Question: can you please help CP 26-6 Net present value method for a service company Metro-Goldwyn-Mayer Studios Inc. (MGM) is a major producer and distributor of

can you please help

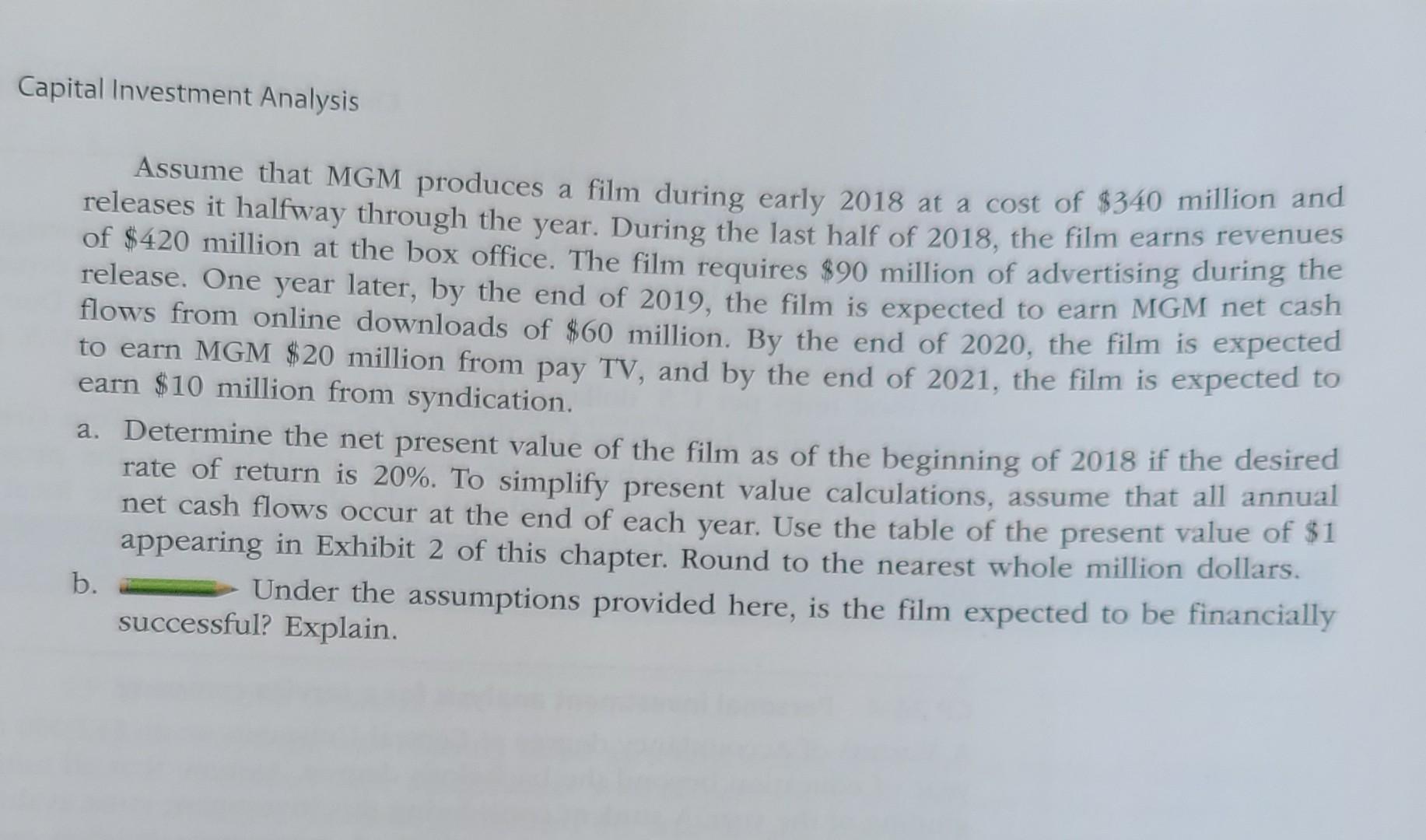

CP 26-6 Net present value method for a service company Metro-Goldwyn-Mayer Studios Inc. (MGM) is a major producer and distributor of theatrical and television filmed entertainment. Regarding theatrical films, MGM states, Our feature films are exploited through a series of sequential domestic and international distribu- tion channels, typically beginning with theatrical exhibition. Thereafter, feature films are first made available for home video (online downloads) generally six months after theatrical release; for pay television, one year after theatrical release; and for syndication, approximately three to five years after theatrical release. (Continued Capital Investment Analysis Assume that MGM produces a film during early 2018 at a cost of $340 million and releases it halfway through the year. During the last half of 2018, the film earns revenues of $420 million at the box office. The film requires $90 million of advertising during the release. One year later, by the end of 2019, the film is expected to earn MGM net cash flows from online downloads of $60 million. By the end of 2020, the film is expected to earn MGM $20 million from pay TV, and by the end of 2021, the film is expected to earn $10 million from syndication. a. Determine the net present value of the film as of the beginning of 2018 if the desired rate of return is 20%. To simplify present value calculations, assume that all annual net cash flows occur at the end of each year. Use the table of the present value of $1 appearing in Exhibit 2 of this chapter. Round to the nearest whole million dollars. Under the assumptions provided here, is the film expected to be financially successful? Explain. b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts