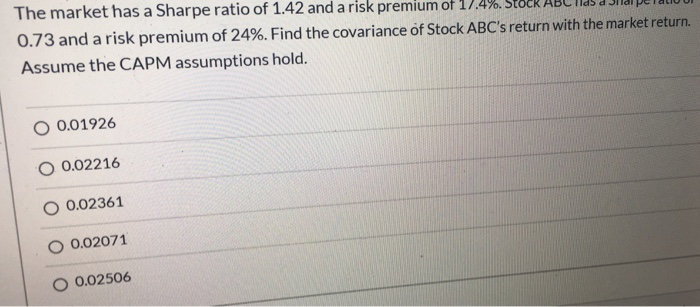

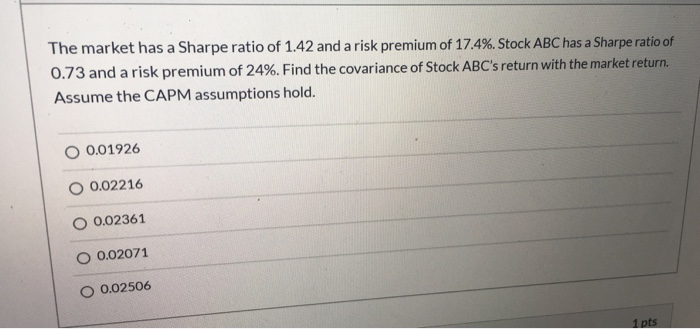

Question: can you please explain how to do it it is corporate finance The market has a Sharpe ratio of 1.42 and a risk premium or

The market has a Sharpe ratio of 1.42 and a risk premium or 17.4%. SUCK ADU T U 0.73 and a risk premium of 24%. Find the covariance of Stock ABC's return with the market return. Assume the CAPM assumptions hold. 0.01926 O 0.02216 0 0.02361 O 0.02071 O 0.02506 The market has a Sharpe ratio of 1.42 and a risk premium of 17.4%. Stock ABC has a Sharpe ratio of 0.73 and a risk premium of 24%. Find the covariance of Stock ABC's return with the market return. Assume the CAPM assumptions hold. O 0.01926 O 0.02216 0.02361 O 0.02071 O 0.02506

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts