Question: Please dont copy and paste answers from another post as i have been told all different answers and the experts answers dont make sense. please

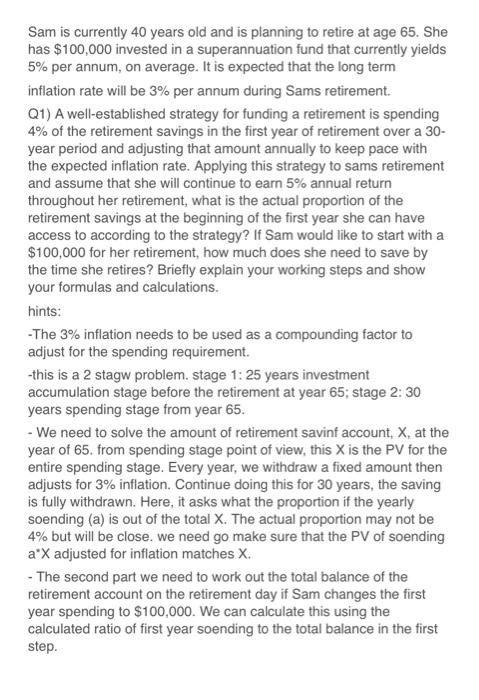

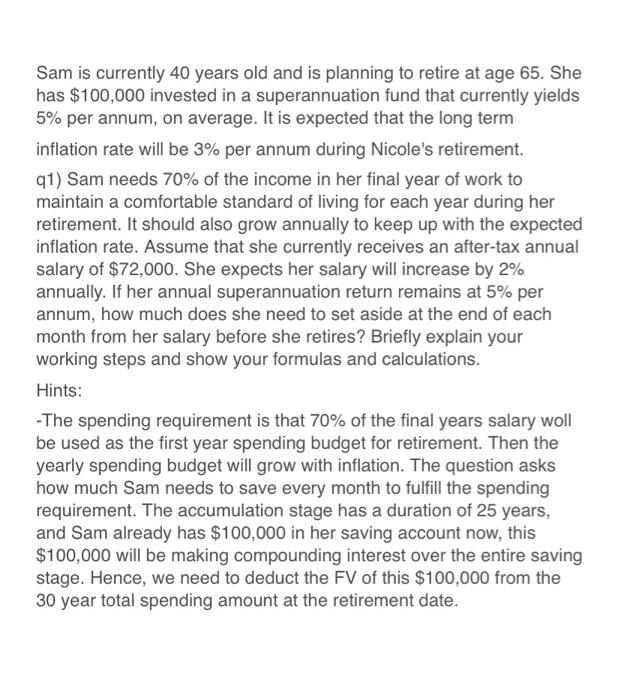

Sam is currently 40 years old and is planning to retire at age 65 . She has $100,000 invested in a superannuation fund that currently yields 5% per annum, on average. It is expected that the long term inflation rate will be 3% per annum during Sams retirement. Q1) A well-established strategy for funding a retirement is spending 4% of the retirement savings in the first year of retirement over a 30 year period and adjusting that amount annually to keep pace with the expected inflation rate. Applying this strategy to sams retirement and assume that she will continue to earn 5% annual return throughout her retirement, what is the actual proportion of the retirement savings at the beginning of the first year she can have access to according to the strategy? If Sam would like to start with a $100,000 for her retirement, how much does she need to save by the time she retires? Briefly explain your working steps and show your formulas and calculations. hints: -The 3% inflation needs to be used as a compounding factor to adjust for the spending requirement. -this is a 2 stagw problem. stage 1:25 years investment accumulation stage before the retirement at year 65; stage 2: 30 years spending stage from year 65 . - We need to solve the amount of retirement savinf account, X, at the year of 65. from spending stage point of view, this X is the PV for the entire spending stage. Every year, we withdraw a fixed amount then adjusts for 3% inflation. Continue doing this for 30 years, the saving is fully withdrawn. Here, it asks what the proportion if the yearly soending (a) is out of the total X. The actual proportion may not be 4% but will be close. we need go make sure that the PV of soending aX adjusted for inflation matches X. - The second part we need to work out the total balance of the retirement account on the retirement day if Sam changes the first year spending to $100,000. We can calculate this using the calculated ratio of first year soending to the total balance in the first step. Sam is currently 40 years old and is planning to retire at age 65 . She has $100,000 invested in a superannuation fund that currently yields 5% per annum, on average. It is expected that the long term inflation rate will be 3% per annum during Nicole's retirement. q1) Sam needs 70% of the income in her final year of work to maintain a comfortable standard of living for each year during her retirement. It should also grow annually to keep up with the expected inflation rate. Assume that she currently receives an after-tax annual salary of $72,000. She expects her salary will increase by 2% annually. If her annual superannuation return remains at 5% per annum, how much does she need to set aside at the end of each month from her salary before she retires? Briefly explain your working steps and show your formulas and calculations. Hints: -The spending requirement is that 70% of the final years salary woll be used as the first year spending budget for retirement. Then the yearly spending budget will grow with inflation. The question asks how much Sam needs to save every month to fulfill the spending requirement. The accumulation stage has a duration of 25 years, and Sam already has $100,000 in her saving account now, this $100,000 will be making compounding interest over the entire saving stage. Hence, we need to deduct the FV of this $100,000 from the 30 year total spending amount at the retirement date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts