Question: Can you please answer this question for me. Marvex Inc. is a CCPC with a nil GRIP balance. Marvex's share capital consists of 450,000 common

Can you please answer this question for me.

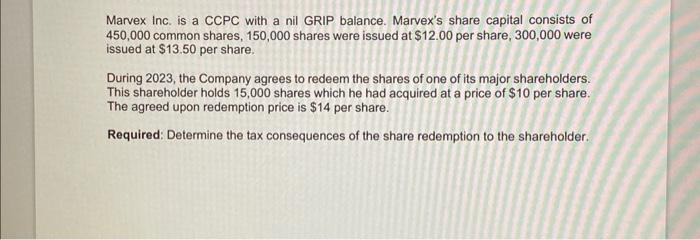

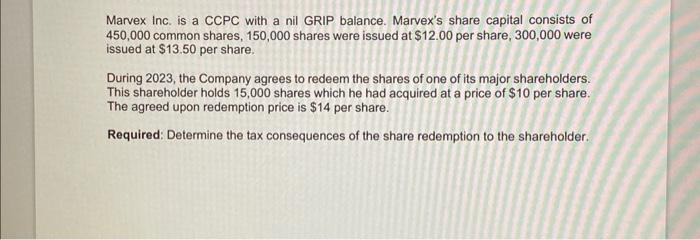

Marvex Inc. is a CCPC with a nil GRIP balance. Marvex's share capital consists of 450,000 common shares, 150,000 shares were issued at $12.00 per share, 300,000 were issued at $13.50 per share. During 2023, the Company agrees to redeem the shares of one of its major shareholders. This shareholder holds 15,000 shares which he had acquired at a price of $10 per share. The agreed upon redemption price is $14 per share. Required: Determine the tax consequences of the share redemption to the shareholder

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock