Question: Can you please answer these questions? Using excel and please show the formulas with the answers as well. Thank You! Complete a three step binomial

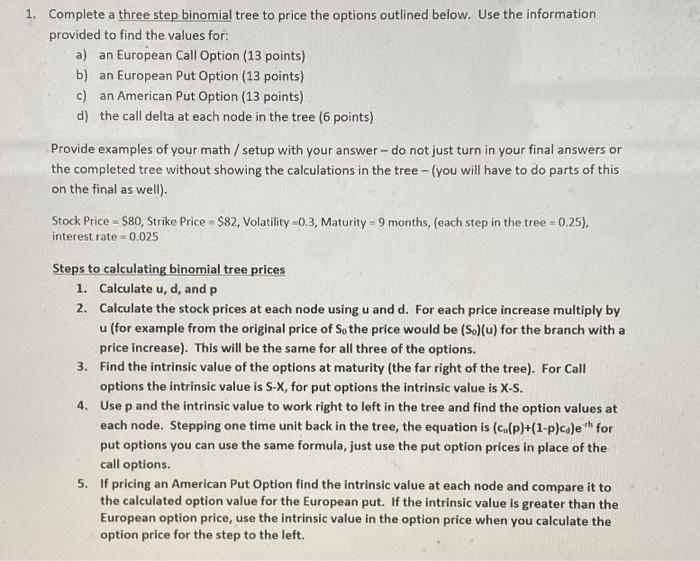

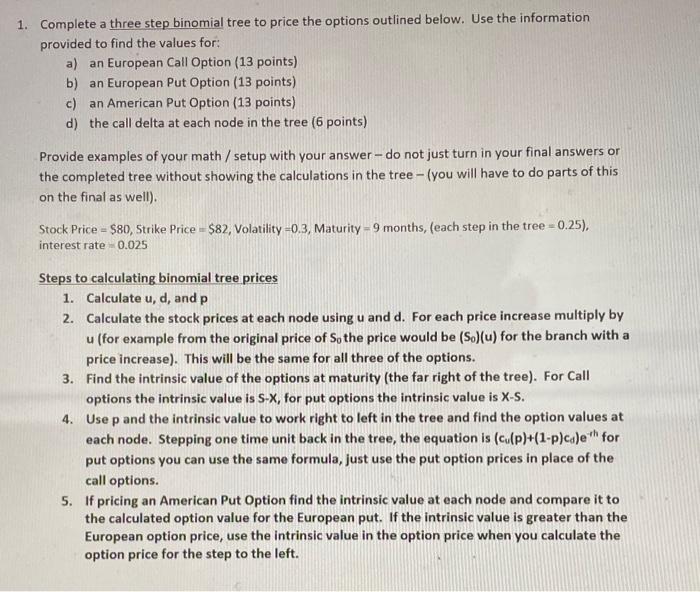

Complete a three step binomial tree to price the options outlined below. Use the information provided to find the values for: a) an European Call Option (13 points) b) an European Put Option (13 points) c) an American Put Option (13 points) d) the call delta at each node in the tree (6 points) Provide examples of your math / setup with your answer - do not just turn in your final answers or the completed tree without showing the calculations in the tree - (you will have to do parts of this on the final as well). Stock Price =$80, Strike Price =$82, Volatility =0.3, Maturity =9 months, (each step in the tree =0.25 ), interest rate =0.025 Steps to calculating binomial tree prices 1. Calculate u,d, and p 2. Calculate the stock prices at each node using u and d. For each price increase multiply by u (for example from the original price of S0 the price would be (S0)(u) for the branch with a price increase). This will be the same for all three of the options. 3. Find the intrinsic value of the options at maturity (the far right of the tree). For Call options the intrinsic value is SX, for put options the intrinsic value is X-S. 4. Use p and the intrinsic value to work right to left in the tree and find the option values at each node. Stepping one time unit back in the tree, the equation is (cu(p)+(1p)cd)eth for put options you can use the same formula, just use the put option prices in place of the call options. 5. If pricing an American Put Option find the intrinsic value at each node and compare it to the calculated option value for the European put. If the intrinsic value is greater than the European option price, use the intrinsic value in the option price when you calculate the option price for the step to the left. 1. Complete a three step binomial tree to price the options outlined below. Use the information provided to find the values for: a) an European Call Option (13 points) b) an European Put Option (13 points) c) an American Put Option (13 points) d) the call delta at each node in the tree ( 6 points) Provide examples of your math / setup with your answer - do not just turn in your final answers or the completed tree without showing the calculations in the tree - (you will have to do parts of this on the final as well). Stock Price =$80,5 trike Price =$82, Volatility =0.3, Maturity =9 months, (each step in the tree =0.25 ), interest rate =0.025 Steps to calculating binomial tree prices 1. Calculate u,d, and p 2. Calculate the stock prices at each node using u and d. For each price increase multiply by u (for example from the original price of S0 the price would be (S0)(u) for the branch with a price increase). This will be the same for all three of the options. 3. Find the intrinsic value of the options at maturity (the far right of the tree). For Call options the intrinsic value is SX, for put options the intrinsic value is X-S. 4. Use p and the intrinsic value to work right to left in the tree and find the option values at each node. Stepping one time unit back in the tree, the equation is (cu(p)+(1p)cd)eth for put options you can use the same formula, just use the put option prices in place of the call options. 5. If pricing an American Put Option find the intrinsic value at each node and compare it to the calculated option value for the European put. If the intrinsic value is greater than the European option price, use the intrinsic value in the option price when you calculate the option price for the step to the left

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts