Question: Can you please answer this question: How stable are the beta estimates obtained from these shorter subperiods? Thank you! Estimate the index model for each

Can you please answer this question: How stable are the beta estimates obtained from these shorter subperiods? Thank you!

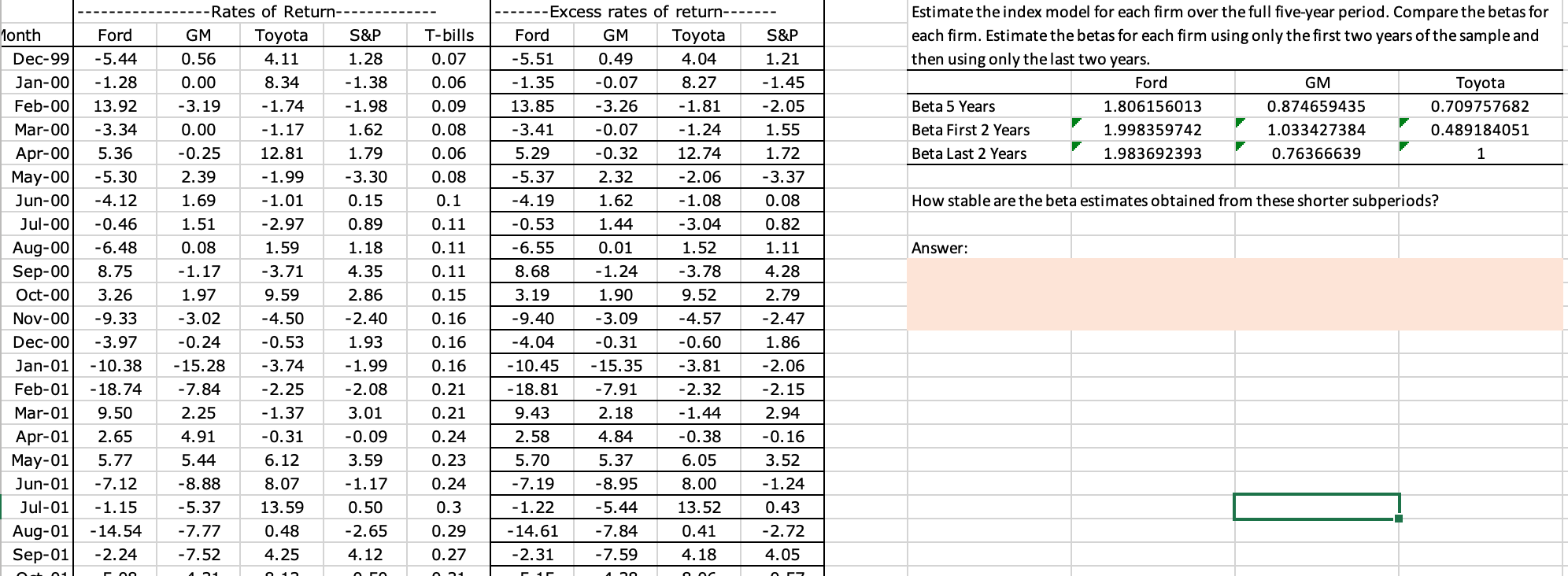

Estimate the index model for each firm over the full five-year period. Compare the betas for each firm. Estimate the betas for each firm using only the first two years of the sample and then using only the last two years. Ford GM Toyota Beta 5 Years 1.806156013 0.874659435 0.709757682 Beta First 2 Years 1.998359742 1.033427384 0.489184051 Beta Last 2 Years 1.983692393 0.76366639 How stable are the beta estimates obtained from these shorter subperiods? 1.59 Answer: ----------------- Rates of Return------------- -------Excess rates of return------- month Ford GM Toyota S&P T-bills Ford GM Toyota S&P Dec-99 -5.44 0.56 4.11 1.28 0.07 -5.51 0.49 4.04 1.21 Jan-00 -1.28 0.00 8.34 - 1.38 0.06 -1.35 -0.07 8.27 -1.45 Feb-00 13.92 -3.19 -1.74 -1.98 0.09 13.85 -3.26 -1.81 -2.05 Mar-00 -3.34 0.00 -1.17 1.62 0.08 -3.41 -0.07 -1.24 1.55 Apr-001 5.36 -0.25 12.81 1.79 0.06 5.29 -0.32 12.74 1.72 May-00 -5.30 2.39 -1.99 -3.30 0.08 -5.37 2.32 -2.06 -3.37 Jun-00 -4.12 1.69 -1.01 0.15 0.1 -4.19 1.62 -1.08 0.08 Jul-00 -0.46 1.51 -2.97 0.89 0.11 -0.53 1.44 -3.04 0.82 Aug-00 -6.48 0.08 1.18 0.11 -6.55 0.01 1.52 1.11 Sep-00 8.75 -1.17 -3.71 4.35 0.11 8.68 -1.24 -3.78 4.28 Oct-00 3.26 1.97 9.59 2.86 0.15 3.19 1.90 9.52 2.79 Nov-00 -9.33 -3.02 -4.50 -2.40 0.16 -9.40 -3.09 -4.57 -2.47 Dec-00 -3.97 -0.24 -0.53 1.93 0.16 1 -4.04 -0.31 -0.60 1.86 Jan-01 -10.38 -15.28 -3.74 -1.99 0.16 -10.45 - 15.35 -3.81 -2.06 Feb-01 - 18.74 -7.84 -2.25 -2.08 0.21 -18.81 -7.91 -2.32 -2.15 Mar-01 9.50 2.25 -1.37 3.01 0.21 9.43 2.18 -1.44 2.94 Apr-01 2.65 4.91 -0.31 -0.09 0.24 2.58 4.84 -0.38 -0.16 May-01 5.77 5.44 6.12 3.59 0.23 15.70 5.37 6.05 3.52 Jun-01 -7.12 -8.88 8.07 -1.17 0.24 -7.19 -8.95 8.00 - 1.24 Jul-01 -1.15 -5.37 13.59 0.50 0.3 -1.22 -5.44 13.52 0.43 Aug-01 -14.54 -7.77 0.48 -2.65 0.29 - 14.61 -7.84 0.41 -2.72 Sep-01 -2.24 -7.52 4.25 4.12 0.27 -2.31 -7.59 4.18 4.05 A4 Estimate the index model for each firm over the full five-year period. Compare the betas for each firm. Estimate the betas for each firm using only the first two years of the sample and then using only the last two years. Ford GM Toyota Beta 5 Years 1.806156013 0.874659435 0.709757682 Beta First 2 Years 1.998359742 1.033427384 0.489184051 Beta Last 2 Years 1.983692393 0.76366639 How stable are the beta estimates obtained from these shorter subperiods? 1.59 Answer: ----------------- Rates of Return------------- -------Excess rates of return------- month Ford GM Toyota S&P T-bills Ford GM Toyota S&P Dec-99 -5.44 0.56 4.11 1.28 0.07 -5.51 0.49 4.04 1.21 Jan-00 -1.28 0.00 8.34 - 1.38 0.06 -1.35 -0.07 8.27 -1.45 Feb-00 13.92 -3.19 -1.74 -1.98 0.09 13.85 -3.26 -1.81 -2.05 Mar-00 -3.34 0.00 -1.17 1.62 0.08 -3.41 -0.07 -1.24 1.55 Apr-001 5.36 -0.25 12.81 1.79 0.06 5.29 -0.32 12.74 1.72 May-00 -5.30 2.39 -1.99 -3.30 0.08 -5.37 2.32 -2.06 -3.37 Jun-00 -4.12 1.69 -1.01 0.15 0.1 -4.19 1.62 -1.08 0.08 Jul-00 -0.46 1.51 -2.97 0.89 0.11 -0.53 1.44 -3.04 0.82 Aug-00 -6.48 0.08 1.18 0.11 -6.55 0.01 1.52 1.11 Sep-00 8.75 -1.17 -3.71 4.35 0.11 8.68 -1.24 -3.78 4.28 Oct-00 3.26 1.97 9.59 2.86 0.15 3.19 1.90 9.52 2.79 Nov-00 -9.33 -3.02 -4.50 -2.40 0.16 -9.40 -3.09 -4.57 -2.47 Dec-00 -3.97 -0.24 -0.53 1.93 0.16 1 -4.04 -0.31 -0.60 1.86 Jan-01 -10.38 -15.28 -3.74 -1.99 0.16 -10.45 - 15.35 -3.81 -2.06 Feb-01 - 18.74 -7.84 -2.25 -2.08 0.21 -18.81 -7.91 -2.32 -2.15 Mar-01 9.50 2.25 -1.37 3.01 0.21 9.43 2.18 -1.44 2.94 Apr-01 2.65 4.91 -0.31 -0.09 0.24 2.58 4.84 -0.38 -0.16 May-01 5.77 5.44 6.12 3.59 0.23 15.70 5.37 6.05 3.52 Jun-01 -7.12 -8.88 8.07 -1.17 0.24 -7.19 -8.95 8.00 - 1.24 Jul-01 -1.15 -5.37 13.59 0.50 0.3 -1.22 -5.44 13.52 0.43 Aug-01 -14.54 -7.77 0.48 -2.65 0.29 - 14.61 -7.84 0.41 -2.72 Sep-01 -2.24 -7.52 4.25 4.12 0.27 -2.31 -7.59 4.18 4.05 A4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts