Question: CAN YOU PLEASE CLEARLY WRITTEN ANSWER THESE QUESTIONS USING THE FINANCIAL PROFESSIONAL CALCULATOR KEYS ONLY CLEARLY WRITTEN USING ONLY THE PROFESSIONAL CALCULATOR PLEASE AND THANK

CAN YOU PLEASE CLEARLY WRITTEN ANSWER THESE QUESTIONS USING THE FINANCIAL PROFESSIONAL CALCULATOR KEYS ONLY CLEARLY WRITTEN USING ONLY THE PROFESSIONAL CALCULATOR PLEASE AND THANK YOU

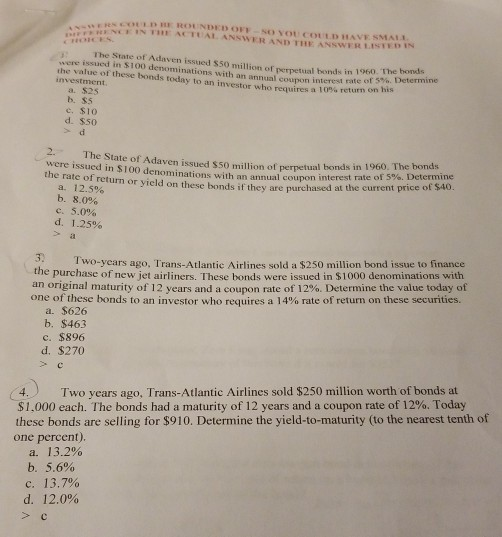

ct", D11, ROENDE D OFF NOYot.cott.DIIAVESMA ERNCE IN THE ACTUAL ANSWER AND THE ANSWER LISTED The State of Adaven issued $50 million of perpetual bonds in eas were issued in $100 denominations with an annual coupon interest rate the value of these bonds today to an investor who requires a 10% ret of 5%. Determine investment. a. $25 b. $5 c. $10 d. $50 2. The State of Adaven issued $50 million of perpetual bonds in 1960.The bon - were issued in $100 d enom inations with an annual coupon interest rate of 5%. Determine or yield on these bonds if they are purchased at the current price of $40 a. 12.5% b. 8.000 d. 1.25% >a 3. I wo-years ago, Trans-Atlantic Airlines sold a $250 million bond issue to finance the purchase of new jet airliners. These bonds were issued in $1000 denominations with an original maturity of 12 years and a coupon rate of 12%. Determine the value today of one ofthese bonds to an investor who requires a 14% rte of return on these securities. a. $626 b. $463 c. $896 d. $270 4. ) Two years ago. Trans-Atlantic Airlines sold $250 million worth of bonds at $1,000 each. The bonds had a maturity of 12 years and a coupon rate of 12%. Today these bonds are selling for $910. Determine the yield-to-maturity (to the nearest tenth of one percent). a. 13.2% b. 5.6% c. d. 12.0% > C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts