Question: can you please explain this question on excel!! asap Question 2 20 / 20 pts XYZ Co is expecting $5m of free cash flows in

can you please explain this question on excel!! asap

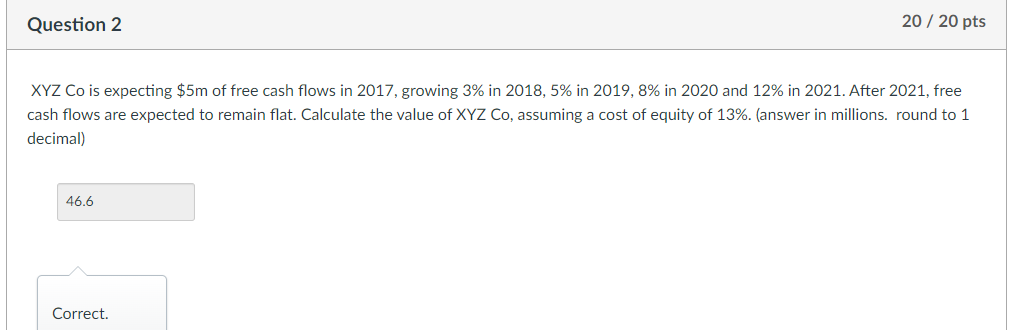

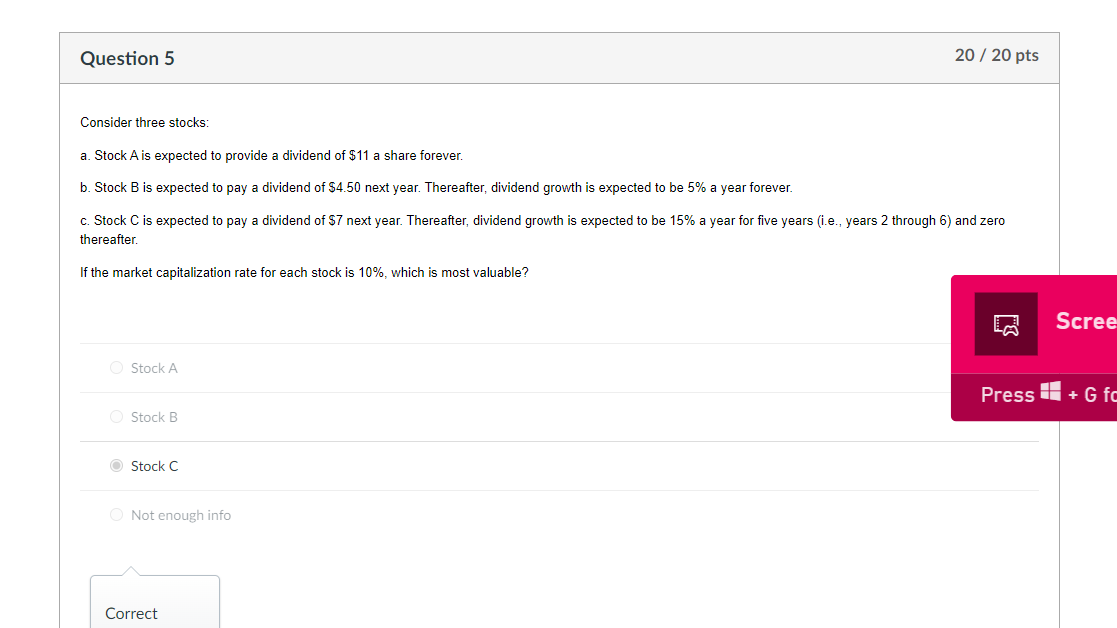

Question 2 20 / 20 pts XYZ Co is expecting $5m of free cash flows in 2017, growing 3% in 2018, 5% in 2019, 8% in 2020 and 12% in 2021. After 2021, free cash flows are expected to remain flat. Calculate the value of XYZ Co, assuming a cost of equity of 13%. (answer in millions. round to 1 decimal) 46.6 Correct. Question 5 20 / 20 pts Consider three stocks a. Stock A is expected to provide a dividend of $11 share forever. b. Stock B is expected to pay a dividend of $4.50 next year. Thereafter, dividend growth is expected to be 5% a year forever. c. Stock C is expected to pay a dividend of $7 next year. Thereafter, dividend growth is expected to be 15% a year for five years (i.e., years 2 through 6) and zero thereafter. If the market capitalization rate for each stock is 10%, which is most valuable? Scree Stock A Press 1 + G fc Stock B O Stock C Not enough info Correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts