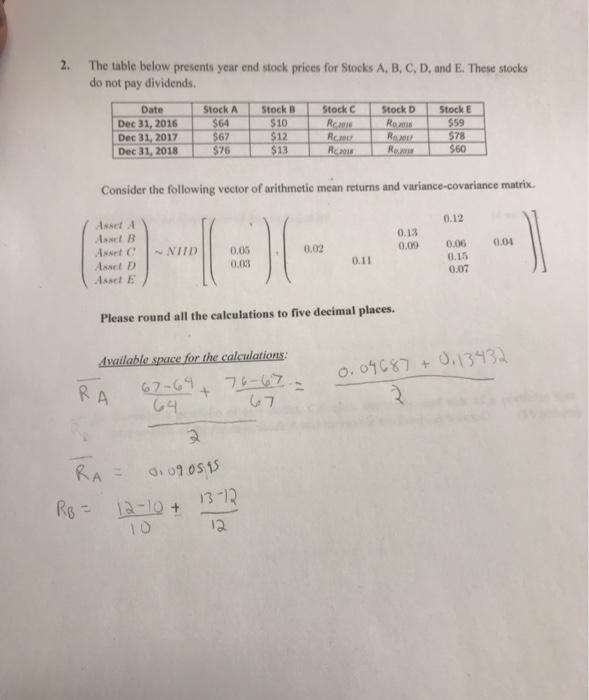

Question: 2. The table below presents year end stock prices for Stocks A, B, C, D, and E. These stocks do not pay dividends. Stock $10

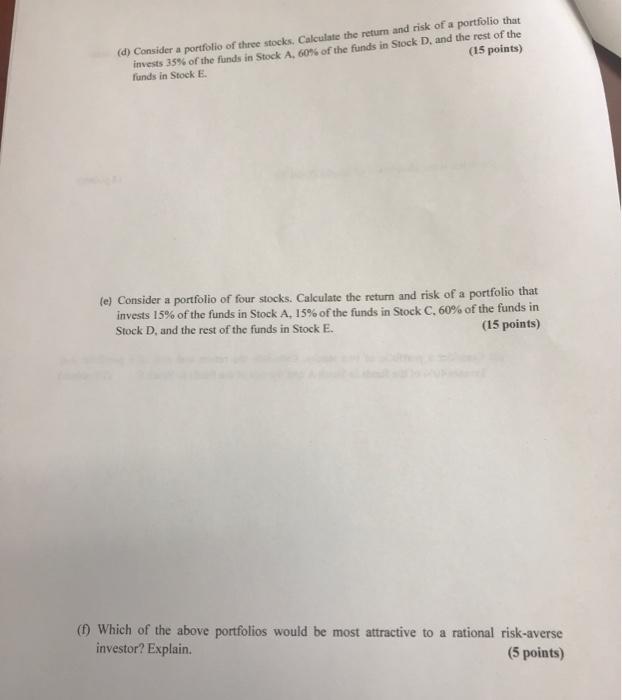

2. The table below presents year end stock prices for Stocks A, B, C, D, and E. These stocks do not pay dividends. Stock $10 Date Dec 31, 2016 Dec 31, 2017 Dec 31, 2018 Stock A $64 $67 $76 Stock Rc Reme RC Stock D Ro Re Ro Stock $59 $78 $60 $12 $13 Consider the following vector of arithmetic mean returns and variance-covariance matrix 0.12 0.13 0.00 0.04 Annel B Asset C Asset D Asset E MID 0.02 0.05 0.03 0.11 0.06 0.15 0.07 Please round all the calculations to five decimal places. Available space for the calculations: 0.04687 + 0.13432 RA 64 2 RA ugost RB = 12-10+ 13-12 10 12 (d) Consider a portfolio of three stocks. Calculate the return and risk of a portfolio that invests 35% of the funds in Stock A, 60% of the funds in Stock D, and the rest of the funds in Stock E (15 points) le) Consider a portfolio of four stocks. Calculate the return and risk of a portfolio that invests 15% of the funds in Stock A, 15% of the funds in Stock C. 60% of the funds in Stock D, and the rest of the funds in Stock E. (15 points) (1) Which of the above portfolios would be most attractive to a rational risk-averse investor? Explain. (5 points) 2. The table below presents year end stock prices for Stocks A, B, C, D, and E. These stocks do not pay dividends. Stock $10 Date Dec 31, 2016 Dec 31, 2017 Dec 31, 2018 Stock A $64 $67 $76 Stock Rc Reme RC Stock D Ro Re Ro Stock $59 $78 $60 $12 $13 Consider the following vector of arithmetic mean returns and variance-covariance matrix 0.12 0.13 0.00 0.04 Annel B Asset C Asset D Asset E MID 0.02 0.05 0.03 0.11 0.06 0.15 0.07 Please round all the calculations to five decimal places. Available space for the calculations: 0.04687 + 0.13432 RA 64 2 RA ugost RB = 12-10+ 13-12 10 12 (d) Consider a portfolio of three stocks. Calculate the return and risk of a portfolio that invests 35% of the funds in Stock A, 60% of the funds in Stock D, and the rest of the funds in Stock E (15 points) le) Consider a portfolio of four stocks. Calculate the return and risk of a portfolio that invests 15% of the funds in Stock A, 15% of the funds in Stock C. 60% of the funds in Stock D, and the rest of the funds in Stock E. (15 points) (1) Which of the above portfolios would be most attractive to a rational risk-averse investor? Explain. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts