Question: Can you please help me solve this question and show steps please. Problem 5 (10 points): Nike, Inc. is considering a $10M investment (paid at

Can you please help me solve this question and show steps please.

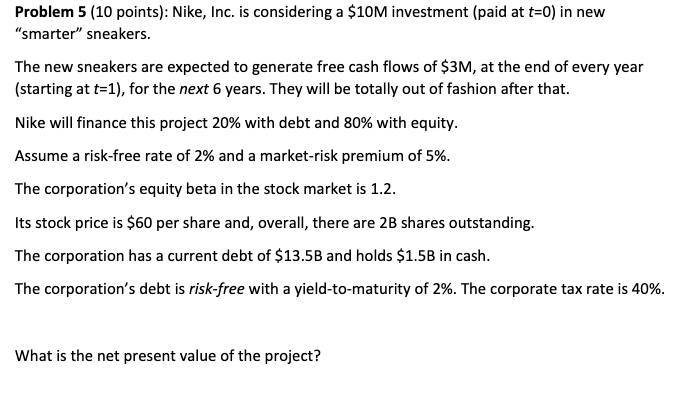

Problem 5 (10 points): Nike, Inc. is considering a $10M investment (paid at t=0) in new "smarter" sneakers. The new sneakers are expected to generate free cash flows of $3M, at the end of every year (starting at t=1), for the next 6 years. They will be totally out of fashion after that. Nike will finance this project 20% with debt and 80% with equity. Assume a risk-free rate of 2% and a market-risk premium of 5%. The corporation's equity beta in the stock market is 1.2. Its stock price is $60 per share and, overall, there are 2B shares outstanding. The corporation has a current debt of $13.5B and holds $1.5B in cash. The corporation's debt is risk-free with a yield-to-maturity of 2%. The corporate tax rate is 40%. What is the net present value of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts