Question: can you please help me with my practice? Question 22 (0.5 points) If a firm is due to be paid in peso in two months,

can you please help me with my practice?

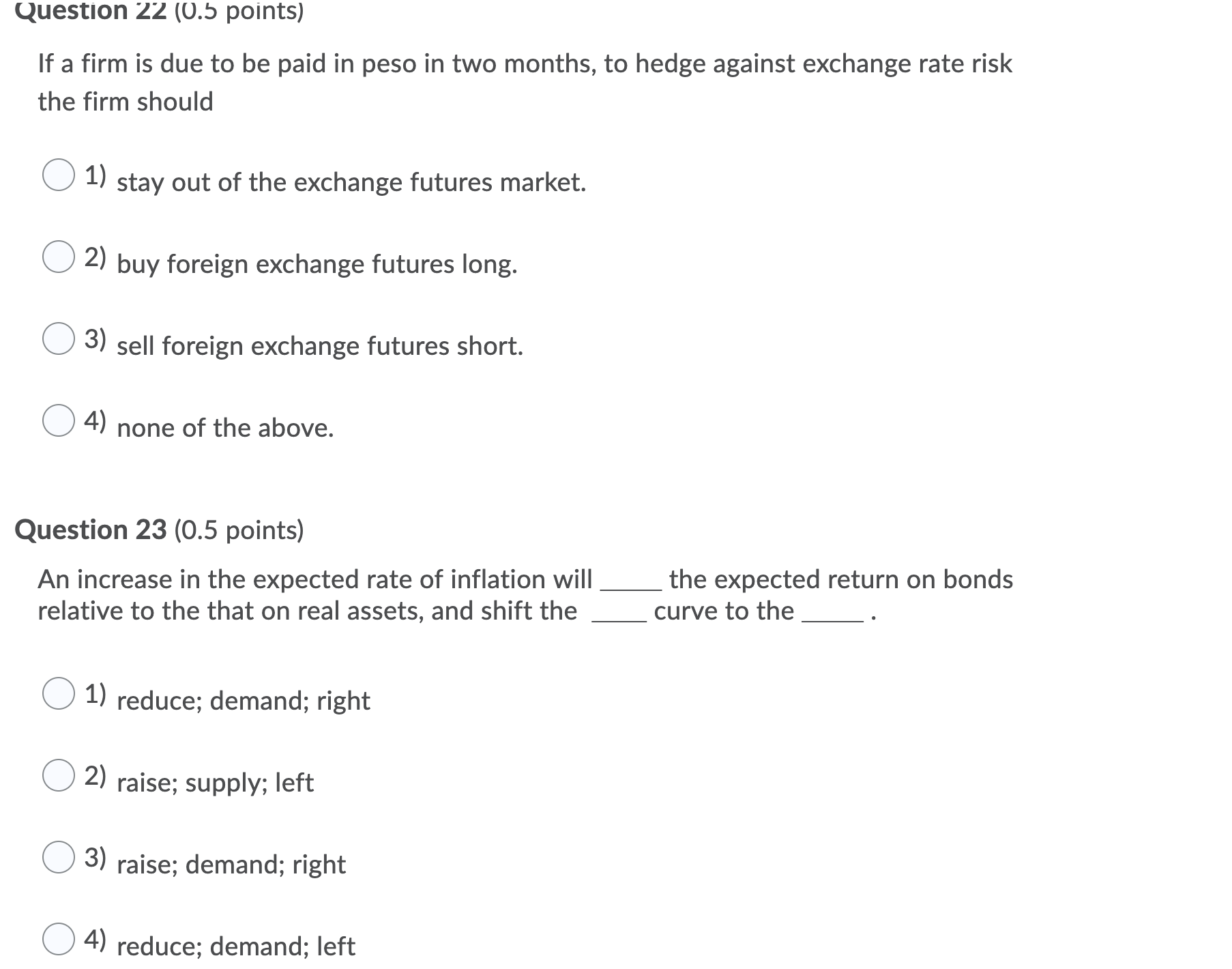

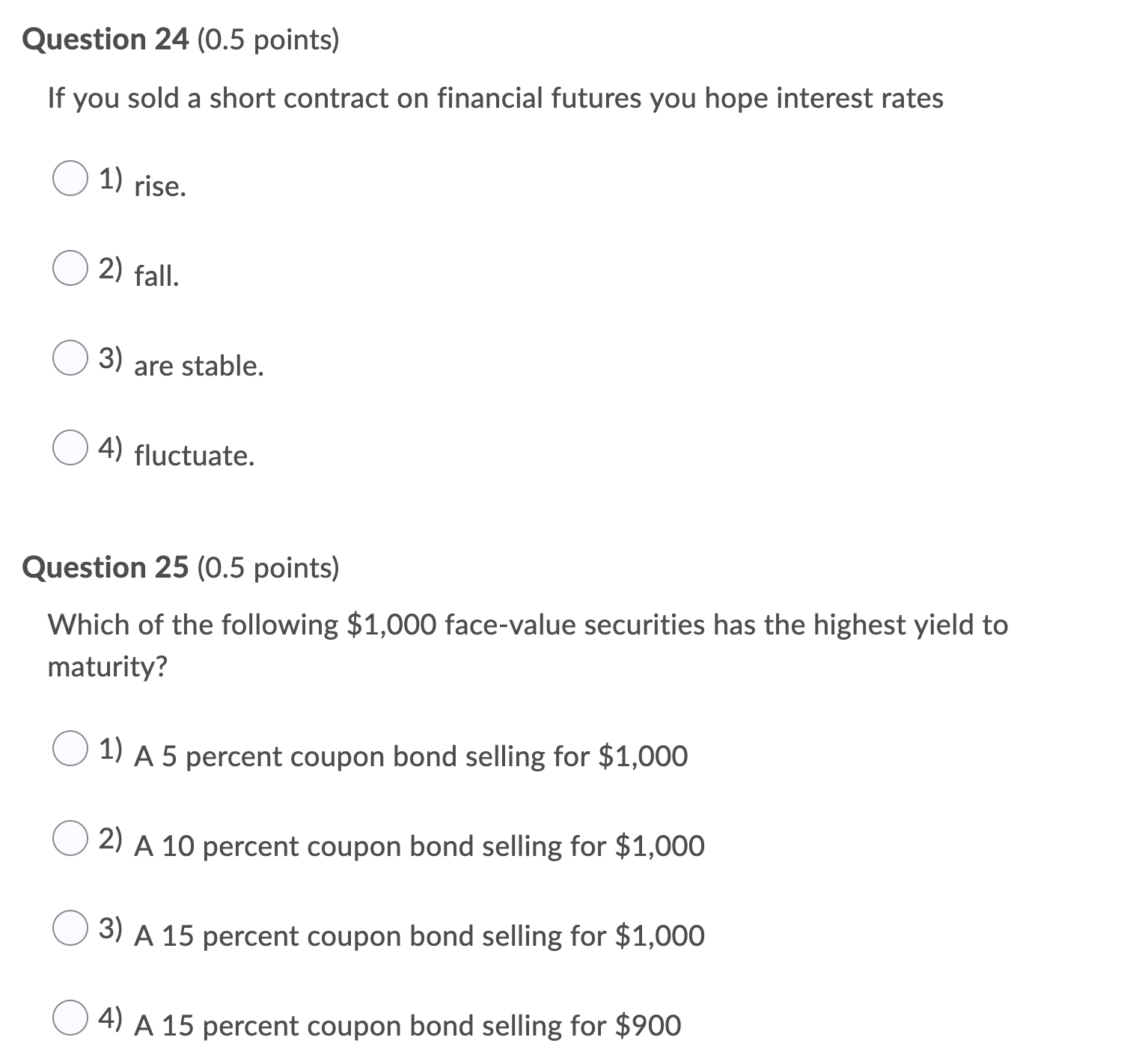

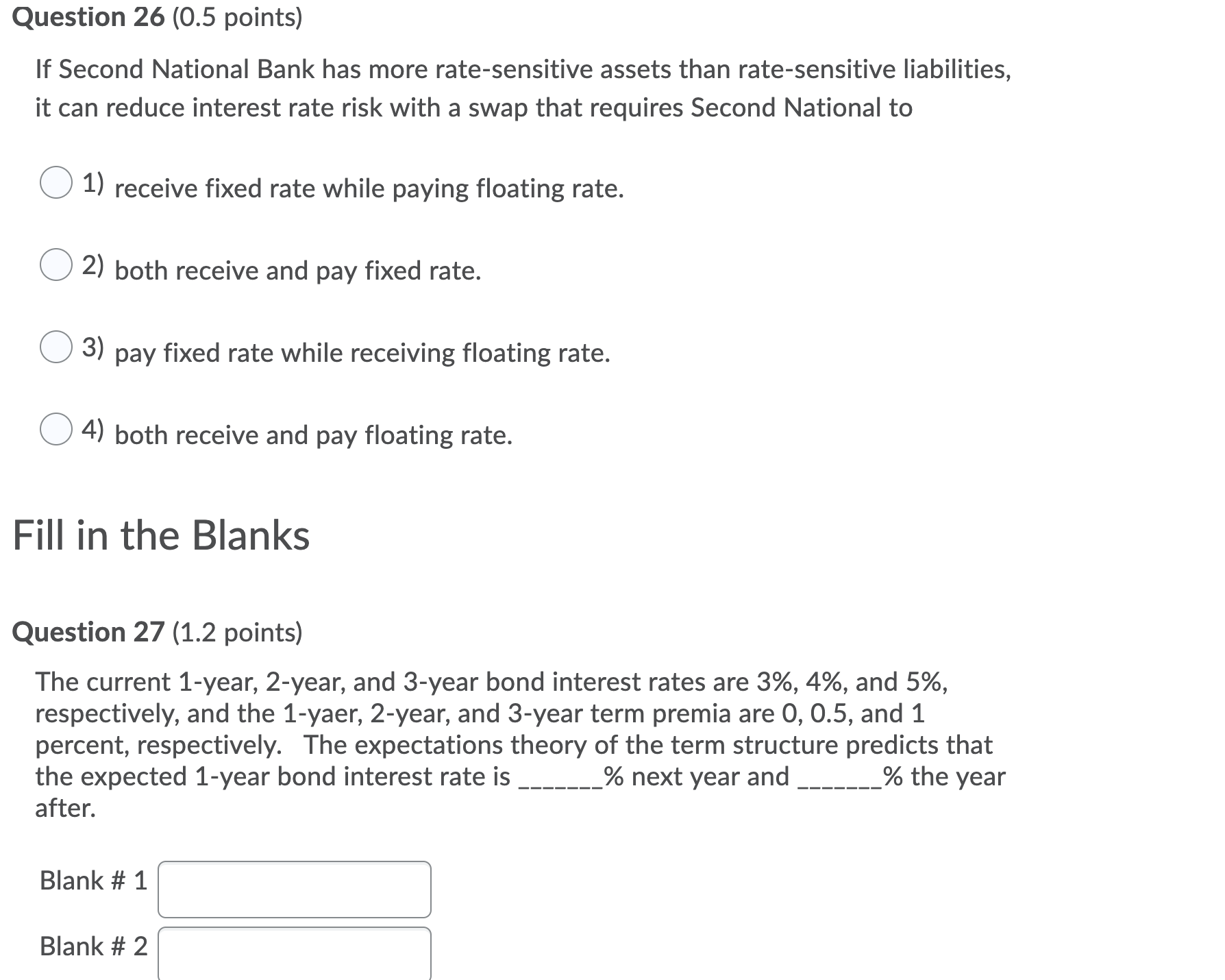

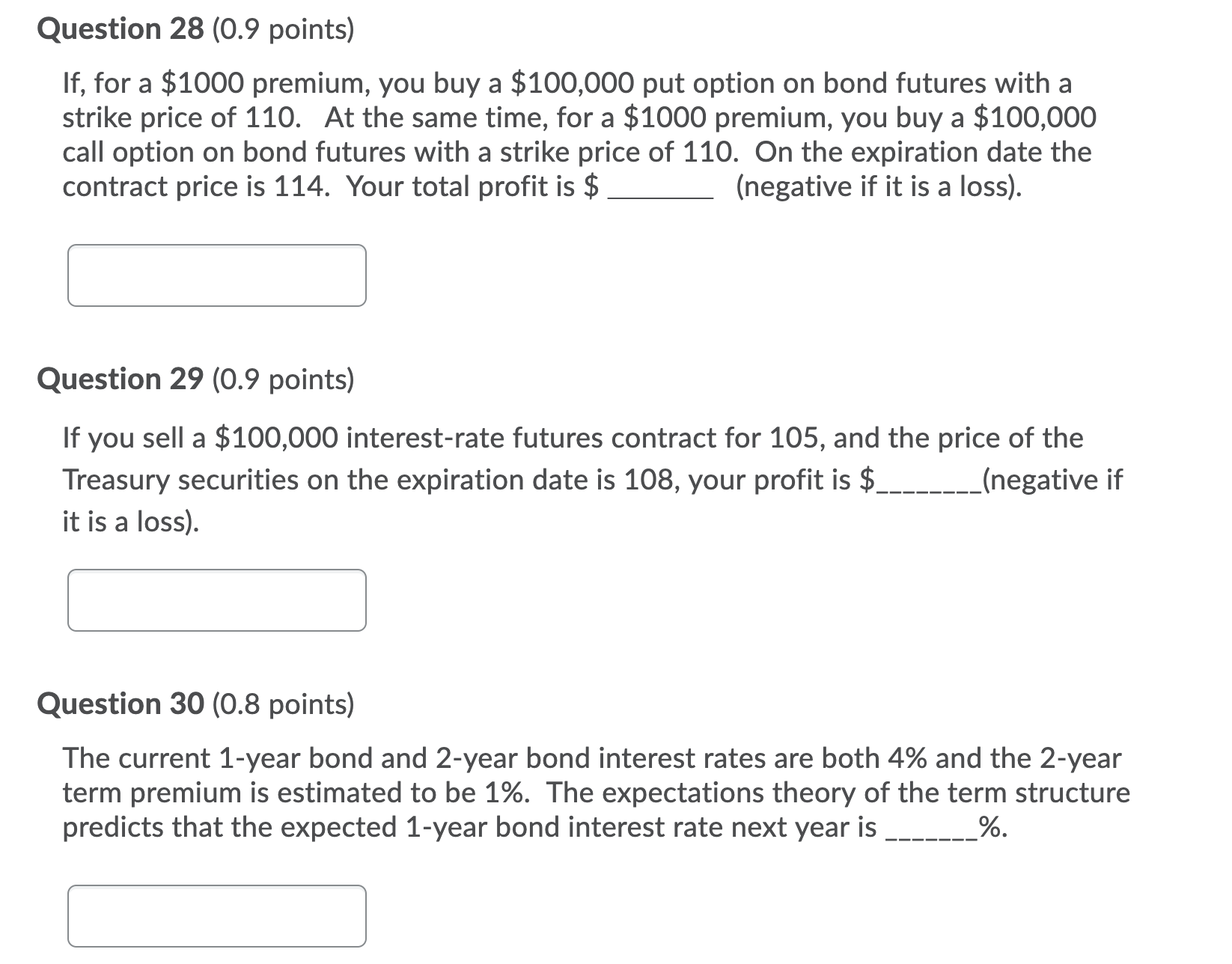

Question 22 (0.5 points) If a firm is due to be paid in peso in two months, to hedge against exchange rate risk the firm should 0 1) stay out of the exchange futures market. 0 2) buy foreign exchange futures long. 0 3) sell foreign exchange futures short. O 4) none of the above. Question 23 (0.5 points) An increase in the expected rate of inflation will the expected return on bonds relative to the that on real assets, and shift the curve to the O 1) reduce; demand; right O 2) raise; supply; left O 3) raise; demand; right O 4) reduce; demand; left Question 24 (0.5 points) If you sold a short contract on financial futures you hope interest rates O 1) rise. 0 2) fall. 0 3) are stable. O 4) fluctuate. Question 25 (0.5 points) Which of the following $1,000 face-value securities has the highest yield to maturity? O 1) A 5 percent coupon bond selling for $1,000 O 2l A 10 percent coupon bond selling for $1,000 O 3) A 15 percent coupon bond selling for $1,000 0 4) A 15 percent coupon bond selling for $900 Question 26 (0.5 points) If Second National Bank has more ratesensitive assets than ratesensitive liabilities, it can reduce interest rate risk with a swap that requires Second National to O 1) receive fixed rate while paying floating rate. Q 2) both receive and pay fixed rate. Q 3) pay fixed rate while receiving floating rate. Q 4) both receive and pay floating rate. Fill in the Blanks Question 27 (1.2 points) The current 1year, 2year, and 3year bond interest rates are 3%, 4%, and 5%, respectively, and the 1-yaer, 2-year, and 3-year term premia are 0, 0.5, and 1 percent, respectively. The expectations theory of the term structure predicts that the expected 1-year bond interest rate is _______ % next year and _______ % the year after. Blank# 2 Question 28 (0.9 points) If, for a $1000 premium, you buy a $100,000 put option on bond futures with a strike price of 110. At the same time, for a $1000 premium, you buy a $100,000 call option on bond futures with a strike price of 110. On the expiration date the contract price is 114. Your total profit is $ (negative if it is a loss). Question 29 (0.9 points) If you sell a $100,000 interestrate futures contract for 105, and the price of the Treasury securities on the expiration date is 108, your profit is $ ________ (negative if it is a loss). g] Question 30 (0.8 points) The current 1-year bond and 2-year bond interest rates are both 4% and the 2-year term premium is estimated to be 1%. The expectations theory of the term structure predicts that the expected 1-year bond interest rate next year is _______ %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts