Question: Can you please help me solve this? Cybersecurity Solutions needs to overhaul its security systems or buy a new one. The facts have been gathered,

Can you please help me solve this?

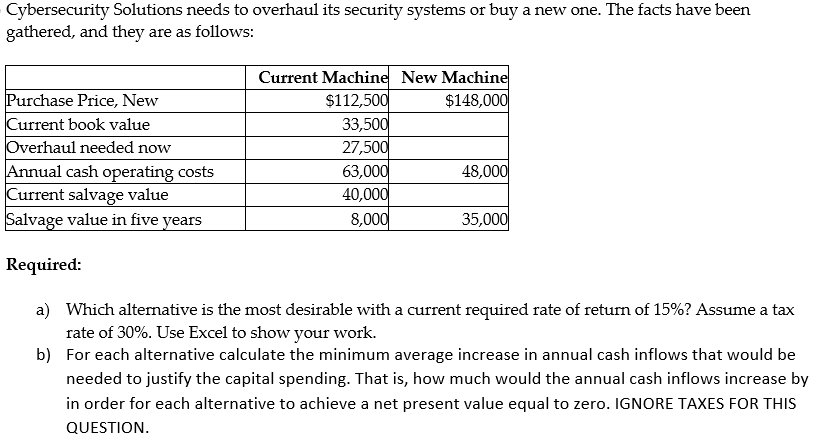

Cybersecurity Solutions needs to overhaul its security systems or buy a new one. The facts have been gathered, and they are as follows: Current Machine New Machine Purchase Price, New $112,500 $148,000 Current book value 33,500 Overhaul needed now 27,500 Annual cash operating costs 63,000 48,000 Current salvage value 40,000 Salvage value in five years 8,000 35,000 Required: a) Which alternative is the most desirable with a current required rate of return of 15%? Assume a tax rate of 30%. Use Excel to show your work. b) For each alternative calculate the minimum average increase in annual cash inflows that would be needed to justify the capital spending. That is, how much would the annual cash inflows increase by in order for each alternative to achieve a net present value equal to zero. IGNORE TAXES FOR THIS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts