Question: Can you please help me solve this question and show steps please. Problem 4 (10 points): Anheuser-Bush InBev sustains in the last years a fixed

Can you please help me solve this question and show steps please.

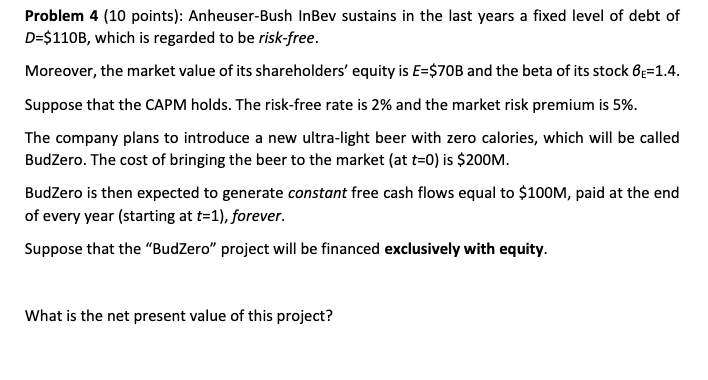

Problem 4 (10 points): Anheuser-Bush InBev sustains in the last years a fixed level of debt of D=$110B, which is regarded to be risk-free. Moreover, the market value of its shareholders' equity is E=$70B and the beta of its stock Be=1.4. Suppose that the CAPM holds. The risk-free rate is 2% and the market risk premium is 5%. The company plans to introduce a new ultra-light beer with zero calories, which will be called BudZero. The cost of bringing the beer to the market (at t=0) is $200M. BudZero is then expected to generate constant free cash flows equal to $100M, paid at the end of every year (starting at t=1), forever. Suppose that the BudZero" project will be financed exclusively with equity. What is the net present value of this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts