Question: Can you please explain using excel. Please show how I would be able to enter into excel myself. Thank you 2. Stock Valuation: INPUT/OUTPUT: Enterprise

Can you please explain using excel. Please show how I would be able to enter into excel myself. Thank you

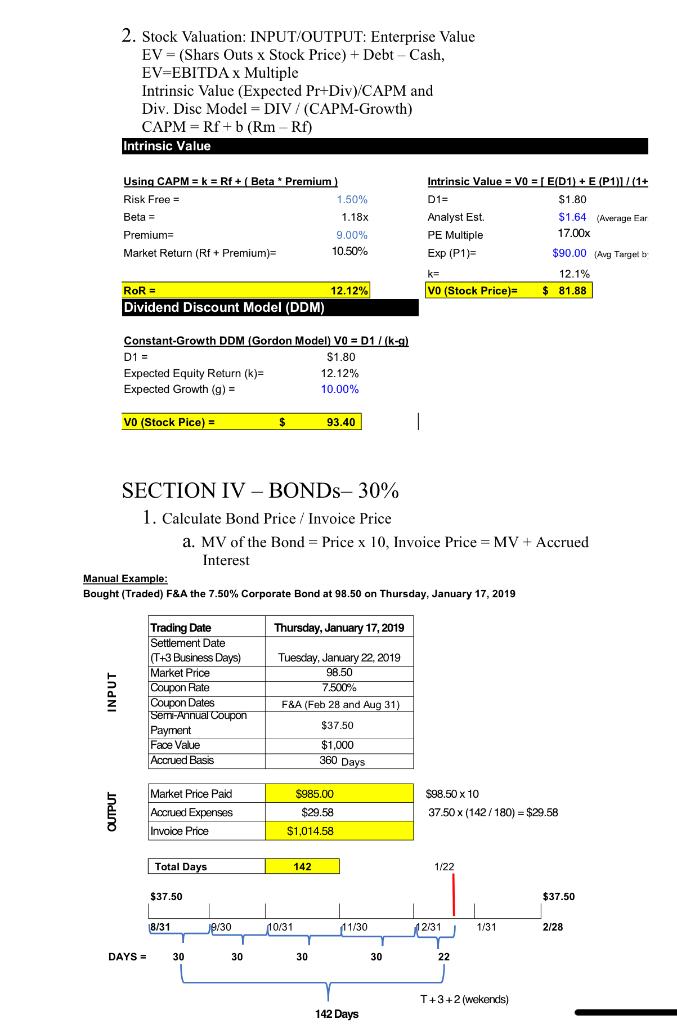

2. Stock Valuation: INPUT/OUTPUT: Enterprise Value EV = (Shars Outs x Stock Price) + Debt -- Cash, EV=EBITDA x Multiple Intrinsic Value (Expected Pr+Div)/CAPM and Div. Disc Model =DIV / (CAPM-Growth) CAPM = Rf + b (Rm - Rf) Intrinsic Value Using CAPM = k = Rf + ( Beta * Premium) () Risk Free = 1.50% Beta = 1.18x Premium 9.00% Market Return (Rf + Premium) 10.50% Intrinsic Value = V0 = E(D1) + E (P11/(1+ D1= $1.80 Analyst Est. $1.64 (Average Ear PE Multiple 17.00x Exp (P1)- $90.00 (Avy Target by k= 12.1% VO (Stock Price) $ 81.88 12.12% RoR = Dividend Discount Model (DDM) Constant-Growth DDM (Gordon Model) VO = D1 /(k-g) D1 = $1.80 Expected Equity Return (k)= 12.12% Expected Growth (g) = 10.00% VO (Stock Pice) = $ 93.40 | SECTION IV-BONDs, 30% 1. Calculate Bond Price / Invoice Price a. MV of the Bond = Price x 10, Invoice Price =MV + Accrued Interest Manual Example: Bought (Traded) F&A the 7.50% Corporate Bond at 98.50 on Thursday, January 17, 2019 Thursday, January 17, 2019 INPUT Trading Date Settlement Date (T+3 Business Days) Market Price Coupon Rate Coupon Dates Semi-Annual Coupon Payment Face Value Accrued Basis Tuesday, January 22, 2019 98.50 7.500% F&A (Feb 28 and Aug 31) $37.50 $1,000 360 Days OUTPUT Market Price Paid Accrued Expenses Invoice Price $985.00 $29.58 $1,014.58 $98.50 x 10 37.50 x (142/ 180) = $29.58 Total Days 142 1/22 $37.50 $37.50 8/31 10/31 11/30 12/31 1/31 2/28 1 9/30 1 30 DAYS = 30 30 30 22 T+3+2 (wekends) 142 Days 2. Stock Valuation: INPUT/OUTPUT: Enterprise Value EV = (Shars Outs x Stock Price) + Debt -- Cash, EV=EBITDA x Multiple Intrinsic Value (Expected Pr+Div)/CAPM and Div. Disc Model =DIV / (CAPM-Growth) CAPM = Rf + b (Rm - Rf) Intrinsic Value Using CAPM = k = Rf + ( Beta * Premium) () Risk Free = 1.50% Beta = 1.18x Premium 9.00% Market Return (Rf + Premium) 10.50% Intrinsic Value = V0 = E(D1) + E (P11/(1+ D1= $1.80 Analyst Est. $1.64 (Average Ear PE Multiple 17.00x Exp (P1)- $90.00 (Avy Target by k= 12.1% VO (Stock Price) $ 81.88 12.12% RoR = Dividend Discount Model (DDM) Constant-Growth DDM (Gordon Model) VO = D1 /(k-g) D1 = $1.80 Expected Equity Return (k)= 12.12% Expected Growth (g) = 10.00% VO (Stock Pice) = $ 93.40 | SECTION IV-BONDs, 30% 1. Calculate Bond Price / Invoice Price a. MV of the Bond = Price x 10, Invoice Price =MV + Accrued Interest Manual Example: Bought (Traded) F&A the 7.50% Corporate Bond at 98.50 on Thursday, January 17, 2019 Thursday, January 17, 2019 INPUT Trading Date Settlement Date (T+3 Business Days) Market Price Coupon Rate Coupon Dates Semi-Annual Coupon Payment Face Value Accrued Basis Tuesday, January 22, 2019 98.50 7.500% F&A (Feb 28 and Aug 31) $37.50 $1,000 360 Days OUTPUT Market Price Paid Accrued Expenses Invoice Price $985.00 $29.58 $1,014.58 $98.50 x 10 37.50 x (142/ 180) = $29.58 Total Days 142 1/22 $37.50 $37.50 8/31 10/31 11/30 12/31 1/31 2/28 1 9/30 1 30 DAYS = 30 30 30 22 T+3+2 (wekends) 142 Days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts