Question: Can you please help me out? Case Study Questions: Q1. Of the three companies, which company has the highest WACC? Describe the reasons for which

Can you please help me out?

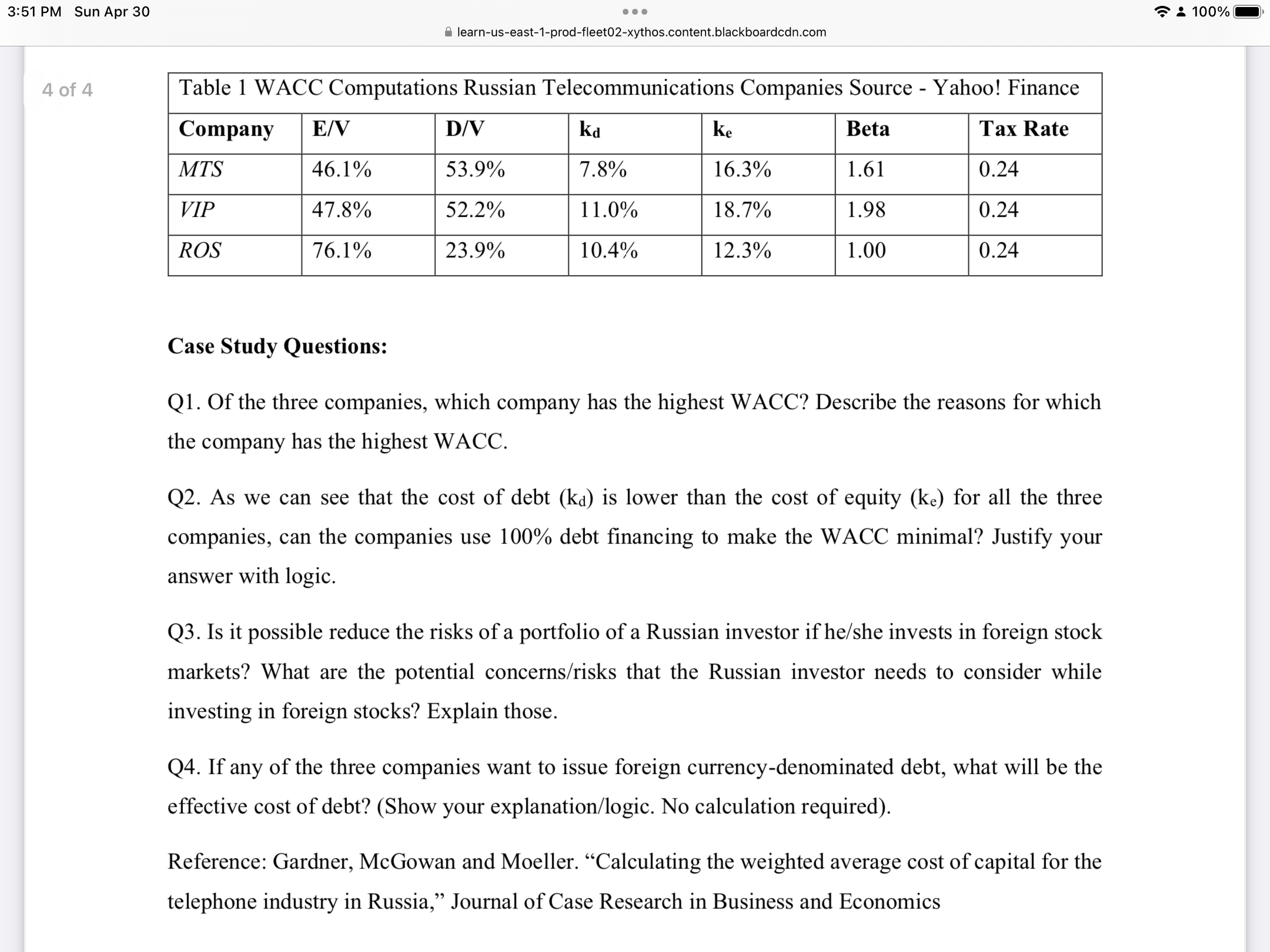

Case Study Questions: Q1. Of the three companies, which company has the highest WACC? Describe the reasons for which the company has the highest WACC. Q2. As we can see that the cost of debt (kd) is lower than the cost of equity (ke) for all the three companies, can the companies use 100% debt financing to make the WACC minimal? Justify your answer with logic. Q3. Is it possible reduce the risks of a portfolio of a Russian investor if he/she invests in foreign stock markets? What are the potential concerns/risks that the Russian investor needs to consider while investing in foreign stocks? Explain those. Q4. If any of the three companies want to issue foreign currency-denominated debt, what will be the effective cost of debt? (Show your explanation/logic. No calculation required). Reference: Gardner, McGowan and Moeller. "Calculating the weighted average cost of capital for the telephone industry in Russia," Journal of Case Research in Business and Economics

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts