4 & 5? No need to do question 1. Thanks!

You have just been hired as a management trainee by Benjamins Fashions, a nationwide distributor of a designer's silk ties. The company has an exclusive franchise on the distribution of the ties, and sales have grown so rapidly over the last few years that it has become necessary to add new members to the management team. You have been given responsibility for all planning and budgeting. Your first assignment is to prepare a master budget for the next 12 months starting January 1, 2022. You are anxious to make a favorable impression on the president and have assembled the information below.

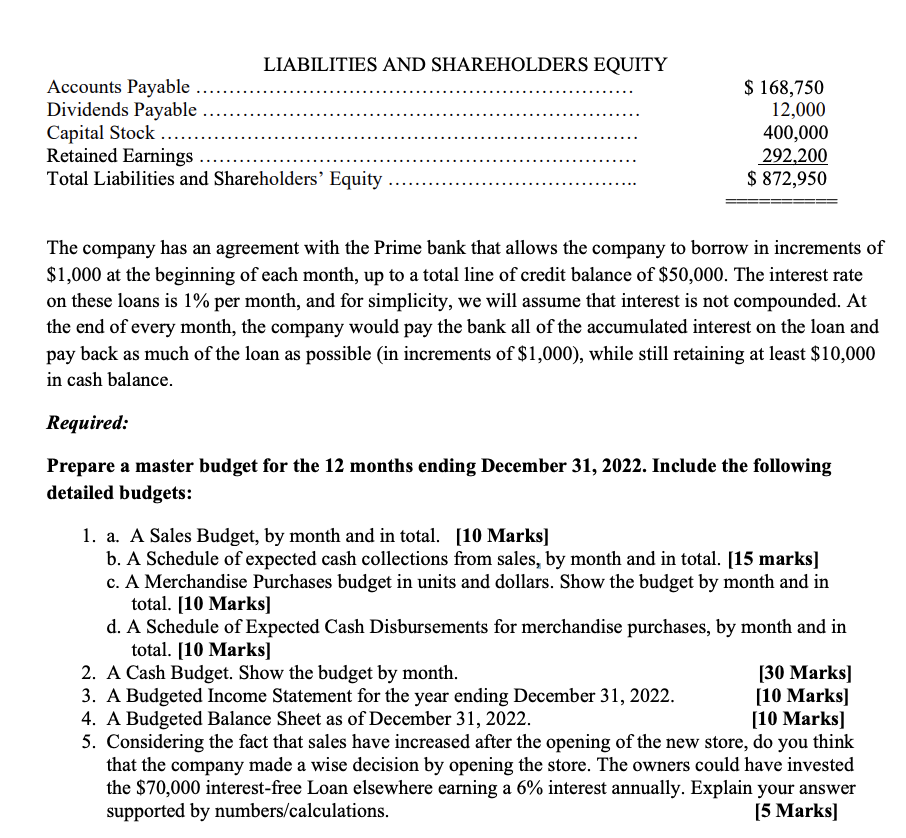

MASTER BUDGET FACTS AND FIGURES: You have just been hired as a management trainee by Benjamin's Fashions, a nationwide distributor of a designer's silk ties. The company has an exclusive franchise on the distribution of the ties, and sales have grown so rapidly over the last few years that it has become necessary to add new members to the management team. You have been given responsibility for all planning and budgeting. Your first assignment is to prepare a master budget for the next 12 months starting January 1, 2022. You are anxious to make a favorable impression on the president and have assembled the information below. The company desires a minimum ending cash balance each month of $10,000. The ties are sold to retailers for $8.00 each (75% of total sales, all on account) and $10.00 each to the individual customers in the mall stores (25% of total sales, all in cash). Recent and forecasted sales in units are as follows: LIABILITIES AND SHAREHOLDERS EQUITY Accounts Payable Dividends Payable Capital Stock .... Retained Earnings Total Liabilities and Shareholders' Equity $ 168,750 12,000 400,000 292,200 $ 872,950 The company has an agreement with the Prime bank that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total line of credit balance of $50,000. The interest rate on these loans is 1% per month, and for simplicity, we will assume that interest is not compounded. At the end of every month, the company would pay the bank all of the accumulated interest on the loan and pay back as much of the loan as possible in increments of $1,000), while still retaining at least $10,000 in cash balance. Required: Prepare a master budget for the 12 months ending December 31, 2022. Include the following detailed budgets: 1. a. A Sales Budget, by month and in total. [10 Marks] b. A Schedule of expected cash collections from sales, by month and in total. [15 marks] c. A Merchandise Purchases budget in units and dollars. Show the budget by month and in total. [10 Marks] d. A Schedule of Expected Cash Disbursements for merchandise purchases, by month and in total. [10 Marks] 2. A Cash Budget. Show the budget by month. [30 Marks] 3. A Budgeted Income Statement for the year ending December 31, 2022. [10 Marks 4. A Budgeted Balance Sheet as of December 31, 2022. [10 Marks 5. Considering the fact that sales have increased after the opening of the new store, do you think that the company made a wise decision by opening the store. The owners could have invested the $70,000 interest-free Loan elsewhere earning a 6% interest annually. Explain your answer supported by numbers/calculations. (5 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts