Question: can you please do it and explain no u can do it by cov over protfolio of varince A portfolio consists of three stocks: Stock

can you please do it and explain

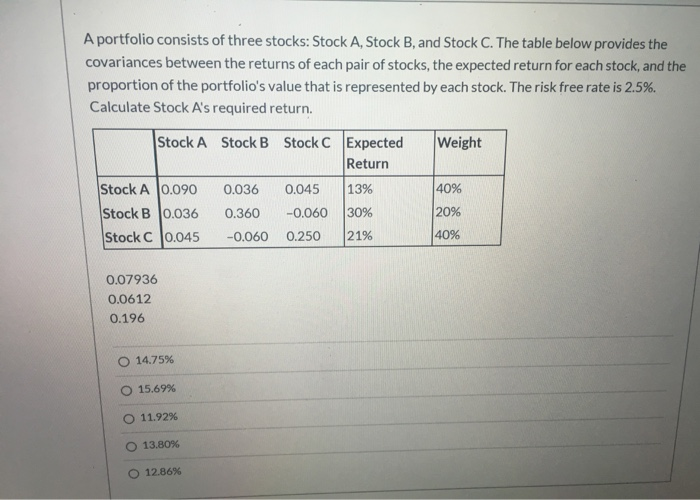

A portfolio consists of three stocks: Stock A, Stock B, and Stock C. The table below provides the covariances between the returns of each pair of stocks, the expected return for each stock, and the proportion of the portfolio's value that is represented by each stock. The risk free rate is 2.5%. Calculate Stock A's required return. Stock A Stock B Stock C Expected Weight Return Stock A 10.090 0.036 0.045 13% 40% Stock B 0.036 0.360 -0.060 30% 20% Stock C 0.045 -0.060 0.250 21% 40% 0.07936 0.0612 0.196 O 14.75% O 15.69% O 11.92% O 13.80% O 12.86% A portfolio consists of three stocks: Stock A, Stock B, and Stock C. The table below provides the covariances between the returns of each pair of stocks, the expected return for each stock, and the proportion of the portfolio's value that is represented by each stock. The risk free rate is 2.5%. Calculate Stock A's required return. Stock A Stock B Stock C Expected Weight Return Stock A 10.090 0.036 0.045 13% 40% Stock B 0.036 0.360 -0.060 30% 20% Stock C 0.045 -0.060 0.250 21% 40% 0.07936 0.0612 0.196 O 14.75% O 15.69% O 11.92% O 13.80% O 12.86%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts