Question: can you please do it in excel with the formulas for a better understanding thanks Consider a C corporation. The corporation earns $2.5 per share

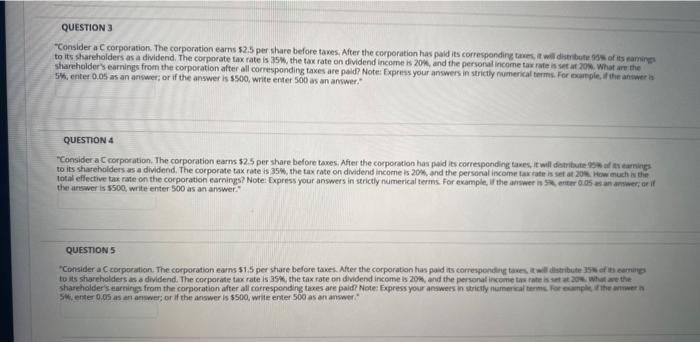

"Consider a C corporation. The corporation earns $2.5 per share before taxes. After the corporation has paid its corresponding tawes, at will disen buth 9s of its raming to its shareholders as a dividend. The corporate tax rate is 35W, the tax rate on dividend income is 20%, and the personal income tax rate is set at 20%. What are the shareholder's earnings from the corporation after all corresponding taxes afe pald? Note: Express your answers in strictly numerical terms. For exarpie, 1 the antwer in Wh, enter 0.05 as an answer; or if the answer is 5500 , write enter 500 as an anwer," QUESTION 4 Consider a C corporation. The corporation earns 52.5 per share before tawes, After the corporation has paid its corresponding taxes, it will detritate igs af tr earnings to its sharaholders ass a dividend. The corporate tax rate is 35%, the tax rate on dividend income is 20%. and the personal income tax rate is set at 208 . Hew much is the the arswer is 5500 . write enter 500 as an answer." QuESTIONS "Coqsider a Ccorporation. The corporation eams $1.5 per state before taves. After the corporation has paid its corresponding taves it williatibute 35 ef at eaming Soiventer 0.05 as an answer; or if the answer is $500, write enter 500 as an

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts