Question: can you please help me? is it possible to write the steps on a piece of paper please? At the end of 2020, the bond

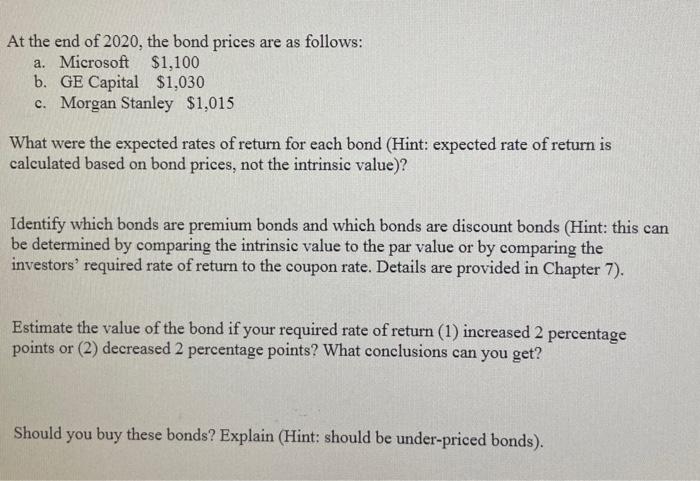

At the end of 2020, the bond prices are as follows: a. Microsoft $1,100 b. GE Capital $1,030 c. Morgan Stanley $1,015 What were the expected rates of return for each bond (Hint: expected rate of return is calculated based on bond prices, not the intrinsic value)? Identify which bonds are premium bonds and which bonds are discount bonds (Hint: this can be determined by comparing the intrinsic value to the par value or by comparing the investors' required rate of return to the coupon rate. Details are provided in Chapter 7). Estimate the value of the bond if your required rate of return (1) increased 2 percentage points or (2) decreased 2 percentage points? What conclusions can you get? Should you buy these bonds? Explain (Hint: should be under-priced bonds)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts