Question: Can you please explain the answer with the formula(excel)? Common Size Income Statement Projected Income Statement Percent of Sales Projections - Dec 2022 Consolidated Statements

Can you please explain the answer with the formula(excel)?

Can you please explain the answer with the formula(excel)?

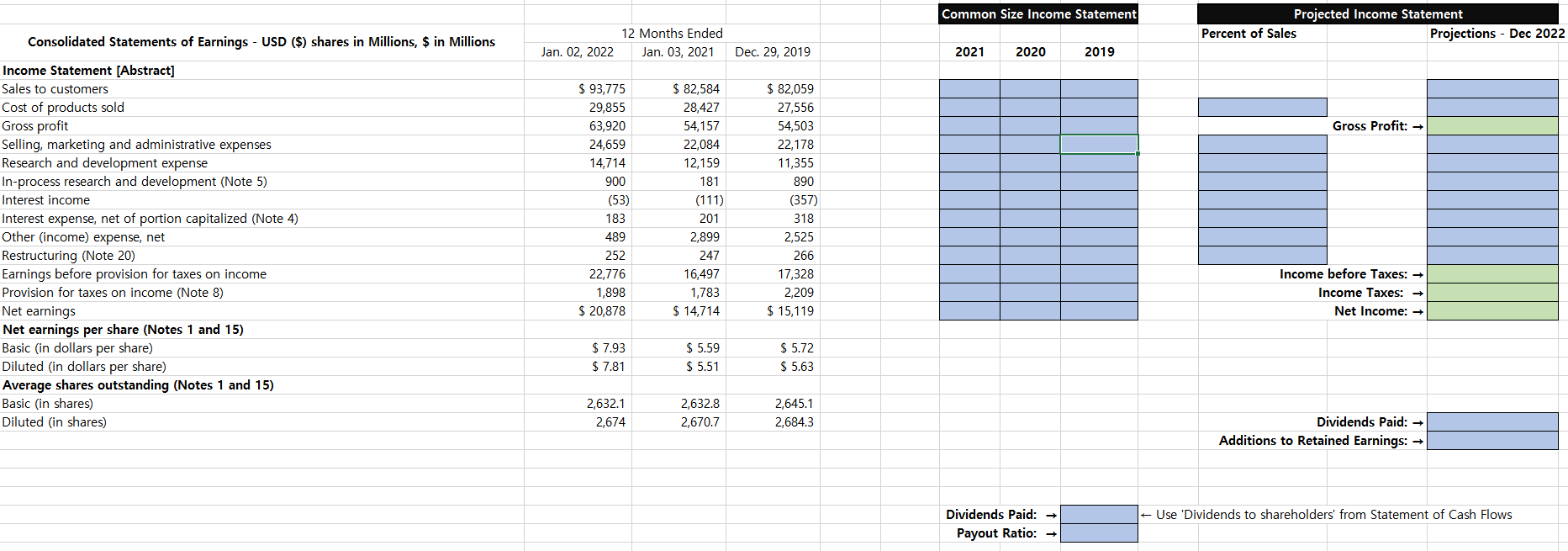

Common Size Income Statement Projected Income Statement Percent of Sales Projections - Dec 2022 Consolidated Statements of Earnings - USD ($) shares in Millions, $ in Millions 12 Months Ended Jan. 03, 2021 Jan. 02, 2022 Dec. 29, 2019 2021 2020 2019 Gross Profit: Income Statement [Abstract] Sales to customers Cost of products sold Gross profit Selling, marketing and administrative expenses Research and development expense In-process research and development (Note 5) Interest income Interest expense, net of portion capitalized (Note 4) Other (income) expense, net Restructuring (Note 20) Earnings before provision for taxes on income Provision for taxes on income (Note 8) Net earnings Net earnings per share (Notes 1 and 15) Basic (in dollars per share) Diluted (in dollars per share) Average shares outstanding (Notes 1 and 15) Basic (in shares) ) Diluted (in shares) $ 93,775 29,855 63,920 24,659 14,714 900 (53) 183 489 252 22,776 1,898 $ 20,878 $ 82,584 28,427 54,157 22,084 12,159 181 (111) 201 2,899 247 16,497 1,783 $ 14,714 $ 82,059 27,556 54,503 22,178 11,355 890 (357) 318 2,525 266 17,328 2,209 $ 15,119 Income before Taxes: Income Taxes: + Net Income: $ 7.93 $ 7.81 $ 5.59 $ 5.51 $ 5.72 $ 5.63 2,632.1 2,674 2,632.8 2,670.7 2,645.1 2,684.3 Dividends Paid: Additions to Retained Earnings: - Use 'Dividends to shareholders' from Statement of Cash Flows Dividends Paid: + Payout Ratio: + Common Size Income Statement Projected Income Statement Percent of Sales Projections - Dec 2022 Consolidated Statements of Earnings - USD ($) shares in Millions, $ in Millions 12 Months Ended Jan. 03, 2021 Jan. 02, 2022 Dec. 29, 2019 2021 2020 2019 Gross Profit: Income Statement [Abstract] Sales to customers Cost of products sold Gross profit Selling, marketing and administrative expenses Research and development expense In-process research and development (Note 5) Interest income Interest expense, net of portion capitalized (Note 4) Other (income) expense, net Restructuring (Note 20) Earnings before provision for taxes on income Provision for taxes on income (Note 8) Net earnings Net earnings per share (Notes 1 and 15) Basic (in dollars per share) Diluted (in dollars per share) Average shares outstanding (Notes 1 and 15) Basic (in shares) ) Diluted (in shares) $ 93,775 29,855 63,920 24,659 14,714 900 (53) 183 489 252 22,776 1,898 $ 20,878 $ 82,584 28,427 54,157 22,084 12,159 181 (111) 201 2,899 247 16,497 1,783 $ 14,714 $ 82,059 27,556 54,503 22,178 11,355 890 (357) 318 2,525 266 17,328 2,209 $ 15,119 Income before Taxes: Income Taxes: + Net Income: $ 7.93 $ 7.81 $ 5.59 $ 5.51 $ 5.72 $ 5.63 2,632.1 2,674 2,632.8 2,670.7 2,645.1 2,684.3 Dividends Paid: Additions to Retained Earnings: - Use 'Dividends to shareholders' from Statement of Cash Flows Dividends Paid: + Payout Ratio: +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts