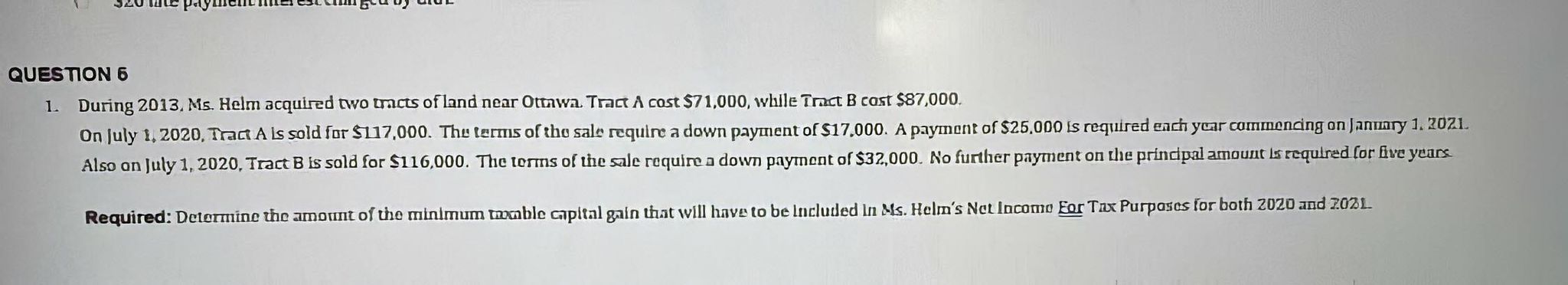

Question: Can you Please explain me this problem the way it is Required? Thanks! Just Telling it that (Subject or Course Name is Canadian Income Tax)

Can you Please explain me this problem the way it is Required? Thanks!

Just Telling it that (Subject or Course Name is Canadian Income Tax)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts