Question: can you please help answer A B & C Check my work 1 12 Assume Maple Corporation has just completed the third year of its

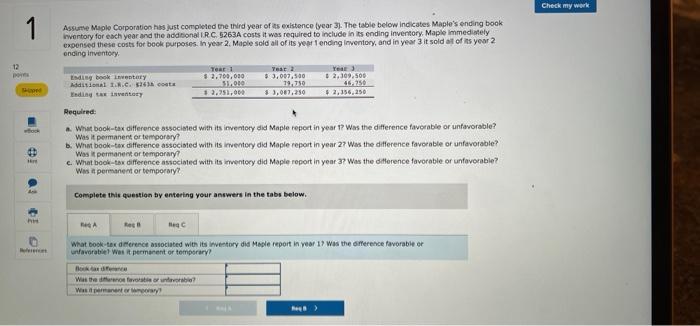

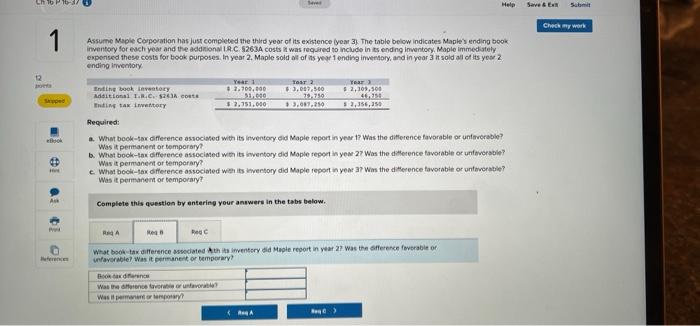

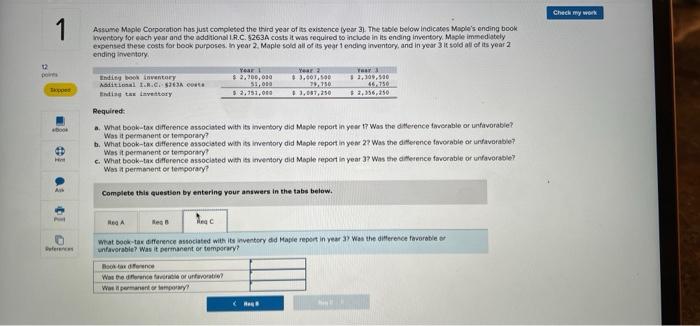

Check my work 1 12 Assume Maple Corporation has just completed the third year of its existence year 3). The table below indicates Maple's ending book Inventory for each year and the additional IRC 5263A costs it was required to include in its ending inventory Maple immedinely expensed these costs for book purposes. In year 2. Maple sold all of its year ending inventory, and in year 3 it sold all of its year 2 onding inventory Year 1 Year Ei ook wetery $2.700,00 $3,007,500 $ 2,309,500 Addisionat 1... 24 costa 31.010 19.750 46.250 Ending te very 12,951,000 33,061,230 Required: What book-tax difference associated with its inventory did Maple report in year 17 was the difference favorable or unfavorable? Was it permanent or temporary? b. Whut book-tax difference associated with its inventory did Maple report in year 2? Was the difference favorable of unfavorable? Was it permanent or temporary c. What book to difference sociated with its inventory did Maple report in year 3? Was the difference favorable or unfavorable? Was permanent or temporary Complete the question by entering your answers in the tabs below. RA Reso Nec What booke-tex deference sociated with its inventory did Maple report in year 17 was the difference favorable or unfavorable? Was it permanent or temporary Wis the favor? Winter Me> Ch 1 70-37 Svet Help Save & Submit Check my work 1 12 Assume Maple Corporation has just completed the third year of its existence year 3) The table below indicates Maple's ending book inventory for each year and the additional IC 5263A costs was required to include in tsending inventory, Maple immediately exponsed these costs for book purposes. In year 2. Maple sold all of its your 1 ending inventory, and in year 3 it sold all of its your ending Inventory Year Test 2 Team Inting book toy 3 2.700,000 53,047,500 52,109,500 Additional L.R.C. 5264 corte 31.00 79.750 4. Tuding tax wory 5 2.751.000 33.002.250 53,386,250 Required: .. What book-tax difference associated with its inventory did Maple report in year 1? Was the difference favorable or unfavorable? Was it permanent or temporary? b. What book-tax difference associated with its inventory did Maple report in yow 27 Was the difference favorable or unfavorable? Was it permanent or temporary? What book-tax Gifference associated with its inventory did Maple report in your 3? Wm the difference favorable or untevorable? Was it permanent or temporary! co 00 Complete this question by entering your answers in the tabs below. RA R Rece Ince What bookta difference sciated this inventory did Maple report in year 27 was the difference favorable or unfavorable? Was it permanent or temporary Bo tako Was the lower unteva Wasil per A B) Check my work 1 Assame Maple Corporation has just completed the third year of its existence year 3. The table below indicates Maple's ending book inventory for each year and the additional I.R.C. $263A costs it was required to include in its ending Inventory Maple immediately expensed these costs for book purposes. In year 2. Maple sold all of its year 1 ending inventory, and in year 3 sold all of its year 2 ending inventory Year Year Year Indoor entory $ 2,700,000 1.3.401.500 3 3.100,00 Addition 1... Score 51,010 150 46.750 Tag tar investory 32,151,00 + 1,087,250 $2,256,250 Required: What book-tax difference associated with its inventory did Maple report in year 17 Was the difference fivvorable or unfavorable? Was it permanent or temporary? t. What book-tax difference associated with its wentary did Maple report in yow 2? Was the difference favorable or unavorable Was it permanent or temporary c. What book-tak difference associated with its inventory did Maple report in year 3? Was the difference favorable or unfavorable Was it permanent or temporary 10 10 Complete this question by entering your answers in the tabs below. NGA Rec Der wat book-tax difference associated with its inventory did Maple report in year was the difference favorable unfavorable? Was it permanent or temporary? Book on Waste or untuvo Wspomnimy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts