Question: Can you please explain step by step how to do this problem? And if possible, explain how to use the financial calculator when finding the

Can you please explain step by step how to do this problem? And if possible, explain how to use the financial calculator when finding the PV of each year?

Thank you!

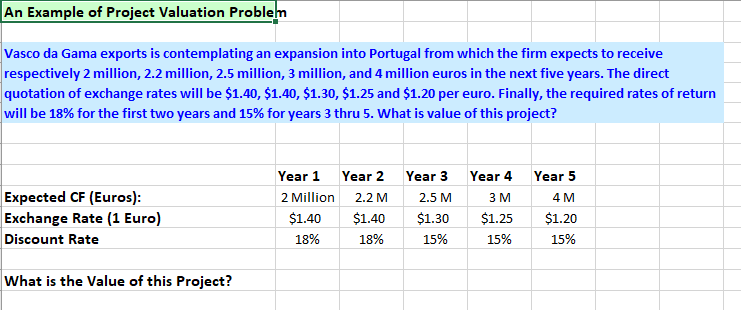

An Example of Project Valuation Problem Vasco da Gama exports is contemplating an expansion into Portugal from which the firm expects to receive respectively 2 million, 2.2 million, 2.5 million, 3 million, and 4 million euros in the next five years. The direct quotation of exchange rates will be $1.40, $1.40, $1.30, $1.25 and $1.20 per euro. Finally, the required rates of return will be 18% for the first two years and 15% for years 3 thru 5. What is value of this project? Expected CF (Euros): Exchange Rate (1 Euro) Discount Rate Year 1 2 Million $1.40 Year 2 2.2 M $1.40 18% Year 3 2.5 M $1.30 15% Year 4 3 M $1.25 15% Year 5 4M $1.20 15% 18% What is the Value of this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts