Question: can you please do each homework individually :) net Exercise 14.30 cording the LOS Demo 145 Chapter 14 Investments in Debt und iaity On Jumuary

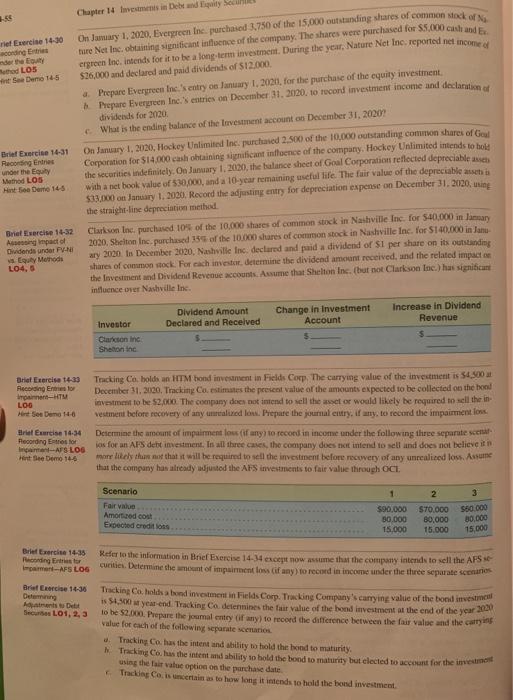

net Exercise 14.30 cording the LOS Demo 145 Chapter 14 Investments in Debt und iaity On Jumuary 1, 2000. Evergreen le purchased 3.750 of the 15.000 outstanding shares of common stock of Na ture Net Inc. obtaining significant influence of the company. The shares were purchased for 55.000 cash and be ergreen Inc. intends for it to be a long term investment. During the year, Nature Net Inc. reported net income $36,000 and declared and paid dividends of $12.000 Prepare Evergreen Inc.'s entry on January 1, 2020, for the purchase of the equity investment Prepare Evergreen Inc.'s entries on December 31, 20120.10 record investment income and declarationer dividends for 2020 c. What is the ending balance of the lovestment account on December 31, 20202 Brief Exercise 14-31 Recording Ernes under the Euty Method LOS Hintse Demo 145 On January 1, 2020, Hockey Unlimited Inc. purchased 2.500 of the 10,000 outstanding common shares of Gel Corporation for $14.000 cash obtaining significant intoence of the company. Hockey Unlimited intends to bols the securities indefinitely. On January 1, 2020, the balance sheet of Goal Corporation reflected depreciable anes with a net book value of 530,000, and a 10-year remaining useful life. The fair value of the depreciable asset $32.000 on January 1, 2020. Record the adjusting entry for depreciation expense on December 31, 2020, uning the straight-line depreciation method Clarkson Inc. purchased 10% of the 10.000 shares of common stock in Nashville Inc. for 540.000 in January 2030. Shelton Inc. purchased 35% of the 10.000 shares of common stock in Nashville Inc. for $140.000 in Jan ary 2020. In December 2020. Nashville Inc. declared and paid a dividend of Si per share on its outstanding shares of common stock. For each imestar determine the dividend amount received, and the related impacto the Investment and Dividend Revenue accounts. Assume that Shelton Inc. (but not Clarkson Inc.) has significant influence over Nashville Inc. Brief Exercise 14-32 Ang impact of Dividends under PVN Equity Methods LO4,6 Dividend Amount Declared and Received Change in Investment Account Increase in Dividend Revenue Investor Clarkson inc Shetani Brief Exercise 14-33 Recording Ensto impainment- LOO Her Se Demo 1-0 Tracking Co. holds a HTM hond investment in Fields Corp The carrying value of the investment is $4.500 at December 31, 2020. Tracking Co. estimates the present value of the amounts expected to be collected on the bood investment to be $2,000. The company does not intend to sell the act or would likely be required to sell the in- vestment before recovery of any maxed low. Prepare the journal entry, if any, to record the impairmention Determine the amount of impairment loss (if any to record in income under the following three separate scenar jos for an AFS debt investment. In all three cases, the company does not intend to sell and does not believe in more likely that not that it will be required to sell the investment before recuery of any unrealised loss. Assume that the company has already adjusted the AFS investments to fair value through OCI Brel Excise 14-34 Recording to I-ATS LOS See Demo 14-6 Scenario Fair Vue Amor.edco Expected credito 1 2 3 $90,000 $70.000 $60.000 30.000 80,000 15.000 15.000 B0.000 15.000 Bred Exercise 14-35 ording Esto pamen-AFS LOG Brief Exercise 14-36 Deleg des Debut SecuL01, 2, 3 Refer to the information in Brief Exercise 14-34 except now assume that the company intends to sell the APS se curities. Determine the amount of impairment loss if any) to record in income under the three separate scenario Tracking Co. holda bond investment in Fields Corp. Tracking Company's carrying value of the bond investment 54.360 st year end. Tracking Co detenines the fair value of the bond investment at the end of the year 2000 to be $2.000. Prepare the joumal entry (if any) to record the difference between the fair value and the carrying value for each of the following separate scenos Tracking Co. has the intent and ability to hold the bond to maturity Tracking Co. Las the intent and ability to hold the bond to maturity but elected to account for the investment using the fair value option on the parchase date Tracking Co is certain as to how long it intends to hold the bond investment Cambridge Business Publishers 14-56 Chapter 14 Investments in Den Eity Securities 4. Tracking Co. is uncertain as to how long it intends to hold the bond investment but elected to account for the investment using the fair value option on the purchase date. On January 1, 2020, Evergreen Ine. purchased 3,750 of the 15.000 outstanding shares of common stock of Nature Brief Exercise 14-37 Net Inc, resulting in significant influence over Nature Net Inc. The shares were purchased for $5,000 cash and Recordings Evergreen elected to account for the investment under the fair value option. During the year, Nature Net reported to thos net income of $26,000 and declared and paid dividends of $12.000. The 3.750 shares of Nature Net Inc. stock had a fair value of $5.500 on December 31, 2020 a. Prepare Evergreen's entry to record the purchase of the common stock of Nature Net Inc. on January 1. 2020 6. Prepare Evergreen's entry to record the receipt of declared dividends on December 31, 2020. c. Prepare Evergreen's entry to adjust the securities to fair value on December 31, 2020, 4. What is the carrying value of the investment on December 31, 2020? On June 15.2020. Diaz Inc. purchased $100,000 bonds at par value and elects to account for the bonds using the Brief Exercise 14-38 fair value option. On December 31, 2020, the bonds had a fair value of $104,000. Diaz Inc. sold the bonds on Recognizing Income January 21, 2021. for $106.000. Option LO 1,2 4. What is the impact on the income statement in 2020 and 2021 for the transactions described above? How would your answer to (a) change if the bonds were instead classified as HTM securities and not ac- counted for using the fair value option? For the following six items, indicate which financial statement category would be affected: (1) net income or (2) Brief Exercise 14 other comprehensive income. Classilying Financial a Realized gain on sale of AFS debt investment L01, 2, 3, 4,5 b. Realized loss on sale of HTM debt investment. c. Unrealized gain on an AFS debt investment d. Unrealized loss on a TS debt investment Unrealized gain on an AFS debt investment accounted for using the fair value option. Unrealized loss on an equity investment measured at FV-NI. under the Fair Value Statement Amounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts