Question: Can you please help me understand this for my final!! thank you so much 5. (10 pts) Suppose that the dollar-yen spot exchange rate is

Can you please help me understand this for my final!! thank you so much

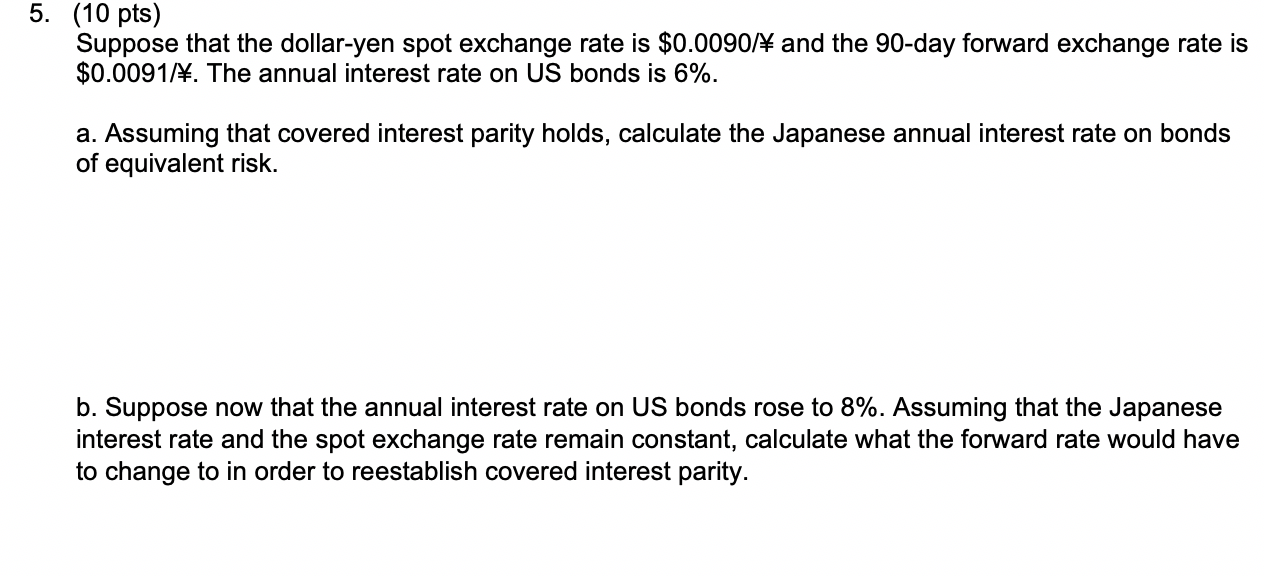

5. (10 pts) Suppose that the dollar-yen spot exchange rate is $0.0090/\ and the 90-day forward exchange rate is $0.0091/. The annual interest rate on US bonds is 6%. a. Assuming that covered interest parity holds, calculate the Japanese annual interest rate on bonds of equivalent risk. b. Suppose now that the annual interest rate on US bonds rose to 8%. Assuming that the Japanese interest rate and the spot exchange rate remain constant, calculate what the forward rate would have to change to in order to reestablish covered interest parity

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock