Question: can you please answer two and three for me? will thumbs up if correct! Morell Electric Motor Corporation manufactures electric motors for commercial use. The

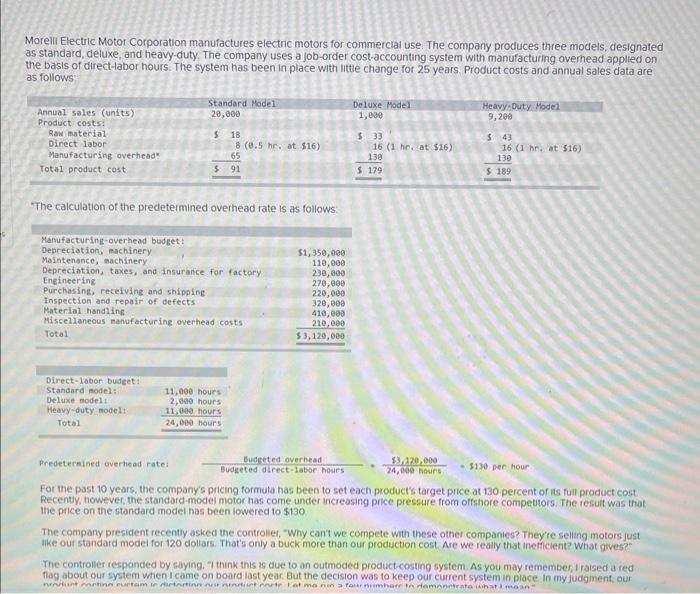

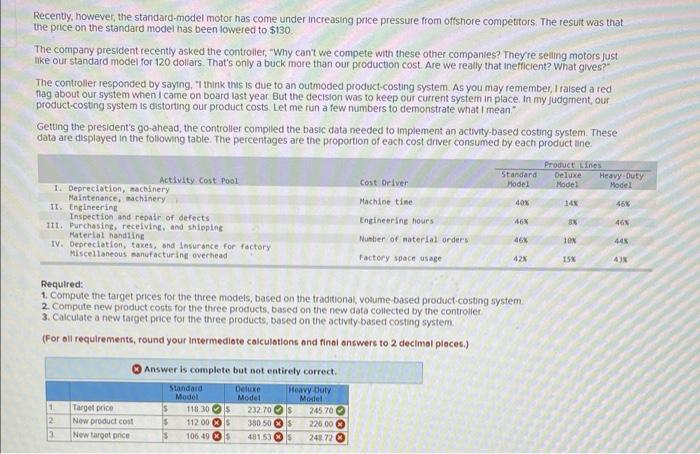

Morell Electric Motor Corporation manufactures electric motors for commercial use. The company produces three models, designated as standard, deluxe, and heavy-duty. The company uses a job-order cost-accounting system with manufacturing overhead applied on the basis of direct-labor hours. The system has been in place with little change for 25 years. Product costs and annual sales data are as follows: The calculation of the predetermined overhead rate is as follows: Predetermined overhead rate: Budgeted overhead 24,000+Bours13,170,000=3130 per hour For the past 10 years. the company's pricing formula has been to set each procluct's target pice at 130 percent of its full product cost Recently, however, the standard-model motor has come under increasing price pressure from offshore competitors. The result was that the price on the standard model has been lowered to $130 The company president recently asked the controlier, "Why can't we compete with these other companies? They're selleng motors just like out standard model for 120 dollars. That's only a buck more than ouf production cost Are we really that ineficient? What gives?" The controler responded by saying. "I think this is due to an outmoded productecosting system. As you may remember, I raised a red flag about ouf system when I came on board last year. Eut the decision was to keep our current system in place in my judginent, our Recently, however, the standard-model motor has come under increasing pnce pressure from offshore competitors. The resuit was that the pnce on the standard model has been lowered to $130. The company president recently asked the controller, "Why can't we compete with these other companies? Theyre selling motors just ilke our standard model for 120 dollars. That's only a buck more than our producton cost. Are we really that inefficient? What gives? The controller responded by saying. 71 think this is due to an outmoded product-costing system. As you may remember, I raised a red flag about our system when I came on board last year. But the decision was to keep our current system in place. In my judgment, our product-costing system is distorting our product costs Let me run a few numbers to demonstrate what I mean- Getting the president's go-ahead, the controller complied the basic data needed to implement an activity-based costing system. These data are dispiayed in the foliowng table. The percentages are the proportion of each cost driver consumed by each product ine. Requlfed: 1. Compute the target prices for the three modeis, based on the fraditional, voume-based product-costing system. 2. Compute new product conts for the three products, based on the new data collected by the controller. 3. Calculate a new tatget pnce for the three products, based on the activity based costing system. (For all requlrements, round your intermediate calculations and final answers to 2 decimal pleces.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts