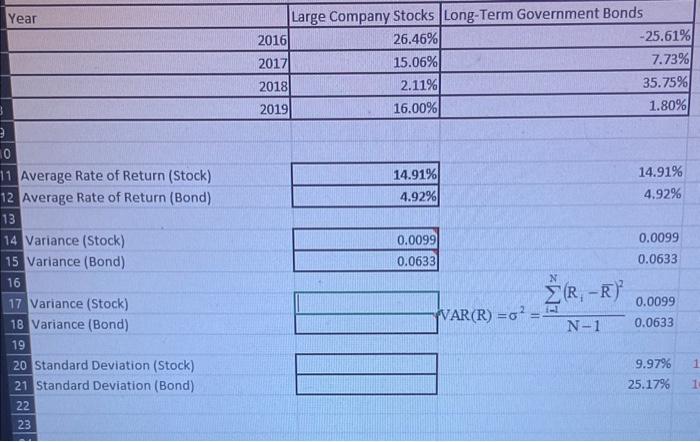

Question: can you please help me entering the formula for Variance as described in PP page begin{tabular}{|r|r|r|} hline Year & Large Company Stocks & Long-Term Government

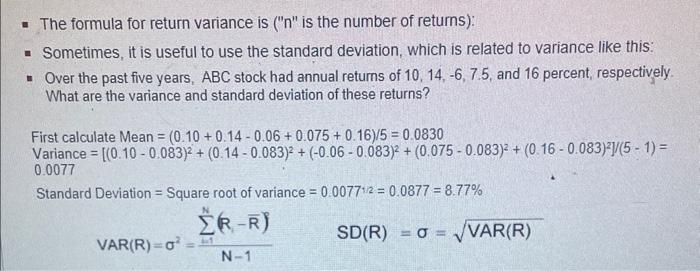

\begin{tabular}{|r|r|r|} \hline Year & Large Company Stocks & Long-Term Government Bonds \\ \hline 2016 & 26.46% & 25.61% \\ \hline 2017 & 15.06% & 7.73% \\ \hline 2018 & 2.11% & 35.75% \\ \hline 2019 & 16.00% & 1.80% \\ \hline \end{tabular} Average Rate of Return (Stock) Average Rate of Return (Bond) Variance (Stock) Variance (Bond) Variance (Stock) Variance (Bond) 20 Standard Deviation (Stock) 21 Standard Deviation (Bond) 2322 \begin{tabular}{|r|} \hline 14.91% \\ \hline 4.92% \\ \hline \end{tabular} \begin{tabular}{|r|} \hline 0.0099 \\ \hline 0.0633 \\ \hline \end{tabular} 14.91% 4.92% 0.0099 0.0633 VAR(R)=2=N1i=1(RiR)0.00990.0633 9.97% 25.17% - The formula for return variance is (" n " is the number of returns): - Sometimes, it is useful to use the standard deviation, which is related to variance like this: - Over the past five years, ABC stock had annual returns of 10,14,6,7.5, and 16 percent, respectively. What are the variance and standard deviation of these returns? FirstcalculateMean=(0.10+0.140.06+0.075+0.16)/5=0.0830Variance=[(0.100.083)2+(0.140.083)2+(0.060.083)2+(0.0750.083)2+(0.160.083)2]/(51)=0.0077StandardDeviation=Squarerootofvariance=0.007712=0.0877=8.77%VAR(R)=2=N1i=1N(RR)SD(R)==VAR(R)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts