Question: Can you Please explain me this problem the way it is Required? Thanks! Just Telling it that (Subject or Course Name is Canadian Income Tax)

Can you Please explain me this problem the way it is Required? Thanks!

Just Telling it that (Subject or Course Name is Canadian Income Tax)

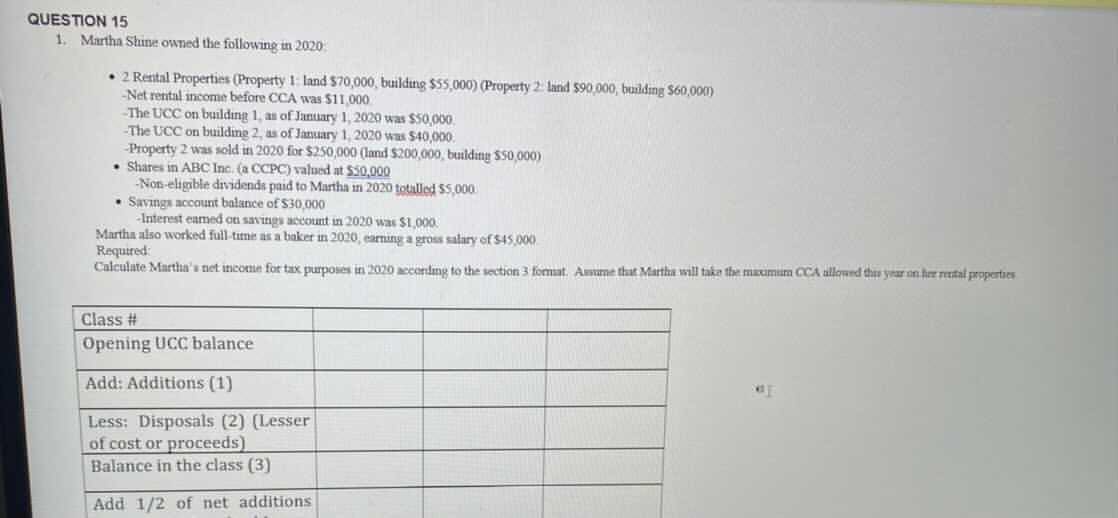

QUESTION 15 1, Martha Shine owned the following in 2020 . 2 Rental Properties (Property 1: land $70,000, building $55,000) (Property 2: land $90,000, building $60,090) -Net rental income before CCA was $11,000 The UCC on building 1, as of January 1, 2020 was $50,000 -The UCC on building 2, as of January 1, 2020 was $40,000. -Property 2 was sold in 2020 for $250,000 (land $200,000, building $50,000) . Shares in ABC Inc. (a CCPC) valued at $50,000 -Non-eligible dividends paid to Martha in 2020 tothled $5.000 . Savings account balance of $30,000 -Interest earned on savings account in 2020 was $1,000. Martha also worked full-time as a baker in 2020, earning a gross salary of $45,000 Required: Calculate Martha's net income for tax purposes in 2020 according to the section 3 format. Assume that Martha will take the maximum CCA allowed this year on her regal properties Class # Opening UCC balance Add: Additions (1) Less: Disposals (2) (Lesser of cost or proceeds) Balance in the class (3) Add 1/2 of net additions