Question: Can you Please explain me this Problem? Thanks! Susan White incurred the following income, disbursements, and losses in 2019 and 2020: 2020 2019 $50,000 20,000

Can you Please explain me this Problem? Thanks!

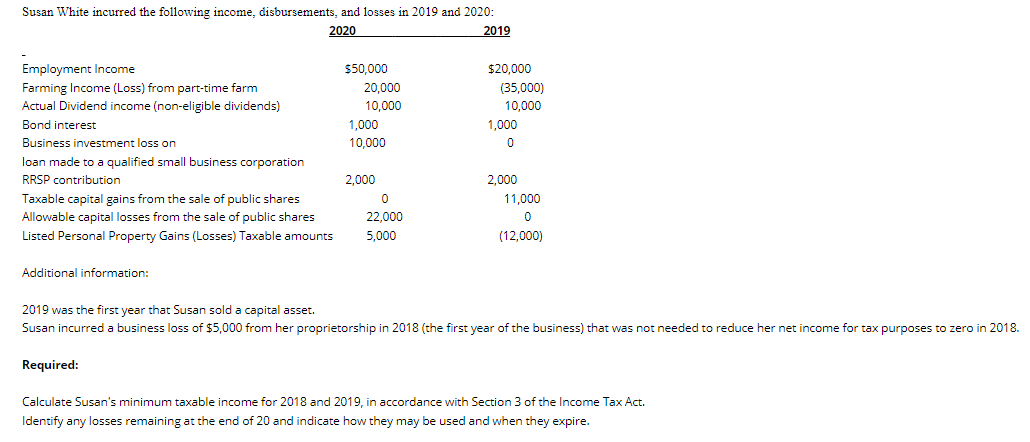

Susan White incurred the following income, disbursements, and losses in 2019 and 2020: 2020 2019 $50,000 20,000 10,000 1,000 10,000 $20,000 (35,000) 10,000 1,000 0 Employment Income Farming Income (Loss) from part-time farm Actual Dividend income (non-eligible dividends) Bond interest Business investment loss on loan made to a qualified small business corporation RRSP contribution Taxable capital gains from the sale of public shares Allowable capital losses from the sale of public shares Listed Personal Property Gains (Losses) Taxable amounts 2,000 0 22,000 5,000 2,000 11,000 0 (12,000) Additional information: 2019 was the first year that Susan sold a capital asset. Susan incurred a business loss of $5,000 from her proprietorship in 2018 (the first year of the business) that was not needed to reduce her net income for tax purposes to zero in 2018. Required: Calculate Susan's minimum taxable income for 2018 and 2019, in accordance with Section 3 of the Income Tax Act. Identify any losses remaining at the end of 20 and indicate how they may be used and when they expire. Susan White incurred the following income, disbursements, and losses in 2019 and 2020: 2020 2019 $50,000 20,000 10,000 1,000 10,000 $20,000 (35,000) 10,000 1,000 0 Employment Income Farming Income (Loss) from part-time farm Actual Dividend income (non-eligible dividends) Bond interest Business investment loss on loan made to a qualified small business corporation RRSP contribution Taxable capital gains from the sale of public shares Allowable capital losses from the sale of public shares Listed Personal Property Gains (Losses) Taxable amounts 2,000 0 22,000 5,000 2,000 11,000 0 (12,000) Additional information: 2019 was the first year that Susan sold a capital asset. Susan incurred a business loss of $5,000 from her proprietorship in 2018 (the first year of the business) that was not needed to reduce her net income for tax purposes to zero in 2018. Required: Calculate Susan's minimum taxable income for 2018 and 2019, in accordance with Section 3 of the Income Tax Act. Identify any losses remaining at the end of 20 and indicate how they may be used and when they expire

Step by Step Solution

There are 3 Steps involved in it

To calculate Susans minimum taxable income in 2018 and 2019 under Section 3 of the Income Tax Act we need to determine her income from various sources ... View full answer

Get step-by-step solutions from verified subject matter experts