Question: can you please answer this question in full, showing full working out Question 3 Assume a CAPM world with three risky securities but no risk-free

can you please answer this question in full, showing full working out

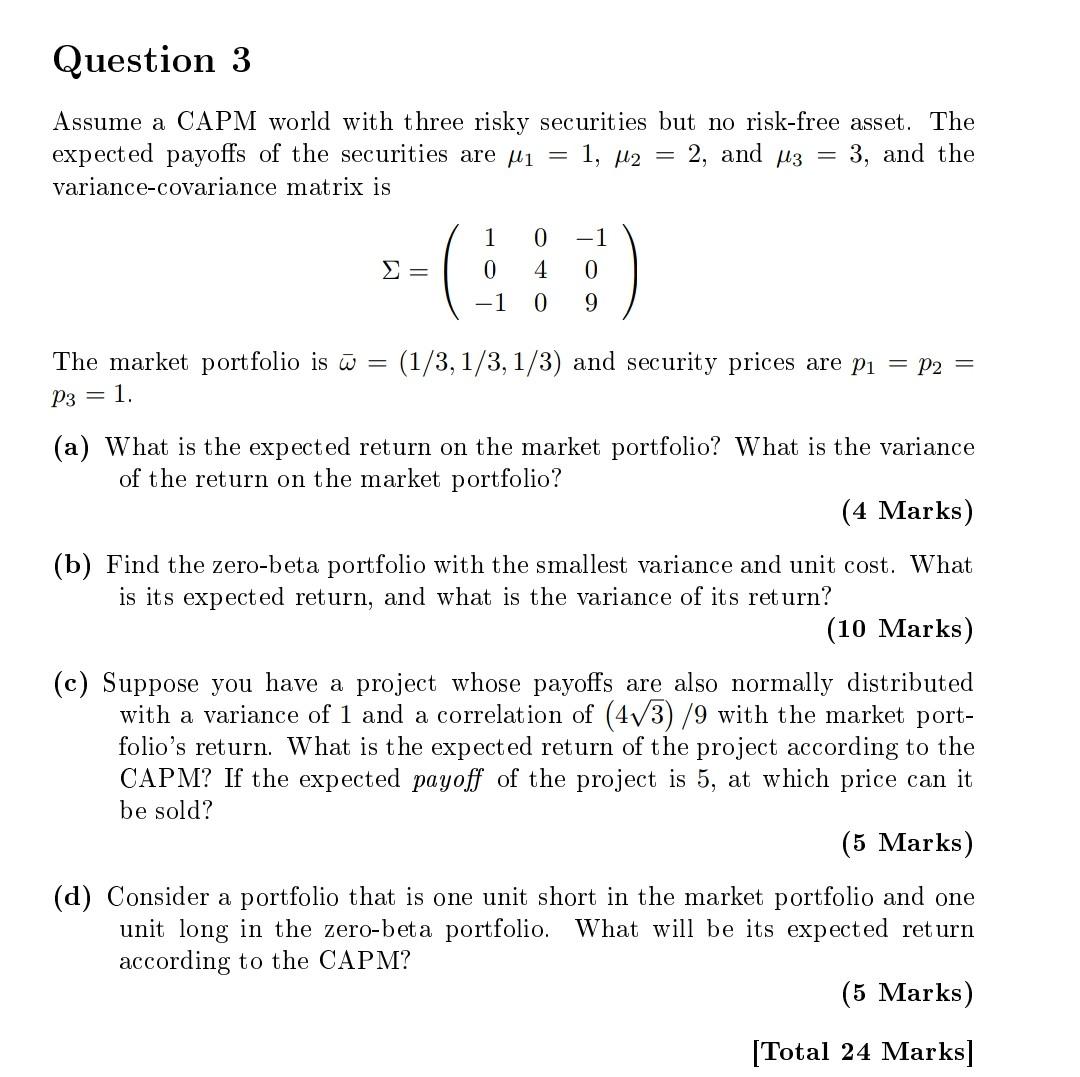

Question 3 Assume a CAPM world with three risky securities but no risk-free asset. The expected payoffs of the securities are Mi = - 1, M2 = 2, and M3 = 3, and the variance-covariance matrix is 1 0 ( 0 4 -1 0 9 -1 0 The market portfolio is W = (1/3, 1/3, 1/3) and security prices are P1 = P2 = P3 = 1. (a) What is the expected return on the market portfolio? What is the variance of the return on the market portfolio? (4 Marks) (b) Find the zero-beta portfolio with the smallest variance and unit cost. What is its expected return, and what is the variance of its return? (10 Marks) (c) Suppose you have a project whose payoffs are also normally distributed with a variance of 1 and a correlation of (473) /9 with the market port- folio's return. What is the expected return of the project according to the CAPM? If the expected payoff of the project is 5, at which price can it be sold? (5 Marks) (d) Consider a portfolio that is one unit short in the market portfolio and one unit long in the zero-beta portfolio. What will be its expected return according to the CAPM? (5 Marks) [Total 24 Marks] Question 3 Assume a CAPM world with three risky securities but no risk-free asset. The expected payoffs of the securities are Mi = - 1, M2 = 2, and M3 = 3, and the variance-covariance matrix is 1 0 ( 0 4 -1 0 9 -1 0 The market portfolio is W = (1/3, 1/3, 1/3) and security prices are P1 = P2 = P3 = 1. (a) What is the expected return on the market portfolio? What is the variance of the return on the market portfolio? (4 Marks) (b) Find the zero-beta portfolio with the smallest variance and unit cost. What is its expected return, and what is the variance of its return? (10 Marks) (c) Suppose you have a project whose payoffs are also normally distributed with a variance of 1 and a correlation of (473) /9 with the market port- folio's return. What is the expected return of the project according to the CAPM? If the expected payoff of the project is 5, at which price can it be sold? (5 Marks) (d) Consider a portfolio that is one unit short in the market portfolio and one unit long in the zero-beta portfolio. What will be its expected return according to the CAPM? (5 Marks) [Total 24 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts