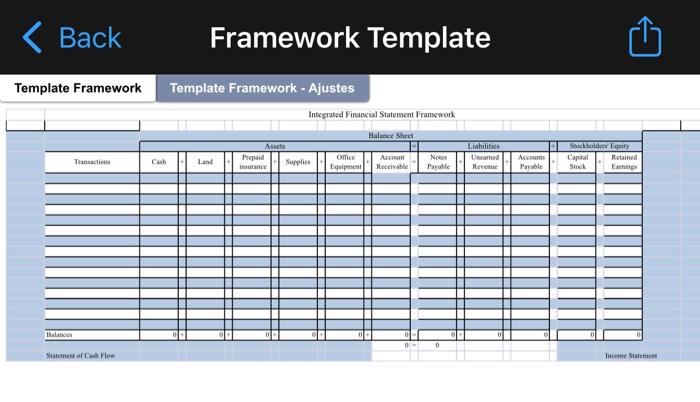

Question: can you please answer this exercises using the integrated financial statement?? thanks a Problems. P4-1 Muple pe af balance sheet et and repart fem 1.

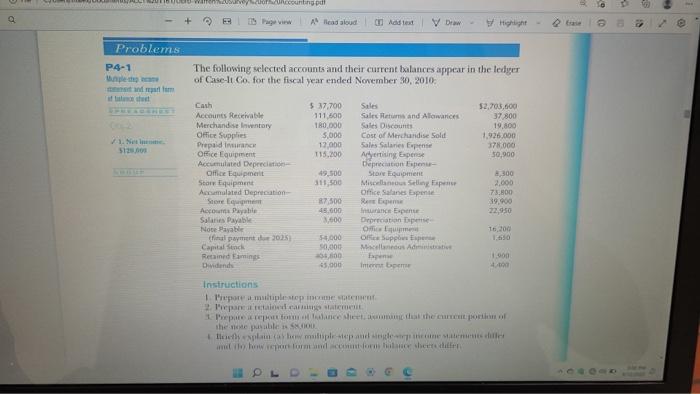

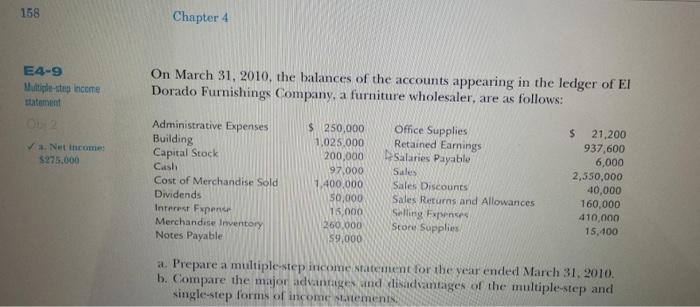

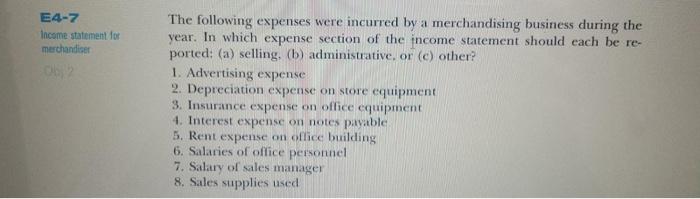

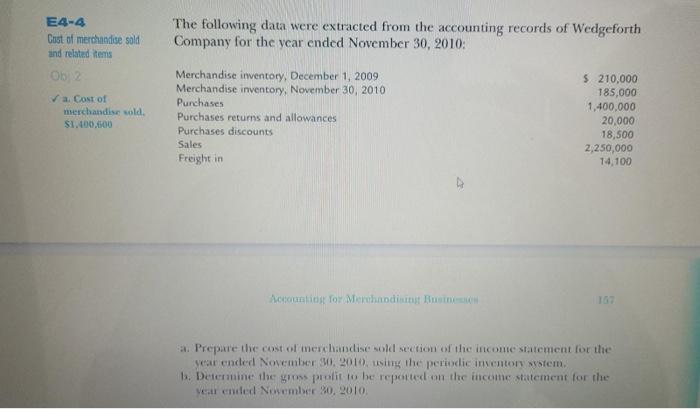

a Problems. P4-1 Muple pe af balance sheet et and repart fem 1. Net Income. $120.000 joerd warehkusurveysoccounting p A lead aloud Add text Draw Highlight The following selected accounts and their current balances appear in the ledger of Case-It Co. for the fiscal year ended November 30, 2010: Cash Sales $2,703,600 $ 37,700 111,600 180,000 37,800 Sales Returns and Allowances Sales Discounts 19,800 Accounts Receivable Merchandise Inventory Office Supplies Prepaid Insurance 5,000 Cost of Merchandise Sold 1,926.000 12,000 Sales Salaries Expense 378,000 Office Equipment 115,200 50,900 Accumulated Depreciation- Office Equipment 49,500 8,300 Advertising Expense Depreciation Expenu- Store Equipment Miscellaneous Selling Expe Office Salanes Expense Res Expense Store Equipment 311,500 2,000 Accumulated Depreciation- 73.800 Store Equipment 87,500 39,900 Accounts Payable 45.600 Insurance Expense 22,950 Salaries Payable 3,600 Depreciation Expense Note Payable Office Equipmen 16,200 (final payment due 2025) $4,000 Office Supplies Expense 1,650 Capital Stock 50,000 404,600 Macellaneous Administrative Expense Interest beme Retained Eamings Dividends 1.900 45,000 4,490 Instructions 1. Prepare a multiple step income statement. 2. Prepare a retained earnings statement. 3. Prepare a report form of balance sheet, asomang that the current portion of the note payable is $8,000. 4. Besedy explain cas how multiple step and single-septe une statements differ and thy how report form and account forms balance sheers differ OLD OFC trase 158 E4-9 Multiple-step income statement a. Net income: $275.000 Chapter 4 On March 31, 2010, the balances of the accounts appearing in the ledger of El Dorado Furnishings Company, a furniture wholesaler, are as follows: Administrative Expenses $ $ 250,000 1,025,000 200,000 Building Capital Stock Office Supplies Retained Earnings Salaries Payable 21,200 937,600 6,000 Cash 97,000 Sales Cost of Merchandise Sold 2,550,000 40,000 1,400,000 Sales Discounts Dividends 50,000 Sales Returns and Allowances 160,000 Interest Expense 15,000 Selling Expenses 410,000 Merchandise Inventory 260,000 Store Supplies 15,400 Notes Payable $9,000 a. Prepare a multiple-step income statement for the year ended March 31, 2010. b. Compare the major advantages and disadvantages of the multiple-step and single-step forms of income statements. E4-7 Income statement for merchandiser The following expenses were incurred by a merchandising business during the year. In which expense section of the income statement should each be re- ported: (a) selling, (b) administrative, or (c) other? 1. Advertising expense 2. Depreciation expense on store equipment 3. Insurance expense on office equipment 4. Interest expense on notes payable. 5. Rent expense on office building 6. Salaries of office personnel 7. Salary of sales manager 8. Sales supplies used E4-4 Cost of merchandise sold and related items Ob 2 a. Cost of merchandise sold. $1,400,600 The following data were extracted from the accounting records of Wedgeforth Company for the year ended November 30, 2010: Merchandise inventory, December 1, 2009 Merchandise inventory, November 30, 2010 Purchases $ 210,000 185,000 1,400,000 Purchases returns and allowances 20,000 Purchases discounts 18,500 Sales Freight in 2,250,000 14,100 Accounting for Merchandising Businesses 167 a. Prepare the cost of merchandise sold section of the income statement for the year ended November 30, 2010, using the periodic inventory system. b. Determine the gross profit to be reported on the income statement for the year ended November 30, 2010. E4-2 For a recent year, Best Buy reported revenue of $40,023 million. Its gross profit was $9.516 million. What was the amount of Best Buy's cost of merchandise sold? Exercises E4-1 Determining grom profit During the current year, merchandise is sold for $795,000. The cost of the merchandise sold is $477,000. a. What is the amount of the gross profit? b. Compute the gross profit percentage (gross profit divided by sales). c. Will the income statement necessarily report a net income? Explain.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts