Question: Can you please explain how you get the answer as well please. On January 2, 2016, Royal Pet purchased fixtures for $70,800 cash, expecting the

Can you please explain how you get the answer as well please.

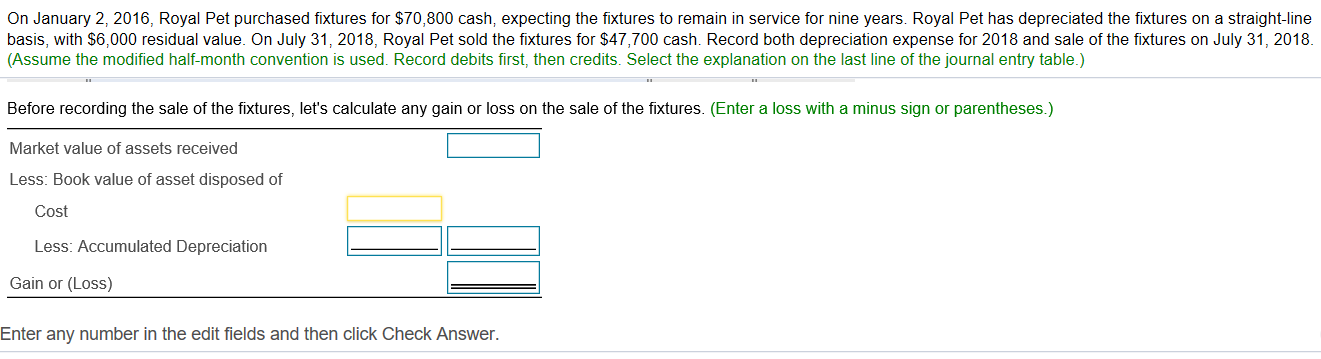

On January 2, 2016, Royal Pet purchased fixtures for $70,800 cash, expecting the fixtures to remain in service for nine years. Royal Pet has depreciated the fixtures on a straight-line basis, with $6.000 residual value. On July 31, 2018, Royal Pet sold the fixtures for $47,700 cash. Record both depreciation expense for 2018 and sale of the fixtures on July 31, 2018. (Assume the modified half-month convention is used. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Before recording the sale of the fixtures, let's calculate any gain or loss on the sale of the fixtures. (Enter a loss with a minus sign or parentheses.) Market value of assets received Less: Book value of asset disposed of Cost Less: Accumulated Depreciation Gain or (Loss) Enter any number in the edit fields and then click Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts