Question: CAN YOU PLEASE ANSWER THOSE QUESTION THANK YOU A bond has a $1,000 par value, 20 years to maturity, and an 8% annual coupon and

CAN YOU PLEASE ANSWER THOSE QUESTION THANK YOU

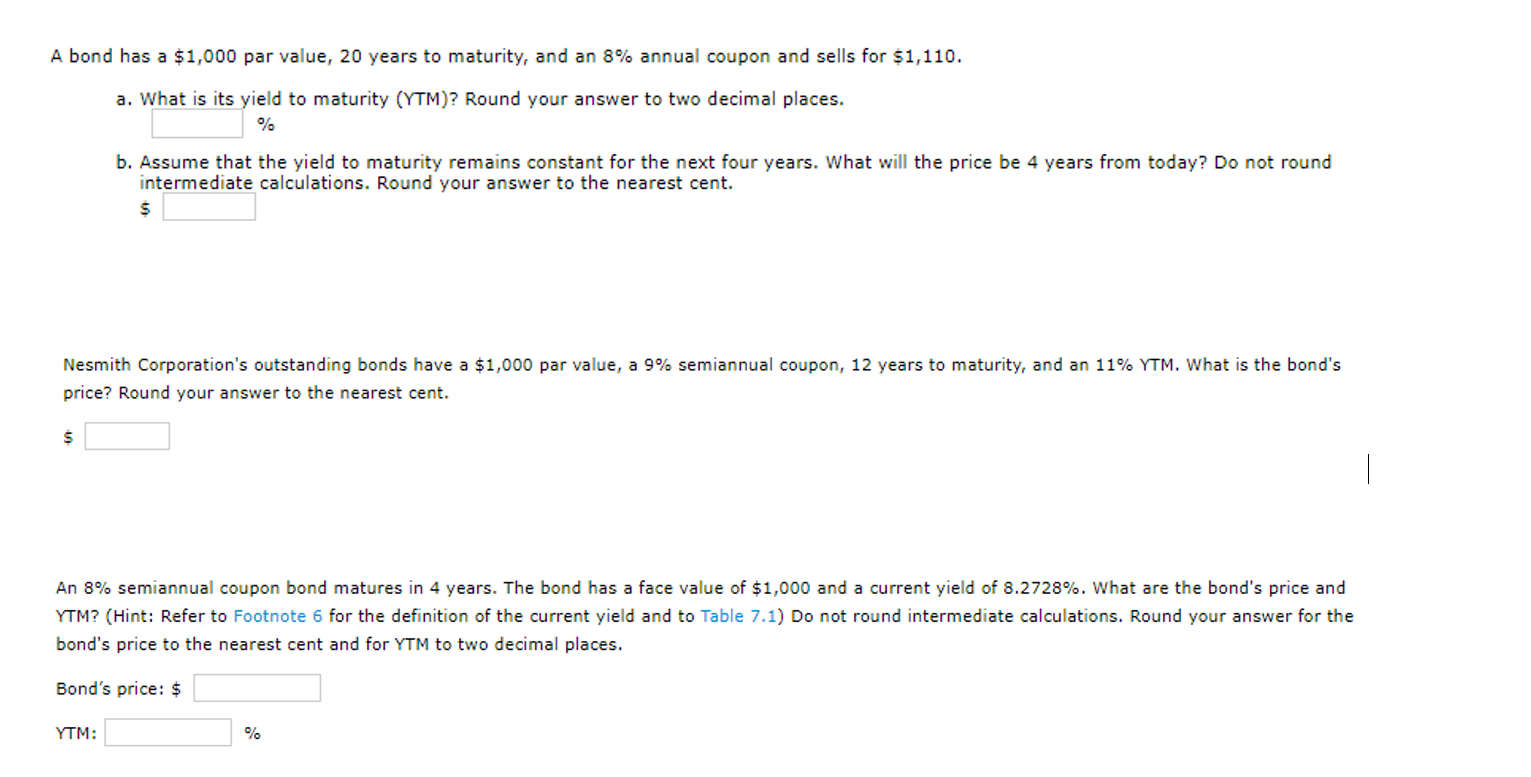

A bond has a $1,000 par value, 20 years to maturity, and an 8% annual coupon and sells for $1,110. a. What is its yield to maturity (YTM)? Round your answer to two decimal places. b. Assume that the yield to maturity remains constant for the next four years. What will the price be 4 years from today? Do not round intermediate calculations. Round your answer to the nearest cent. Nesmith Corporation's outstanding bonds have a $1,000 par value, a 9% semiannual coupon, 12 years to maturity, and an 11% YTM. What is the bond's price? Round your answer to the nearest cent. An 8% semiannual coupon bond matures in 4 years. The bond has a face value of $1,000 and a current yield of 8.2728%. What are the bond's price and YTM? (Hint: Refer to Footnote 6 for the definition of the current yield and to Table 7.1) Do not round intermediate calculations. Round your answer for the bond's price to the nearest cent and for YTM to two decimal places. Bond's price: $ YTM: %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts