Question: can you please help solve for the questions below and id you can explain what you did on yhe excel sheet to come up woth

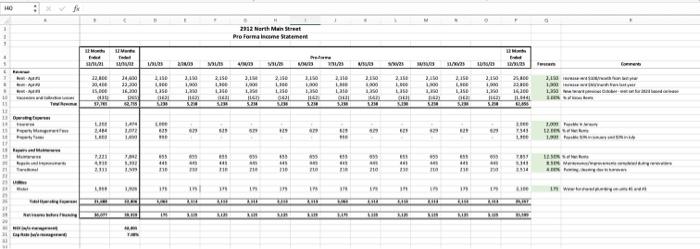

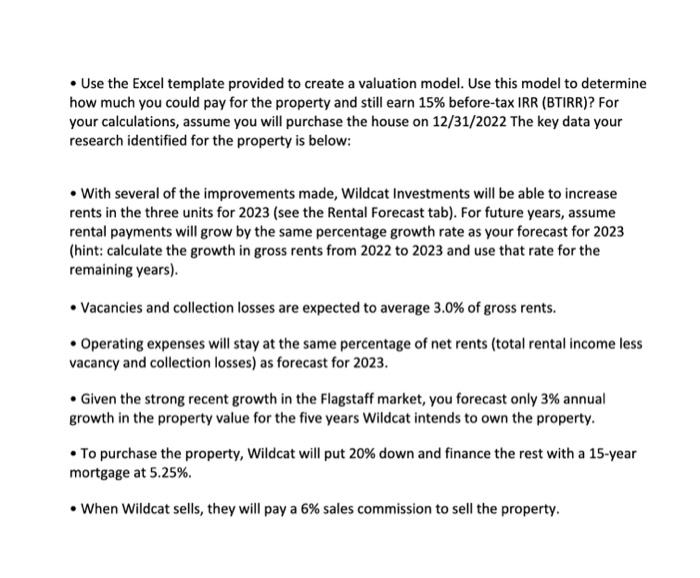

- Use the Excel template provided to create a valuation model. Use this model to determine how much you could pay for the property and still earn 15% before-tax IRR (BTIRR)? For your calculations, assume you will purchase the house on 12/31/2022 The key data your research identified for the property is below: - With several of the improvements made, Wildcat Investments will be able to increase rents in the three units for 2023 (see the Rental Forecast tab). For future years, assume rental payments will grow by the same percentage growth rate as your forecast for 2023 (hint: calculate the growth in gross rents from 2022 to 2023 and use that rate for the remaining years). - Vacancies and collection losses are expected to average 3.0% of gross rents. - Operating expenses will stay at the same percentage of net rents (total rental income less vacancy and collection losses) as forecast for 2023. - Given the strong recent growth in the Flagstaff market, you forecast only 3% annual growth in the property value for the five years Wildcat intends to own the property. - To purchase the property, Wildcat will put 20% down and finance the rest with a 15 -year mortgage at 5.25%. - When Wildcat sells, they will pay a 6% sales commission to sell the property. - Use the Excel template provided to create a valuation model. Use this model to determine how much you could pay for the property and still earn 15% before-tax IRR (BTIRR)? For your calculations, assume you will purchase the house on 12/31/2022 The key data your research identified for the property is below: - With several of the improvements made, Wildcat Investments will be able to increase rents in the three units for 2023 (see the Rental Forecast tab). For future years, assume rental payments will grow by the same percentage growth rate as your forecast for 2023 (hint: calculate the growth in gross rents from 2022 to 2023 and use that rate for the remaining years). - Vacancies and collection losses are expected to average 3.0% of gross rents. - Operating expenses will stay at the same percentage of net rents (total rental income less vacancy and collection losses) as forecast for 2023. - Given the strong recent growth in the Flagstaff market, you forecast only 3% annual growth in the property value for the five years Wildcat intends to own the property. - To purchase the property, Wildcat will put 20% down and finance the rest with a 15 -year mortgage at 5.25%. - When Wildcat sells, they will pay a 6% sales commission to sell the property

Step by Step Solution

There are 3 Steps involved in it

To solve this problem follow these steps in Excel Step 1 Forecast Rental Income and Cash Flows 1 Calculate Growth Rate Determine the growth rate in gr... View full answer

Get step-by-step solutions from verified subject matter experts